As filed with the Securities and Exchange Commission on July 21, 2010

Registration No. 333–163957

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 11

TO

FORM S–1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SurgiVision, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3841 | 58-2394628 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

SurgiVision, Inc.

One Commerce Square, Suite 2550

Memphis, TN 38103

(901) 522-9300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

Kimble L. Jenkins

Chief Executive Officer

SurgiVision, Inc.

One Commerce Square, Suite 2550

Memphis, TN 38103

(901) 522-9300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Robert J. DelPriore, Esq. Matthew S. Heiter, Esq. Richard F. Mattern, Esq. Baker, Donelson, Bearman, Caldwell & Berkowitz, PC 165 Madison Avenue, Suite 2000 Memphis, TN 38103 (901) 577-8228 |

Carmelo M. Gordian, Esq. Edward A. Gilman, Esq. Nicholas F. Ducoff, Esq. Andrews Kurth LLP 111 Congress Avenue, Suite 1700 Austin, TX 78701 (512) 320-9290 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one)

| Large Accelerated filer |

¨ |

Accelerated filer | ¨ | |||

| Non-accelerated filer |

x (Do not check if a smaller reporting company) |

Smaller reporting company | ¨ |

| Title of Each Class of Securities to be Registered |

Amount to be Registered (1) |

Proposed Maximum per Share (2) |

Proposed Maximum Aggregate Offering Price (2) |

Amount

of Registration Fee (3) | |||||||

| Common Stock, $0.01 par value per share |

2,875,000 shares | $ | 11.00 | $ | 31,625,000 | $ | 2,255.00 | ||||

| (1) | Includes shares of common stock that the underwriters have an option to purchase. |

| (2) | This amount represents the proposed maximum aggregate offering price of the securities registered hereunder to be sold by the Registrant. These figures are estimated solely for the purpose of computing the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | Previously paid a registration fee of $3,075.00 on June 25, 2010. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED JULY 21, 2010 |

2,500,000 Shares

SurgiVision, Inc.

Common Stock

This is the initial public offering of shares of common stock of SurgiVision, Inc. We are offering 2,500,000 shares of our common stock.

No public market currently exists for our common stock. We estimate that the initial public offering price will be between $9.00 and $11.00 per share. We have been approved for the quotation of our common stock on the Nasdaq Capital Market under the symbol “SRGV”.

Investing in our common stock involves risk. See “Risk Factors” beginning on page 7 of this prospectus to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||

| Initial public offering price |

$ | $ | ||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||

| Proceeds, before expenses, to us |

$ | $ | ||||

| (1) | See “Underwriting” beginning on page 127 of this prospectus to read about compensation to the underwriters. |

To the extent that the underwriters sell more than 2,500,000 shares of our common stock, the underwriters have the option to purchase up to an additional 375,000 shares from us at the initial public offering price less the underwriting discounts and commissions.

In connection with this offering, we have also agreed to issue to the underwriters warrants to purchase up to an aggregate of 125,000 shares of our common stock at an exercise price of $12.50 per share assuming an initial public offering price of $10.00 per share, which is the mid-point of the range listed above. These warrants are exercisable commencing on the first anniversary of the date of this prospectus and ending on the fifth anniversary of the date of this prospectus.

The underwriters expect to deliver the shares on or about , 2010.

| Canaccord Genuity |

Rodman & Renshaw, LLC |

Prospectus dated , 2010

| Page | ||

| 1 | ||

| 7 | ||

| 34 | ||

| 35 | ||

| 36 | ||

| 37 | ||

| 39 | ||

| 41 | ||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

42 | |

| 57 | ||

| 91 | ||

| 105 | ||

| 114 | ||

| 116 | ||

| 118 | ||

| 122 | ||

| 124 | ||

| 127 | ||

| 136 | ||

| 136 | ||

| 137 | ||

| F-1 |

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares of common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

For investors outside the United States: We have not and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

Dealer Prospectus Delivery Obligation

Through and including , 2010 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

i

Trademarks, Trade Names and Service Marks

ClearConnect™ , ClearPoint™, ClearTrace™, SmartFrame™, SmartGrid™ and SurgiVision™ are trademarks of SurgiVision, Inc. All other trademarks, trade names and service marks referred to in this prospectus are the property of their respective owners. Siemens refers to Siemens Aktiengesellschaft, Healthcare Sector. Boston Scientific refers to Boston Scientific Corporation and its affiliates.

Industry and Market Data

The market data and other statistical information used throughout this prospectus are based on independent industry publications, government publications, reports by market research firms and other published independent sources. Some data is also based on our good faith estimates, which are derived from other relevant statistical information, as well as the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information.

ii

This summary highlights the information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. Before investing in our common stock, you should read this entire prospectus, including the information set forth under the heading “Risk Factors” and the financial statements and the notes thereto.

Unless the context otherwise requires, references in this prospectus to “SurgiVision,” “we,” “our,” “us” and the “company” refer to SurgiVision, Inc. The historical financial statements and financial data included in this prospectus are those of SurgiVision, Inc. and its consolidated subsidiary, which was merged into SurgiVision, Inc. on June 11, 2010.

Our Business

We are a medical device company focused on the development and commercialization of technology that enables physicians to see inside the brain and heart using direct, intra-procedural magnetic resonance imaging, or MRI, guidance while performing minimally invasive procedures. Utilizing hospitals’ existing MRI suites, we believe that our marketed products and our product candidates will deliver better patient outcomes in shorter procedure times, enhance revenue potential for both physicians and hospitals, and reduce costs to the healthcare system. For the year ended December 31, 2009, we recorded revenues of $2,600,000, incurred a net loss of approximately $7,159,000, and received a going concern qualification from our auditors. For the three months ended March 31, 2010, we generated revenues of $650,000 and incurred a net loss of approximately $2,516,000.

Millions of people suffer from brain and heart diseases and disorders. While some patients can be treated with medication, some will require surgery. Current surgical interventions include both open and minimally invasive procedures. Given the option, patients, physicians and hospitals prefer minimally invasive procedures over open procedures. However, because of restricted visibility of the patient’s anatomy, surgical field and instruments, minimally invasive alternatives for some procedures in the brain and heart are either unavailable or exceedingly complex.

To address these issues, we have designed two innovative platforms for use in hospitals’ existing MRI suites. We call these platforms our ClearPoint system and the ClearTrace system. By combining the continuous, high resolution imaging capabilities of MRI with minimally invasive techniques, these two platforms, subject to appropriate regulatory clearance or approval, will enable physicians to:

| • | Guide a surgical instrument within the patient as it is advanced towards the therapeutic target; |

| • | Deliver a planned therapy with precise visualization of a patient’s anatomy, the surgical field and instruments; |

| • | Monitor for adverse events during and immediately after the administration of the therapy; and |

| • | Confirm the desired results of a procedure. |

Our Marketed Products

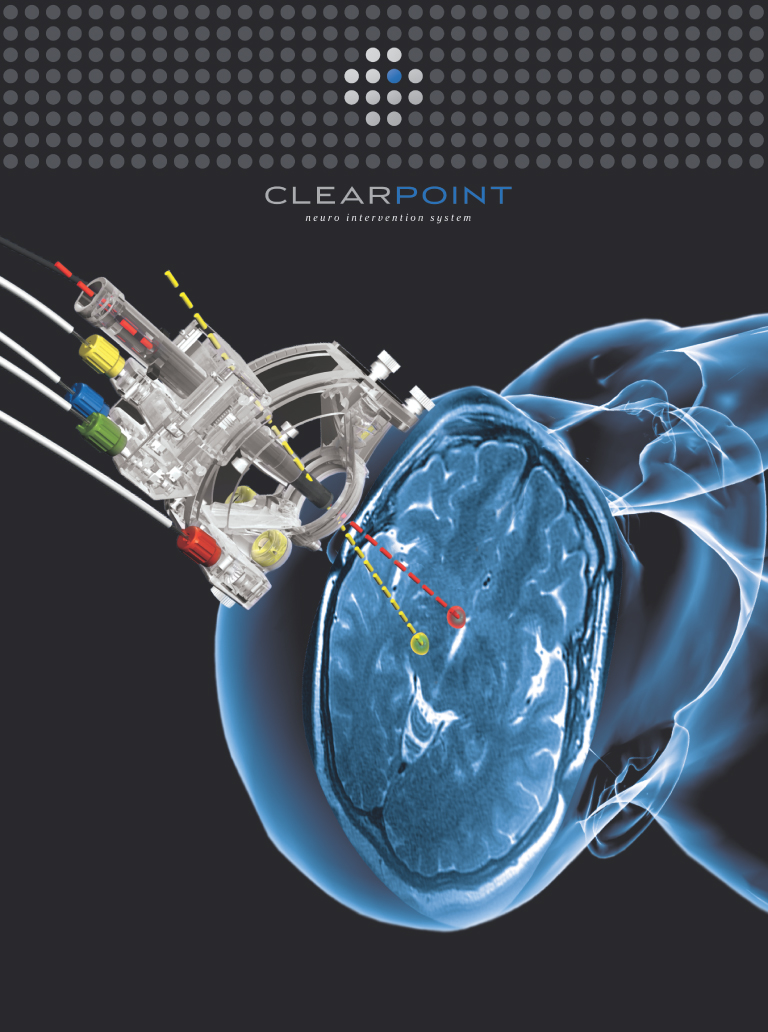

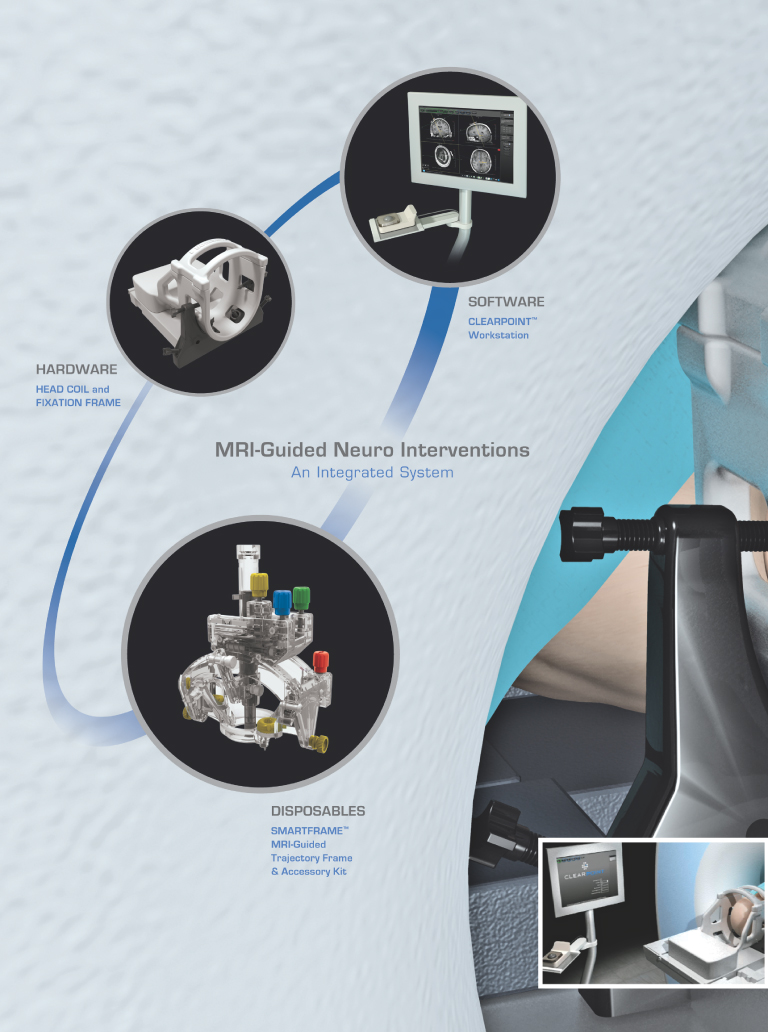

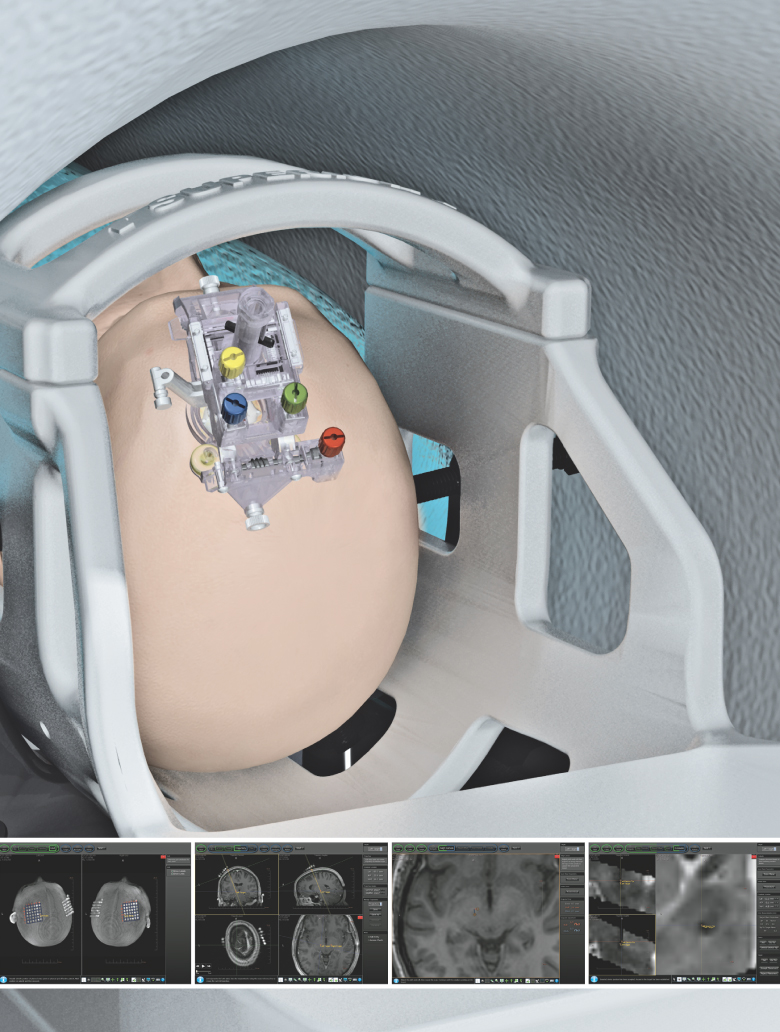

Our ClearPoint system is designed to allow minimally invasive procedures in the brain to be performed in an existing MRI suite. Our ClearPoint system is an integrated system of reusable components, disposable components and intuitive, menu-driven software, which we refer to as our marketed products. Using our ClearPoint system, a physician sees and selects a neurological target, aims our targeting device and watches as the surgical instrument is advanced to the target, significantly reducing the time and complexity of the interventional procedure. Millions of people suffer from neurological disorders or diseases. Performing minimally invasive procedures in the brain presents special challenges, including a need to reach small therapeutic targets often located deep within the brain. We believe that our ClearPoint system addresses these challenges and can become the platform-of-choice for performing the next generation of minimally invasive procedures in the brain.

1

On June 16, 2010, we received 510(k) clearance from the Food and Drug Administration, or the FDA, to market our ClearPoint system in the United States for general neurological interventional procedures. We are marketing our ClearPoint system to provide guidance for the placement and operation of instruments or devices during the planning and operation of neurological procedures within the MRI environment and in conjunction with MR imaging. Our ClearPoint system is intended to be used as an integral part of procedures such as biopsies and catheter and electrode insertion, which have traditionally been performed using other methods. We are focusing our marketing efforts on physicians and hospitals to adopt use of our ClearPoint system. Our strategy is to convince physicians that our ClearPoint system offers a better procedural solution to their patients. We will work with the physicians to encourage hospitals to install our ClearPoint system in their existing MRI suites. Once our ClearPoint system is installed in a hospital, we will focus on selling the disposable components of our ClearPoint system to generate recurring revenues. We have not yet sold a ClearPoint system and as a result, we have not generated any revenues or recurring revenues from the sale of the reusable or disposable components of the ClearPoint system.

Our Product Candidates

The following table summarizes key information about our product candidates:

| Product Candidate |

Regulatory Status |

Target Market |

Development Partner | |||

| ClearTrace Cardiac Intervention System | Development Stage | Initial target market is catheter-based cardiac ablation to treat cardiac arrhythmias, such as atrial fibrillation. Subsequent target markets may include precision delivery of drugs and biologics. | Siemens | |||

| SafeLead Development Program | Development Stage | Target market is implantable leads for cardiac and neurological applications. | Boston Scientific | |||

The ClearTrace system is designed to allow catheter-based minimally invasive procedures in the heart to be performed using continuous, intra-procedural MRI guidance. We are developing the hardware and MRI software for the ClearTrace system with Siemens, the global market leader in MRI scanners. The ClearTrace system is an integrated system of reusable components, disposable catheters and intuitive, menu-driven software. The ClearTrace system will offer a novel, comprehensive solution for the planning, delivery and intra-procedural assessment of catheter-based cardiac interventions. We expect that the ClearTrace system’s initial application will be catheter-based cardiac ablation to treat cardiac arrhythmias, such as atrial fibrillation. During cardiac ablation, a physician attempts to restore a normal heart rhythm by destroying small areas of heart tissue to block irregular electrical impulses that cause an irregular heartbeat, or arrhythmia. Atrial fibrillation is the most common cardiac arrhythmia, affecting over three million people in the United States alone.

Our other area of development activity is referred to as the SafeLead Development Program. Over the last ten years, we have pioneered several technologies that improve the MRI-safety profile of implantable medical leads. These leads are thin, insulated wires that are connected to implantable generators, such as a pacemaker or neurostimulator, and deliver electrical pulses or stimulation to a specific area of the body, such as the heart or the brain. During an MRI scan, these leads are susceptible to heating, which could burn and destroy adjacent tissue. Our technologies address this issue by maintaining lead temperatures well within safe levels during an MRI scan. We are working with Boston Scientific to incorporate our MRI-safety technologies into Boston Scientific’s implantable leads for cardiac and neurological applications. Boston Scientific paid us licensing fees of $13,000,000 in 2008 relating to implantable cardiac leads. In addition, under our agreements, Boston Scientific has agreed to pay us up to $21,600,000 in future milestone-based payments as well as royalties on net sales of products that are covered by a licensed patent. We believe that our MRI-safety technologies, when integrated into Boston Scientific’s implantable leads, could represent a meaningful market differentiator over existing implantable lead designs.

2

Licenses and Collaborative Relationships

In addition to our internally-developed technologies and devices, we have established and intend to continue to pursue licensing and collaborative relationships with medical device companies and academic institutions to further the development and commercialization of our product platforms and core technologies. Our most significant licensing and collaborative relationships are summarized below:

| • | Siemens. We have entered into an agreement with Siemens to develop the hardware and MRI software systems for MRI-guided, catheter-based cardiac ablation to treat cardiac arrhythmias, such as atrial fibrillation. Under this agreement, Siemens will develop the software, and we will develop the catheters and other hardware, other than the MRI scanner and workstation. The agreement contains exclusivity provisions in the area of MRI-guided, catheter-based cardiac ablation. These provisions prohibit Siemens from marketing or offering software intended to work with other manufacturers’ catheters. These provisions also prohibit us from selling or offering catheters intended to work with other manufacturers’ MRI scanners. |

| • | Boston Scientific. We have entered into a series of agreements with Boston Scientific with respect to our MRI-safety technologies. Under these agreements, Boston Scientific has the exclusive, worldwide right, but not the obligation, to use the licensed technologies in Boston Scientific’s implantable leads for cardiac and neurological applications. We are working jointly with Boston Scientific to assess the potential use of our MRI-safety technologies in Boston Scientific’s lead designs. |

| • | University of California, San Francisco. We have entered into a research agreement with the University of California, San Francisco in the field of interventional MRI. Under our agreement, university personnel are conducting research activities relating to interventional MRI guidance for the performance of certain minimally invasive neurological procedures, including an assessment of the safety and clinical efficacy of such procedures. |

| • | The University of Utah. We have established a collaboration with The University of Utah, under which university personnel are conducting research activities and experiments to develop knowledge, techniques, methods and technologies related to MRI-guided cardiac ablation, including a specific focus on MRI-guided cardiac ablation to treat atrial fibrillation. |

| • | The Johns Hopkins University. We have several license agreements with The Johns Hopkins University under which we have obtained exclusive licenses for various technologies relating to devices, systems and methods for performing MRI-guided interventions and MRI-safety. |

Our Business Model and Strategy

Our business model is focused on producing recurring revenue from the sale of the disposable components of both the ClearPoint and ClearTrace systems. Each system’s reusable components can be installed, at minimal cost to the hospital, without disrupting the hospital’s routine schedule for use of its MRI scanner. Our disposable and reusable components are tightly integrated, which allows us to leverage each new installation of a ClearPoint or ClearTrace system to generate recurring sales of our disposable products. We anticipate that recurring revenues will constitute an increasing percentage of our total revenues as our installed base grows.

The key elements of our business strategy are maximizing installation and adoption of our ClearPoint system, continuing development of the ClearTrace system with Siemens, pursuing the SafeLead Development Program with Boston Scientific, and building upon our core technologies to continue to develop additional MRI-based products.

We have a significant intellectual property portfolio in the field of MRI-guided interventions. As of April 30, 2010, our portfolio included 40 patents and 115 patent applications, both United States and foreign, which we wholly-own, co-own or have licensed. In addition, we have meaningful collaborations with major industry participants and renowned academic institutions. Our technologies have been the subject of numerous peer-

3

reviewed articles in medical and scientific journals. As a result of our intellectual property and collaborative relationships, we believe that we are well positioned to remain on the forefront of the emerging market for MRI-guided minimally invasive procedures.

Risks Related to Our Business

We are subject to a number of risks of which you should be aware before you decide to buy our common stock. These risks are discussed more fully in the “Risk Factors” section of this prospectus beginning on page 7 and should be read in their entirety. In general, we face risks associated with the following:

| • | convincing physicians and hospitals to use our ClearPoint system and achieving market acceptance for our marketed products; |

| • | our limited commercialization history; |

| • | the net losses that we have incurred in each year since our inception and expect to continue as we develop our business; |

| • | there is no guarantee that we will achieve the milestones under our agreements with Boston Scientific or be entitled to the milestone payments, and, if some of the milestones relating to neurological applications are not met by December 31, 2012, we will be required to repay to Boston Scientific amounts specified in the related development agreement; |

| • | obtaining FDA or other regulatory approvals or clearances of our product candidates; |

| • | any failure to comply with rigorous FDA and other government regulations; and |

| • | securing and maintaining patent or other intellectual property protection covering our marketed products and product candidates. |

Recent Developments

No material development has occurred since the conclusion of our quarterly period ended March 31, 2010 with the exception of our receipt of FDA clearance to market our ClearPoint system, which is discussed elsewhere in this prospectus.

Corporate Information

We were incorporated in Delaware in 1998 under the name Surgi-Vision, Inc. On November 12, 2008, we changed our name to SurgiVision, Inc. We operate in only one business segment. Our principal executive office is located at One Commerce Square, Suite 2550, Memphis, TN 38103, and our telephone number is (901) 522-9300. Our principal operations are located in Irvine, California. Our website address is www.surgivision.com. We do not incorporate the information on our website into this prospectus, and you should not consider it part of this prospectus.

4

Summary of the Offering

| Common stock offered by us |

2,500,000 shares (or 2,875,000 shares if the underwriters exercise their over-allotment option in full). We are not registering any shares of common stock issuable upon conversion of any of our convertible securities or any shares of common stock held by our stockholders. |

| Common stock to be outstanding after the offering |

10,129,405 shares (or 10,504,405 shares, if the underwriters exercise their over allotment option in full) |

| Nasdaq Capital Market symbol |

SRGV |

| Use of proceeds |

We expect to use the net proceeds from this offering to fund our research and development activities, sales and marketing activities and for working capital and other general corporate purposes. |

The number of shares of common stock to be outstanding after this offering is based on the number of shares outstanding as of April 30, 2010 and excludes:

| • | 600,625 shares of common stock issuable upon exercise of options issued under our stock option plans, at a weighted average exercise price of $3.61 per share; |

| • | 66,652 shares of common stock issuable upon the exercise of an option not issued under our stock option plans, at an exercise price of $9.64 per share; |

| • | 410,542 shares of common stock issuable upon exercise of warrants, at a weighted average exercise price of $3.48 per share; |

| • | 458,630 shares of common stock issuable upon the conversion of $3,669,040 in principal amount of, and interest on, convertible promissory notes, at a conversion price of $8.00 per share; |

| • | 125,000 shares of our common stock that may be issued to the underwriters, upon exercise of warrants, at an exercise price of $12.50 per share, assuming an initial public offering price of $10.00 per share, which is the mid-point of the range listed on the cover of this prospectus; |

| • | 25,444 shares of common stock that may be issued pursuant to the placement agent warrant, at an exercise price of $8.00 per share, assuming an initial public offering price of $10.00 per share, which is the mid-point of the range listed on the cover of this prospectus; |

| • | 12,500 shares of common stock issuable upon the exercise of a warrant to be issued in connection with this offering with an exercise price equal to the initial public offering price; |

| • | 541,000 shares of common stock issuable upon the exercise of options to be issued in connection with this offering under our 2010 Incentive Compensation Plan each with an exercise price equal to the initial public offering price; |

| • | 30,000 shares of common stock to be issued in connection with this offering under our 2010 Incentive Compensation Plan assuming an initial public offering price of $10.00 per share, which is the mid-point of the range listed on the cover of this prospectus; and |

| • | 679,000 shares of common stock reserved for future issuance under our 2010 Incentive Compensation Plan. |

Except as otherwise noted, all information in this prospectus:

| • | assumes no exercise of the underwriters’ over-allotment option; and |

| • | gives effect to a 1-for-4 reverse stock split and conversion into common stock of all outstanding shares of our preferred stock and our 10% senior unsecured convertible notes, or the bridge notes. |

5

Summary Financial Information

The summary financial information below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements, notes thereto and other financial information included elsewhere in this prospectus. The information presented as of and for the three months ended March 31, 2010 and for the three months ended March 31, 2009 is derived from unaudited financial statements and includes, in the opinion of management, all adjustments, consisting only of normal recurring accruals, necessary to present fairly the information for such periods. The summary financial information for the fiscal years ended December 31, 2009, 2008 and 2007 has been derived from our audited financial statements and the notes thereto included elsewhere in this prospectus.

| Three Months Ended March 31, |

Years Ended December 31, | |||||||||||||||||||

| 2010 | 2009 | 2009 | 2008 | 2007 | ||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Related party license revenue |

$ | 650,000 | $ | 650,000 | $ | 2,600,000 | $ | 1,950,000 | $ | — | ||||||||||

| Operating costs and expenses: |

||||||||||||||||||||

| Research and development costs |

1,747,395 | 1,501,555 | 6,067,617 | 4,258,492 | 2,098,672 | |||||||||||||||

| General and administrative expenses |

1,011,747 | 605,683 | 3,595,917 | 2,920,311 | 1,413,369 | |||||||||||||||

| Total operating expenses |

2,759,142 | 2,107,238 | 9,663,534 | 7,178,803 | 3,512,041 | |||||||||||||||

| Other (income) expense |

406,570 | (32,325 | ) | 46,276 | 200,982 | 185,096 | ||||||||||||||

| Income tax expense |

— | — | 49,250 | — | — | |||||||||||||||

| Net loss |

$ | (2,515,712 | ) | $ | (1,424,913 | ) | $ | (7,159,060 | ) | $ | (5,429,785 | ) | $ | (3,697,137 | ) | |||||

| Net loss per share (basic and diluted) |

$ | (0.49 | ) | $ | (0.27 | ) | $ | (1.34 | ) | $ | (1.04 | ) | $ | (0.74 | ) | |||||

| Weighted average shares outstanding (basic and diluted) |

5,129,280 | 5,368,444 | 5,336,633 | 5,245,081 | 5,024,515 | |||||||||||||||

The following table presents a summary of our balance sheet as of March 31, 2010:

| • | on an actual basis; |

| • | on a pro forma basis to reflect a 1-for-4 reverse stock split and the conversion into common stock of all outstanding shares of our preferred stock and the bridge notes; and |

| • | on a pro forma as adjusted basis to reflect the pro forma adjustments reflected above and the sale in this offering of 2,500,000 shares of common stock at an assumed initial public offering price of $10.00 per share, which is the mid-point of the range listed on the cover of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| As of March 31, 2010 | ||||||||||||

| Actual | Pro Forma | Pro Forma as Adjusted |

||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 3,548,719 | $ | 3,548,719 | $ | 24,873,644 | ||||||

| Deferred revenue |

8,546,374 | 8,546,374 | 8,546,374 | |||||||||

| Convertible notes, net of discounts of $1,877,444 |

5,693,556 | 2,436,730 | 2,436,730 | |||||||||

| Convertible preferred stock |

7,965,000 | — | — | |||||||||

| Common stock and additional paid-in capital (less treasury stock) |

25,178,772 | 37,214,772 | 58,539,697 | |||||||||

| Accumulated deficit |

(44,538,676 | ) | (45,352,850 | ) | (45,352,850 | ) | ||||||

| Total stockholders’ equity (deficit) |

(11,394,904 | ) | (8,138,078 | ) | 13,186,847 | |||||||

6

Any investment in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below and all information contained in this prospectus, before you decide whether to purchase our common stock. If any of the following risks or uncertainties actually occurs, our business, financial condition, results of operations and prospects would likely suffer, possibly materially. In addition, the trading price of our common stock could decline due to any of these risks or uncertainties, and you may lose part or all of your investment.

Risks Related to Our Business

We have incurred significant losses since our inception and anticipate that we may continue to incur significant losses. If we fail to generate significant revenue from sales of our marketed products, we may never achieve or sustain profitability.

As of March 31, 2010, we had an accumulated deficit of approximately $44,539,000. The accumulated deficit has resulted principally from costs incurred in our research and development efforts and general operating expenses. We have incurred significant losses in each year since our inception in 1998. Net losses were approximately $2,516,000 for the three months ended March 31, 2010, approximately $7,159,000 for the year ended December 31, 2009, approximately $5,430,000 for the year ended December 31, 2008, and approximately $3,697,000 for the year ended December 31, 2007. We may continue to incur significant operating losses as we continue to invest capital in the sales and marketing of our marketed products, development of our product candidates and our business generally. We also expect that our general and administrative expenses will increase due to additional operational and regulatory burdens associated with operating as a public company.

As a result of the numerous risks and uncertainties associated with developing medical devices, we are unable to predict the extent of any future losses or when we will become profitable, if at all. Our profitability will depend on revenues from the sale of our marketed products. While we recently began marketing of our ClearPoint system in the United States by directly contacting key physicians and hospitals, we may never achieve significant revenues. Therefore, we cannot provide any assurance that we will ever achieve profitability and, even if we achieve profitability, that we will be able to sustain or increase profitability on a quarterly or annual basis. Further, because of our limited commercialization history, we have limited insight into the trends that may emerge and affect our business. We may make errors in predicting and reacting to relevant business trends, which could harm our business and financial condition. Any failure to achieve and maintain profitability would continue to have an adverse effect on our stockholders’ equity and working capital and could result in a decline in our stock price or cause us to cease operations.

Although we have obtained regulatory clearance to market our ClearPoint system in the United States, it may not achieve market acceptance or be commercially successful.

We expect sales of our ClearPoint system will account for the vast majority of our revenues for at least the next several years. Although we received regulatory clearance for our ClearPoint system and we have begun marketing in the United States by directly contacting key physicians and hospitals, our marketed products may not gain market acceptance unless we convince physicians, hospitals and patients of the benefits of our marketed products. Moreover, even if physicians and hospitals understand the benefits of our marketed products, they still may elect not to use our ClearPoint system for a variety of reasons, including:

| • | the shift in location of the procedure from the operating room to the MRI suite; |

| • | the hospital’s ability and willingness to satisfy the increased demand for the MRI suite; |

| • | the cost to the hospital to purchase or otherwise use our marketed products; |

| • | the amount of reimbursement available from third-party payors; |

7

| • | the lack of supporting clinical data; and |

| • | the physician’s familiarity, and having achieved successful results, with other devices and approaches. |

We believe that the market for our ClearPoint system is fairly concentrated among a few hundred hospitals. If physicians and hospitals do not perceive our ClearPoint system as an attractive alternative to other products and procedures, we will not achieve significant market penetration or be able to generate significant revenues, if any. To the extent that our ClearPoint system is not commercially successful or is withdrawn from the market for any reason, our revenues will be adversely impacted and our business, operating results and financial condition will be harmed.

If we fail to obtain regulatory approval for our ClearPoint system in foreign jurisdictions, we will not be able to expand the commercialization of our marketed products abroad.

Currently, we market our ClearPoint system in the United States; however, we also intend to sell our ClearPoint system in the European Union. To market a product in the European Union, we must be entitled to affix a CE mark, an international symbol of adherence to quality assurance standards and compliance with applicable European Union medical device directives. A CE mark would enable us to market a product in all of the countries of the European Union, as well as in other countries, such as Switzerland and Israel, that have mutual recognition agreements with the European Union or have adopted the European Union’s regulatory standards. There can be no assurance that we will receive CE marking approval for our ClearPoint system. To sell our ClearPoint system in other foreign jurisdictions, we will have to obtain separate regulatory approvals from those foreign jurisdictions as well. The regulatory approval process varies among jurisdictions and can involve substantial additional testing. Clearance or approval by the FDA does not ensure clearance or approval by regulatory authorities in other jurisdictions, and clearance or approval by one foreign regulatory authority does not ensure clearance or approval by regulatory authorities in other foreign jurisdictions. The foreign regulatory approval process may include all of the risks associated with obtaining FDA clearance or approval in addition to other risks. In addition, the time required to obtain foreign clearance or approval may differ from that required to obtain FDA clearance or approval and we may not obtain foreign regulatory clearances or approvals on a timely basis, if at all. We may not be able to file for regulatory clearance or approval and may not receive necessary clearance or approval to commercialize our ClearPoint system in any foreign market, either of which would preclude sale of our ClearPoint system in foreign jurisdictions.

We intend to apply for CE marking approval for sale of our ClearPoint system during 2010, and we have engaged KEMA as the Notified Body for our CE marking approval process. A Notified Body is a private commercial entity that is designated by the national government of a European Union member state as being competent to make independent judgments about whether a device complies with applicable regulatory requirements. The exact regulatory pathway for CE marking approval for our ClearPoint system will be the subject of discussions that we have with KEMA. At this time, we are unable to accurately predict when, if ever, CE marking for our ClearPoint system will be obtained, whether clinical trials will be required as part of the CE marking approval process or the regulatory requirements to which we would be subject after approval.

If hospitals and physicians are unable to obtain adequate coverage and reimbursement from third-party payors for procedures utilizing our ClearPoint system, our revenues and prospects for profitability will suffer.

We anticipate that our ClearPoint system components will be purchased primarily by hospitals, which bill various third-party payors, including governmental healthcare programs, such as Medicare, and private insurance plans, for procedures in which our marketed products will be used. Reimbursement is a significant factor considered by hospitals in determining whether to acquire new medical devices such as our marketed products. Therefore, our ability to successfully commercialize our ClearPoint system depends significantly on the availability of coverage and reimbursement from these third-party payors.

Medicare pays hospitals a prospectively determined amount for inpatient operating costs. The prospective payment for a patient’s stay is determined by the patient’s condition and other patient data and procedures

8

performed during the inpatient stay using a classification system known as Medical Severity Diagnosis Related Groups, or MS-DRGs. Medicare pays a fixed amount to the hospital based on the MS-DRG into which the patient’s stay is assigned, regardless of the actual cost to the hospital of furnishing the procedures, items and services provided. Therefore, a hospital must absorb the cost of our marketed products as part of the payment it receives for the procedure in which the product is used. In addition, physicians that perform procedures in hospitals are paid a set amount by Medicare for performing such services under the Medicare physician fee schedule. Medicare payment rates for both systems are established annually.

At this time, we do not know if hospitals will consider third-party reimbursement levels adequate to cover the cost of our marketed products. Furthermore, we do not know if physicians will consider third-party reimbursement levels adequate to compensate them for performing the procedures in which our marketed products are used. Failure by hospitals and physicians to receive an amount that they consider to be adequate reimbursement for procedures in which our marketed products are used will deter them from purchasing or using our marketed products and limit our sales growth.

One result of the current Medicare payment system, which is also utilized by most non-governmental third-party payors, is that a patient’s treating physician orders a particular service and the hospital (or other facility in which the procedure is performed) bears the cost of delivery of the service. Hospitals have limited ability to align their financial interests with those of the treating physician because Medicare law generally prohibits hospitals from paying physicians to assist in controlling the costs of hospital services, including paying physicians to limit or reduce services to Medicare beneficiaries even if such services are medically unnecessary. As a result, hospitals have traditionally stocked supplies and products requested by physicians and have had limited ability to restrict physician choice of products and services.

The Patient Protection and Affordable Care Act enacted on March 23, 2010, as amended by the Health Care and Education Reconciliation Act of 2010 enacted on March 30, 2010, or, together, the Health Care Reform Law, includes a number of provisions that will likely result in more coordination between hospitals and physicians resulting in the alignment of financial incentives between hospitals and physicians to control hospital costs. Most significantly, the Health Care Reform Law provides for the establishment of a Medicare shared savings program whereby Medicare will share certain savings realized in the delivery of services to Medicare beneficiaries with accountable care organizations, which may be organized through various different legal structures between hospitals and physicians. We expect that the overall result of such increased coordination will be voluntary reductions in the array of choices currently available to physicians with respect to diagnostic services, medical supplies and equipment. Such a reduction in physician choices may also result in hospitals reducing the overall number of vendors from which they purchase supplies, equipment and products. The Health Care Reform Law may make it more difficult for us to become and remain an approved vendor, which could have an adverse effect on our financial results and business.

If there are changes in coverage or reimbursement from third-party payors, our revenues and prospects for profitability will suffer.

In the United States, we believe that existing billing codes apply to procedures using our ClearPoint system. Reimbursement levels for procedures using our ClearPoint system or any product that we may market in the future could be decreased or eliminated as a result of future legislation, regulation or reimbursement policies of third-party payors. Any such decrease or elimination would adversely affect the demand for our ClearPoint system or any product that we may market in the future and our ability to sell our products on a profitable basis. For example, on July 30, 2008, Centers for Medicare and Medicaid Services, or CMS, the federal agency that administers the Medicare Program, released a list of potential topics for national coverage determinations. This list included ablation for atrial fibrillation and specifically asked whether the evidence was adequate to demonstrate health benefits in patients who receive the procedure. On October 21, 2009, the Medicare Evidence Development and Coverage Advisory Committee held a meeting on the adequacy of the available evidence for catheter ablation for the treatment of atrial fibrillation. Although CMS has not formally opened a national coverage analysis on this topic, the agency has shown that it is interested in the clinical evidence of atrial

9

fibrillation treatments and any national coverage decisions it makes could have a material effect on the ClearTrace system and our potential business in this area. Furthermore, if procedures using our ClearPoint system gain market acceptance and the number of these procedures increases, CMS, as well as other public or private payors, may establish new billing codes for those procedures that provide for a lower reimbursement amount than traditional approaches, which would adversely affect our financial results and business.

Among other things, the Health Care Reform Law will ultimately increase the overall pool of persons with access to health insurance in the United States. Although such an increase in covered lives should ultimately benefit hospitals, the Health Care Reform Law also includes a number of cuts in Medicare reimbursement to hospitals that may take effect prior to the time hospitals’ realize the financial benefit of a larger pool of insured persons. Such cuts in Medicare reimbursement could adversely impact the operations and finances of hospitals, reducing their ability to purchase medical devices such as our ClearPoint system. Further, the fact that the Health Care Reform Law did not address pending reductions of Medicare physician payment rates under the sustainable growth rate formula could result in an overall reduction of physicians willing to participate in Medicare. Either of these events could adversely affect demand for our ClearPoint system, our business and our financial results.

If third-party payors deny coverage or reimbursement for procedures using our ClearPoint system, our revenues and prospects for profitability will suffer.

Notwithstanding its regulatory clearance in the United States, third-party payors may deny coverage or reimbursement if the payor determines that the use of our ClearPoint system is unnecessary, inappropriate, experimental, not cost-effective, or is used for a non-approved indication. In addition, no uniform policy of coverage and reimbursement for medical technology exists among third-party payors. Therefore, coverage and reimbursement for medical technology can differ significantly from payor to payor. Any denial of coverage or reimbursement for procedures using our ClearPoint system could have an adverse effect on our business, financial results and prospects for profitability.

If we are unable to expand our sales, marketing and distribution capabilities or enter into agreements with third parties to market, sell or distribute our ClearPoint system, we may be unable to generate material product revenues.

We have limited experience in the sales and marketing of medical devices. Currently, our sales and marketing efforts for our ClearPoint system are being coordinated primarily by our Vice President, Sales, our Vice President, Product Management and our two Clinical Engineering Managers. In order to successfully commercialize our ClearPoint system, we will need to expand our present sales and marketing capabilities, which could prove to be time-consuming and expensive. If we are unable to expand these capabilities, we will need to contract with third parties to help us market and sell our ClearPoint system. Likewise, if our current distribution capabilities are unable to satisfy customer demand for our ClearPoint system, we will need to contract with third parties to help us perform that function. To the extent that we enter into arrangements with third parties to perform sales and marketing or distribution services, our product revenues are likely to be lower than if we market, sell and distribute our ClearPoint system ourselves.

Our reliance on single-source suppliers could harm our ability to meet demand for our ClearPoint system in a timely manner or within budget.

Many of the components and component assemblies of our ClearPoint system are currently provided to us by single-source suppliers. We generally purchase components and component assemblies through purchase orders rather than long-term supply agreements and generally do not maintain large volumes of inventory. While alternative suppliers exist and have been identified, the disruption or termination of the supply of components and component assemblies could cause a significant increase in the cost of these components, which could affect our operating results. Our dependence on a limited number of third-party suppliers and the challenges we may face in obtaining adequate supplies involve several risks, including limited control over pricing, availability, quality and delivery schedules. A disruption or termination in the supply of components could also result in our inability to meet demand for our ClearPoint system, which could harm our ability to generate revenues, lead to

10

customer dissatisfaction and damage our reputation. Furthermore, if we are required to change the supplier of a key component or component assembly of our ClearPoint system, we may be required to verify that the new supplier maintains facilities and procedures that comply with quality standards and with all applicable regulations and guidelines. The delays associated with the verification of a new supplier could delay our ability to manufacture our ClearPoint system in a timely manner or within budget.

The Health Care Reform Law and other payment and policy changes may have a material adverse effect on us.

In addition to the reimbursement changes discussed above, the Health Care Reform Law will also impose a 2.3% excise tax on the sale of any taxable human medical device after December 31, 2012, subject to certain exclusions, by the manufacturer, producer or importer of such devices. Further, the Health Care Reform Law encourages hospitals and physicians to work collaboratively through shared savings programs, such as accountable care organizations, which may ultimately result in the reduction of medical device acquisitions and the consolidation of medical device suppliers used by hospitals. While passage of the Health Care Reform Law may ultimately expand the pool of potential end-users of our ClearPoint system, the above-discussed changes could adversely affect our financial results and business.

Further, with the increase in demand for healthcare services, we expect both a strain on the capacity of the healthcare system and more proposals by legislators, regulators and third-party payors to keep healthcare costs down. Certain proposals, if passed, could impose limitations on the prices we will be able to charge for our ClearPoint system, or the amounts of reimbursement available from governmental agencies or third-party payors. These limitations could have a material adverse effect on our financial position and results of operations.

Various healthcare reform proposals have also emerged at the state level. We cannot predict what healthcare initiatives, if any, will be implemented at the federal or state level, or the effect any future legislation or regulation will have on us. However, an expansion in government’s role in the United States healthcare industry may lower reimbursements for our ClearPoint system, reduce medical procedure volumes and adversely affect our business, possibly materially.

Our future success depends on our ability to obtain regulatory clearances or approvals for our current product candidates. We cannot be certain that we will be able to do so in a timely fashion, or at all.

We do not have the necessary regulatory clearances or approvals to market the ClearTrace system in the United States or in any foreign market. In the United States, without FDA clearances or approvals, we cannot market a new medical device, or a new use of, or claim for, or significant modification to, an existing product, unless an exemption applies. To obtain FDA clearance or approval, we must first receive either premarket clearance under Section 510(k) of the federal Food, Drug, and Cosmetic Act or approval of a premarket approval application, or PMA, from the FDA.

In the 510(k) clearance process, the FDA must determine that a proposed device is “substantially equivalent” to a device legally on the market, known as a “predicate” device, with respect to intended use, technology, safety and effectiveness, in order to clear the proposed device for marketing. Clinical data is sometimes required to support substantial equivalence. The 510(k) clearance process generally takes three to twelve months from submission, but can take significantly longer.

The process of obtaining PMA approval is much more costly and uncertain than the 510(k) clearance process. The PMA approval process can be lengthy and expensive and requires an applicant to demonstrate the safety and effectiveness of the device based, in part, on data obtained in clinical trials. The PMA process generally takes one to three years, or even longer, from the time the PMA application is submitted to the FDA until an approval is obtained.

11

Outside the United States, the regulatory approval process varies among jurisdictions and can involve substantial additional testing. Clearance or approval by the FDA does not ensure clearance or approval by regulatory authorities in other jurisdictions, and clearance or approval by one foreign regulatory authority does not ensure clearance or approval by regulatory authorities in other foreign jurisdictions. The foreign regulatory approval process may include all of the risks associated with obtaining FDA clearance or approval in addition to other risks. In addition, the time required to obtain foreign clearance or approval may differ from that required to obtain FDA clearance or approval and we may not obtain foreign regulatory clearances or approvals on a timely basis, if at all. We may not be able to file for regulatory clearance or approval and may not receive necessary clearance or approval to commercialize our product candidates in any foreign market, either of which would preclude sale of our product candidates in foreign jurisdictions.

To market a product in the European Union, we must be entitled to affix a CE mark, an international symbol of adherence to quality assurance standards and compliance with applicable European medical device directives. CE marking approval would enable us to market a product in all of the countries of the European Union, as well as in other countries, such as Switzerland and Israel, that have mutual recognition agreements with the European Union or have adopted the European Union’s regulatory standards.

The regulatory status of our current product candidates is as follows:

| • | ClearTrace System. We are still in the early stages of the development of the ClearTrace system and have not made any regulatory filings with the FDA or any foreign regulatory authority with respect to that system. We anticipate that the initial market for the ClearTrace system will be the European Union and we plan to seek CE marking approval for the ClearTrace system, although there can be no assurance that we will receive CE marking approval. The ClearTrace system consists of several components, including an ablation catheter. Whether as part of the regulatory process in the United States or the CE marking approval process in the European Union, we expect to conduct a clinical trial regarding the safety and effectiveness of our ablation catheter, and we expect to commence enrollment in such a clinical trial in the second half of 2011. The FDA has determined that ablation catheters specifically indicated to treat atrial fibrillation require the submission of a PMA. Therefore, in the United States, we will be required to pursue the PMA process in order to specifically indicate our ablation catheter for the treatment of atrial fibrillation. |

| • | SafeLead Development Program. We are still in the early stages of the SafeLead Development Program. Boston Scientific is responsible for making any regulatory filings with respect to its products that incorporate our MRI-safety technologies. Boston Scientific will control the timing and manner of any regulatory filing, and will be responsible for the costs associated with any regulatory filing. We do not anticipate that we will be able to influence the process or timing in any meaningful way. No regulatory filings have been made to date with the FDA or any foreign regulatory authority. |

The FDA or any applicable foreign authority may not act favorably or quickly in its review of any regulatory submission that we may file or that Boston Scientific may file in connection with the SafeLead Development Program. Additionally, we or Boston Scientific may encounter significant difficulties and costs in obtaining clearances or approvals. If we or Boston Scientific, as the case may be, are unable to obtain regulatory clearances or approvals for our product candidates, or otherwise experience delays in obtaining regulatory clearances or approvals, the commercialization of our product candidates will be delayed or prevented, which will adversely affect our ability to generate revenues. Such delay may also result in the loss of potential competitive advantages that might otherwise be attained by bringing products to market earlier than competitors. Any of these contingencies could adversely affect our business. Even if cleared or approved, our product candidates may not be cleared or approved for the indications that are necessary or desirable for successful commercialization.

12

To the extent we seek a new indication for use of, or new claims for, our ClearPoint system, the FDA may not grant 510(k) clearance or PMA approval of such new use or claims, which may affect our ability to grow our business.

We received 510(k) clearance to market our ClearPoint system for use in general neurological interventional procedures. In the future, we may seek to obtain additional, more specific indications for use of our ClearPoint system beyond the general neurological intervention claim. Some of these expanded claims may require FDA 501(k) clearance. Other claims may require FDA approval of a PMA. Moreover, some specific ClearPoint system claims that we may seek may require clinical trials to support regulatory clearance or approval, and we may not successfully complete or have the funds to initiate these clinical trials. The FDA may not clear or approve these future claims or future generations of our ClearPoint system for the indications that are necessary or desirable for successful commercialization. Indeed, the FDA may refuse our requests for 510(k) clearance or PMA approval. Failure to receive clearance or approval for additional claims for our ClearPoint system would have an adverse effect on our ability to expand our business.

Clinical trials necessary to support 510(k) clearance or PMA approval for the ClearTrace system or any new indications for use for our ClearPoint system will be expensive and may require the enrollment of large numbers of suitable patients, who may be difficult to identify and recruit. Delays or failures in our clinical trials will prevent us from commercializing any modified or new product candidates and will adversely affect our business, operating results and prospects.

Initiating and completing clinical trials necessary to support a PMA for the ClearTrace system or any other product candidates that we may develop, or additional safety and efficacy data that the FDA may require for 510(k) clearance or PMA approval for any new specific indications of our ClearPoint system that we may seek, will be time consuming and expensive with an uncertain outcome. Moreover, the results of early clinical trials are not necessarily predictive of future results, and any product candidate we advance into clinical trials may not have favorable results in later clinical trials.

Conducting successful clinical trials may require the enrollment of large numbers of patients, and suitable patients may be difficult to identify and recruit. Patient enrollment in clinical trials and completion of patient participation and follow-up depends on many factors, including the size of the patient population, the nature of the trial protocol, the attractiveness of, or the discomforts and risks associated with, the treatments received by enrolled subjects, the availability of appropriate clinical trial investigators and support staff, the proximity to clinical sites of patients that are able to comply with the eligibility and exclusion criteria for participation in the clinical trial, and patient compliance. For example, patients may be discouraged from enrolling in our clinical trials if the trial protocol requires them to undergo extensive post-treatment procedures or follow-up to assess the safety and effectiveness of our product candidates or if they determine that the treatments received under the trial protocols are not attractive or involve unacceptable risks or discomforts. In addition, patients participating in clinical trials may die before completion of the trial or suffer adverse medical events unrelated to our product candidates.

Development of sufficient and appropriate clinical protocols to demonstrate safety and efficacy will be required and we may not adequately develop such protocols to support clearance or approval. Further, the FDA may require us to submit data on a greater number of patients than we originally anticipated and/or for a longer follow-up period or change the data collection requirements or data analysis applicable to our clinical trials. Delays in patient enrollment or failure of patients to continue to participate in a clinical trial may cause an increase in costs and delays in the approval and attempted commercialization of our product candidates or result in the failure of the clinical trial. Such increased costs and delays or failures could adversely affect our business, operating results and prospects.

13

If the third parties on which we may need to rely to conduct any clinical trials and to assist us with pre-clinical development do not perform as contractually required or expected, we may not be able to obtain regulatory clearance or approval for the ClearTrace system or any additional claims that we may seek for our ClearPoint system.

We do not have the independent ability to conduct pre-clinical and clinical trials for our marketed products or our product candidates. To the extent that we will need to conduct such trials, we will need to rely on third parties, such as contract research organizations, medical institutions, clinical investigators and contract laboratories, to conduct such trials. If these third parties do not successfully carry out their contractual duties or regulatory obligations or meet expected deadlines, if these third parties need to be replaced, or if the quality or accuracy of the data they obtain is compromised due to the failure to adhere to our clinical protocols or regulatory requirements or for other reasons, our pre-clinical development activities or clinical trials may be extended, delayed, suspended or terminated, and we may not be able to obtain regulatory clearance or approval for a product candidate or additional claims we may seek for our marketed products on a timely basis, if at all. As such, our business, operating results and prospects may be adversely affected. Furthermore, our third-party clinical trial investigators may be delayed in conducting our clinical trials for reasons outside of their control.

The results of our clinical trials may not support our product candidate claims or any additional claims we may seek for our marketed products and may result in the discovery of adverse side effects.

Even if any clinical trial that we need to undertake is completed as planned, we cannot be certain that its results will support our product candidate claims or any new indications that we may seek for our marketed products or that the FDA or foreign authorities will agree with our conclusions regarding the results of those trials. The clinical trial process may fail to demonstrate that our marketed products or a product candidate is safe and effective for the proposed indicated use, which could cause us to stop seeking additional clearances or approvals for our ClearPoint system, abandon a product candidate and may delay development of others. Any delay or termination of our clinical trials will delay the filing of our regulatory submissions and, ultimately, our ability to commercialize a product candidate. It is also possible that patients enrolled in clinical trials will experience adverse side effects that are not currently part of the product candidate’s profile.

The markets for medical devices, such as our ClearPoint system and our product candidates, are highly competitive and we may not be able to compete effectively against the larger, well-established companies in our markets or emerging and small innovative companies that may seek to obtain or increase their share of the market.

We will face competition from products and techniques already in existence in the marketplace. The markets for our ClearPoint system and our product candidates are intensely competitive, and many of our competitors are much larger and have substantially more financial and human resources than we do. Many have long histories and strong reputations within the industry, and a relatively small number of companies dominate these markets. Examples of such large, well-known companies include Biosense Webster Inc., a division of Johnson & Johnson, Medtronic, Inc. and St. Jude Medical Inc.

These companies enjoy significant competitive advantages over us, including:

| • | broad product offerings, which address the needs of physicians and hospitals in a wide range of procedures; |

| • | greater experience in, and resources for, launching, marketing, distributing and selling products, including strong sales forces and established distribution networks; |

| • | existing relationships with physicians and hospitals; |

| • | more extensive intellectual property portfolios and resources for patent protection; |

| • | greater financial and other resources for product research and development; |

14

| • | greater experience in obtaining and maintaining FDA and other regulatory clearances or approvals for products and product enhancements; |

| • | established manufacturing operations and contract manufacturing relationships; and |

| • | significantly greater name recognition and more recognizable trademarks. |

We may not succeed in overcoming the competitive advantages of these large and established companies. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These companies may introduce products that compete effectively against our products in terms of performance, price or both.

We could become subject to product liability claims that could be expensive, divert management’s attention and harm our business.

Our business exposes us to potential product liability risks that are inherent in the manufacturing, marketing and sale of medical devices. We may be held liable if our products cause injury or death or are found otherwise unsuitable or defective during usage. Our ClearPoint system and the ClearTrace system incorporate mechanical and electrical parts, complex computer software and other sophisticated components, any of which can have defective or inferior parts or contain defects, errors or failures. Complex computer software is particularly vulnerable to errors and failures, especially when first introduced.

Because our ClearPoint system and the ClearTrace system are designed to be used to perform complex surgical procedures, defects could result in a number of complications, some of which could be serious and could harm or kill patients. The adverse publicity resulting from any of these events could cause physicians or hospitals to review and potentially terminate their relationships with us.

The medical device industry has historically been subject to extensive litigation over product liability claims. A product liability claim, regardless of its merit or eventual outcome, could result in significant legal defense costs. Although we maintain product liability insurance, the coverage is subject to deductibles and limitations, and may not be adequate to cover future claims. Additionally, we may be unable to maintain our existing product liability insurance in the future at satisfactory rates or in adequate amounts. A product liability claim, regardless of its merit or eventual outcome could result in:

| • | decreased demand for our marketed products; |

| • | injury to our reputation; |

| • | diversion of management’s attention; |

| • | significant costs of related litigation; |

| • | payment of substantial monetary awards by us; |

| • | product recalls or market withdrawals; |

| • | a change in the design, manufacturing process or the indications for which our marketed products may be used; |

| • | loss of revenue; and |

| • | an inability to commercialize product candidates. |

We may not realize the anticipated benefits from our collaborative agreement with Siemens regarding the ClearTrace system.

We have entered into a co-development agreement with Siemens to develop the hardware and MRI software necessary for the ClearTrace system. There can be no assurance that our co-development efforts will be successful or that we will complete development of the ClearTrace system hardware and MRI software. Under

15

our agreement, Siemens is responsible for developing the software for the ClearTrace system, and we are responsible for developing the catheters and other hardware, other than the MRI scanner and workstation. We are obligated to pay Siemens up to approximately $2,500,000 in milestone payments associated with Siemens’ successful development of the software in accordance with our specifications. We started making these payments in the second quarter of 2009 and will continue through the third quarter of 2011. Once the software for the ClearTrace system is commercially available, Siemens is obligated to pay us a fixed amount for each software license sold by Siemens until we recoup our investment in the software. However, if Siemens does not successfully commercialize the software, or if our agreement with Siemens is terminated, we may not recover our investment in the software.

We may not realize the anticipated benefits from our collaborative agreements with Boston Scientific regarding the SafeLead Development Program.

We entered into license and development agreements with Boston Scientific with respect to our MRI-safety technologies. We are working with Boston Scientific to incorporate our MRI-safety technologies into Boston Scientific’s implantable medical leads for cardiac and neurological applications. There is no assurance that our joint development efforts will be successful or that patents will issue on any patent applications we licensed to Boston Scientific, in which case we would not receive future milestone payments or royalties provided for under our agreements with Boston Scientific. Further, Boston Scientific has no obligation to include our licensed intellectual property in its product candidates. Even if Boston Scientific incorporates our licensed intellectual property into its product candidates, Boston Scientific may be unable to obtain regulatory clearance or approval or successfully commercialize the related products, in which case we would not receive royalties in the amounts that we currently anticipate.

We may be required to pay amounts to Boston Scientific under our development agreement in the neurological field if all of our development milestones under that agreement are not met by December 31, 2012.

Our development agreement with Boston Scientific in the neurological field requires specified milestones in the development of an MRI-safe implantable lead to be achieved by December 31, 2012. If the milestones are not achieved by that date, and this failure is not the result of Boston Scientific’s failure to reasonably cooperate with us in pursuing the milestones, we will be required to pay Boston Scientific a sum of money equal to all milestone payments previously paid to us by Boston Scientific under the development agreement, all development expense reimbursements previously paid to us by Boston Scientific under the development agreement, and all patent prosecution costs incurred by Boston Scientific with respect to the intellectual property licensed under the related license agreement. As of March 31, 2010, the potential obligation to Boston Scientific was approximately $750,000, plus costs incurred by Boston Scientific in prosecuting the licensed intellectual property. Our potential payment obligation to Boston Scientific under the neuro development agreement does not apply to any amounts we receive under our agreements in the cardiac field, including the $13,000,000 of upfront licensing fees and any development milestone payments. Our agreements with Boston Scientific in the cardiac field do not impose a payment obligation on us for failure to achieve development milestones.

Boston Scientific has the right to terminate our development agreement for implantable cardiac leads under specified circumstances.

Boston Scientific has the one-time option, within 60 days after successful completion of the first lead feasibility study for cardiac applications, to cease further development work and to terminate the development agreement. If Boston Scientific elects to exercise its termination option under the development agreement, the license we granted to Boston Scientific in that field of use will automatically become non-exclusive with respect to some intellectual property, other intellectual property will be removed from the scope of the license and all rights will revert to us, and Boston Scientific will not be obligated to pay us any future royalties based on sales of its products containing our intellectual property that remains subject to the non-exclusive license.

16

Risks Related to our Need for Financing

We may not be able to continue operations as a going concern and our stockholders may lose their entire investment in us.

At March 31, 2010 and December 31, 2009, we had cash and cash equivalents of approximately $3,549,000 and $2,569,000, respectively, and stockholders’ deficit of approximately $11,395,000 and $9,888,000, respectively. In addition, we had a net loss for the three months ended March 31, 2010 of approximately $2,516,000 and a net loss for the year ended December 31, 2009 of approximately $7,159,000.

As discussed in note 3 to our financial statements included elsewhere in this prospectus, our cumulative net loss since inception and the net losses we incurred in 2009, 2008 and 2007 raise substantial doubt that we will be able to continue operations as a going concern. Our independent auditors included an explanatory paragraph regarding the uncertainty of whether we will be able to continue operations as a going concern in their report on our financial statements for the year ended December 31, 2009. Our ability to continue as a going concern is dependent upon us generating cash flow sufficient to fund operations and reducing operating expenses. Our business plans may not be successful in addressing these issues. If we cannot continue as a going concern, our stockholders may lose their entire investment in us.

We may need additional funding to continue to commercialize our marketed products and to bring our product candidates to market and we may not be able to raise capital when needed, which would force us to delay, reduce or eliminate our product development programs or commercialization efforts.

We will require substantial future capital in order to continue to establish effective marketing and sales capabilities for our ClearPoint system and conduct the research and development and regulatory clearance and approval activities necessary to bring our product candidates to market. If we are unable to generate revenue, we do not expect our existing capital resources and the net proceeds from this offering to be sufficient to enable us to fund the completion of the development and commercialization of all of our product candidates. Excluding cash generated from sales of our marketed products, we believe that the net proceeds from this offering, our existing cash resources and interest on these funds will be sufficient to meet our projected operating requirements through the end of 2011. However, our operating plans may change, and we may need additional funds sooner than anticipated to meet our operational needs and capital requirements for product development, clinical trials, regulatory clearances and approvals, and product commercialization.