0001285550DEF 14Afalse00012855502022-01-012022-12-31iso4217:USD00012855502021-01-012021-12-310001285550ecd:PeoMemberclpt:GrantDateFairValueOfEquityAwardsMember2022-01-012022-12-310001285550ecd:PeoMemberclpt:GrantDateFairValueOfEquityAwardsMember2021-01-012021-12-310001285550clpt:FairValueOfAwardsGrantedOutstandingAndUnvestedMemberecd:PeoMember2022-01-012022-12-310001285550clpt:FairValueOfAwardsGrantedOutstandingAndUnvestedMemberecd:PeoMember2021-01-012021-12-310001285550ecd:PeoMemberclpt:ChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMember2022-01-012022-12-310001285550ecd:PeoMemberclpt:ChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMember2021-01-012021-12-310001285550ecd:PeoMemberclpt:ChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2022-01-012022-12-310001285550ecd:PeoMemberclpt:ChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2021-01-012021-12-310001285550ecd:PeoMemberclpt:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMember2022-01-012022-12-310001285550ecd:PeoMemberclpt:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMember2021-01-012021-12-310001285550ecd:PeoMemberclpt:FairValueAtEndOfThePriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310001285550ecd:PeoMemberclpt:FairValueAtEndOfThePriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310001285550ecd:PeoMemberclpt:DividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2022-01-012022-12-310001285550ecd:PeoMemberclpt:DividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2021-01-012021-12-310001285550clpt:GrantDateFairValueOfEquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310001285550clpt:GrantDateFairValueOfEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310001285550clpt:FairValueOfAwardsGrantedOutstandingAndUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001285550clpt:FairValueOfAwardsGrantedOutstandingAndUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001285550clpt:ChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310001285550clpt:ChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310001285550clpt:ChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310001285550clpt:ChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310001285550clpt:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001285550clpt:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001285550ecd:NonPeoNeoMemberclpt:FairValueAtEndOfThePriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310001285550ecd:NonPeoNeoMemberclpt:FairValueAtEndOfThePriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310001285550ecd:NonPeoNeoMemberclpt:DividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2022-01-012022-12-310001285550ecd:NonPeoNeoMemberclpt:DividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☑

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☑ | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to Rule 14a-12 |

CLEARPOINT NEURO, INC.

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| x | No fee required. |

| |

| o | Fee paid previously with preliminary materials: |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

| |

ClearPoint Neuro, Inc.

120 S. Sierra Avenue, Suite 100

Solana Beach, California 92075

April 14, 2023

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of ClearPoint Neuro, Inc. to be held on Wednesday, May 24, 2023 at 9:00 a.m., Pacific Time. Our Annual Meeting will be held virtually via the Internet at https://www.cstproxy.com/clearpointneuro/2023, with no physical, in-person meeting. For more information on how to access and attend this year’s virtual Annual Meeting, please refer to the General Information section beginning on page 1 in the enclosed Proxy Statement.

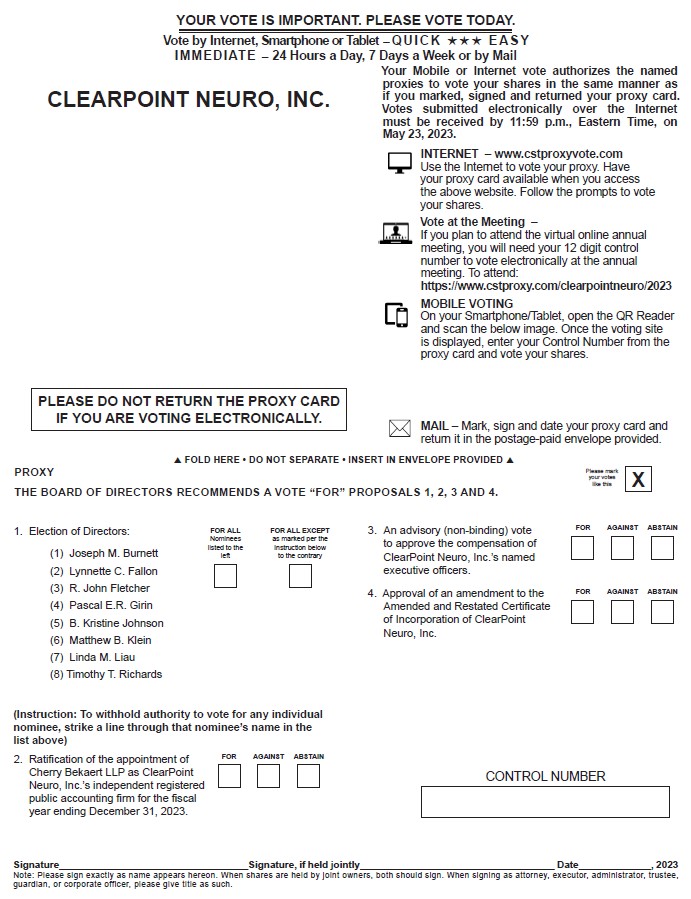

At this year’s Annual Meeting, the agenda includes: (1) the election of the eight directors named in the accompanying Proxy Statement; (2) a proposal to ratify the appointment of our independent registered public accounting firm; (3) a proposal to approve the compensation of our named executive officers; and (4) a proposal to approve an amendment to our Amended and Restated Certificate of Incorporation to decrease the number of authorized shares of our common stock. The Board of Directors recommends that you vote FOR the election of the eight directors named in the accompanying Proxy Statement, FOR the ratification of the appointment of our independent registered public accounting firm, FOR the compensation of our named executive officers, and FOR an amendment to our Amended and Restated Certificate of Incorporation to decrease the number of authorized shares of our common stock. Executive officers of the company will be present at the Annual Meeting to answer any appropriate questions you may have.

It is important that your shares be represented and voted at the Annual Meeting, regardless of the size of your holdings. Accordingly, you are urged to submit your proxy electronically via the Internet as instructed in these materials. If you attend the Annual Meeting, you may, of course, withdraw your proxy should you wish to vote at the Annual Meeting. Your vote is very important. We urge you to vote your proxy as soon as possible.

We look forward to seeing you at the Annual Meeting.

| | | | | | | | |

| Joseph M. Burnett | |

| Chief Executive Officer and President |

| | |

Your Vote Is Important You are urged to vote electronically via the Internet as instructed in these materials. |

ClearPoint Neuro, Inc.

120 S. Sierra Avenue, Suite 100

Solana Beach, California 92075

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 24, 2023

Dear Stockholder:

The regular Annual Meeting of Stockholders of ClearPoint Neuro, Inc. will be held on Wednesday, May 24, 2023 at 9:00 a.m., Pacific Time. Our Annual Meeting will be held virtually via the Internet at https://www.cstproxy.com/clearpointneuro/2023, with no physical, in-person meeting. For more information on how to access and attend the Annual Meeting, please refer to the General Information section beginning on page 1 in the Proxy Statement. The Annual Meeting will be held for the following purposes:

1.Election of our Directors. To elect the eight directors named herein to serve until the 2024 Annual Meeting of Stockholders;

2.Ratification of the Auditors. To ratify the selection of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023;

3.Advisory Approval of Executive Compensation. To cast an advisory (non-binding) vote to approve the compensation of our named executive officers;

4.Approval of an Amendment to our Amended and Restated Certificate of Incorporation. To approve an amendment to our Amended and Restated Certificate of Incorporation to reduce the number of authorized shares of common stock from two hundred million (200,000,000) shares to ninety million (90,000,000) shares; and

5.Other Business. To transact such other business as may properly come before the Annual Meeting or any adjournment of the meeting.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE PROPOSALS.

Only those stockholders of record at the close of business on March 27, 2023 are entitled to notice of, and to vote at, the Annual Meeting and any adjournment thereof. On that day, 24,582,251 shares of common stock were outstanding. Each share entitles the holder to one vote.

Pursuant to rules adopted by the Securities and Exchange Commission, we are providing access to our proxy materials over the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”), which contains instructions on how stockholders can access those documents over the Internet and vote their shares. The Notice also contains instructions on how stockholders can receive a paper copy of our proxy materials, including this Proxy Statement, our 2022 Annual Report, and a Proxy Card. We believe this process will expedite stockholders’ receipt of proxy materials, lower the costs of our 2023 Annual Meeting of Stockholders and conserve natural resources.

| | | | | | | | |

| By Order of the Board of Directors, |

| | | | | | | | |

| Ellisa Cholapranee | |

| General Counsel and Secretary |

April 14, 2023

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 24, 2023:

The Company’s Proxy Statement and Annual Report to stockholders for the fiscal year ended December 31, 2022 are available at https://www.cstproxy.com/clearpointneuro/2023

A Notice or the Proxy Statement, form of proxy and accompanying materials are first being sent to shareholders on or about April 14, 2023. |

Table of Contents

| | | | | |

| Page No. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PROPOSAL NO. 3 ADVISORY (NON-BINDING) VOTE TO APPROVE EXECUTIVE COMPENSATION | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

ClearPoint Neuro, Inc.

120 S. Sierra Avenue, Suite 100

Solana Beach, California 92075

Proxy Statement for Annual Meeting of Stockholders

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDERS MEETING TO BE HELD ON WEDNESDAY, MAY 24, 2023:

THIS PROXY STATEMENT, THE PROXY CARD AND OUR 2022 ANNUAL REPORT ON

FORM 10-K ARE AVAILABLE ON THE INTERNET AT

HTTPS://WWW.CSTPROXY.COM/CLEARPOINTNEURO/2023.

GENERAL INFORMATION

What is the Notice of Internet Availability of Proxy Materials and why am I receiving it?

Pursuant to the “e-proxy” rules promulgated by the Securities and Exchange Commission (the “SEC”), we are providing access to our proxy materials in a fast and efficient manner via the Internet. Accordingly, on or about April 14, 2023, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record as of the close of business on March 27, 2023, and posted our proxy materials on the website referenced in the Notice (https://www.cstproxy.com/clearpointneuro/2023). As more fully described in the Notice, all stockholders may choose to access our proxy materials on the website referred to in the Notice. The Notice contains instructions on how to access and read this Proxy Statement and our Annual Report on the Internet and how to vote online. If you received a Notice by mail, you will not receive paper copies of the proxy materials in the mail, unless you request them. If you received a Notice by mail and would like to receive a printed copy of the materials, please follow the instructions on the Notice for requesting the materials, and we will promptly mail the materials to you.

What is this document?

This document is the Proxy Statement of ClearPoint Neuro, Inc. for the 2023 Annual Meeting of Stockholders, or the “Annual Meeting,” to be held at 9:00 a.m., Pacific Time, on Wednesday, May 24, 2023.

We refer to ClearPoint Neuro, Inc. throughout this document as “we,” “us” or the “Company.”

What is the date and time of the Annual Meeting?

The Annual Meeting is scheduled to be held on Wednesday, May 24, 2023, at 9:00 a.m. Pacific Time.

How do I access and attend the Annual Meeting?

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by audio webcast. No physical in-person meeting will be held. The online Annual Meeting will begin promptly at 9:00 a.m. Pacific Time on May 24, 2023. We encourage you to access the Annual Meeting prior to the start time, leaving ample time to check in. You will be able to attend the Annual Meeting online and vote by visiting https://www.cstproxy.com/clearpointneuro/2023.

If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, or “Continental” (i.e., you are the stockholder of record), please follow the instructions included in the Notice sent to you, which contains the URL address (https://www.cstproxy.com/clearpointneuro/2023), along with your control number. You will need your control number included in the Notice sent to you or, if you requested printed copies be sent to you by mail, on your Proxy Card or in the instructions that accompanied your proxy materials, to access and attend the Annual Meeting virtually via the Internet. If you do not have your control number, please contact Continental at the phone number or e-mail address below.

If your shares are held in the name of your broker, bank or other nominee, you must contact your broker, bank or other nominee and obtain a legal proxy. Once you obtain your legal proxy, please contact Continental to have a control number generated for the Annual Meeting:

•By telephone at (917) 728-9124; or

•By email at proxy@continentalstock.com.

Can I ask questions at the virtual Annual Meeting?

Stockholders who attend our virtual Annual Meeting will have an opportunity to submit questions live via the Internet during a designated portion of the Annual Meeting. You must have your control number provided in the Notice sent to you or obtained by following the instructions above.

What is a proxy?

It is your legal designation of another person, called a “proxy,” to vote the stock you own. The document that designates someone as your proxy is also called a proxy, or a “Proxy Card.”

Who is paying the costs to prepare this Proxy Statement and solicit my proxy?

We will pay all expenses in connection with the solicitation of the proxies related to this Proxy Statement.

Who is soliciting my proxy, and will anyone be compensated to solicit my proxy?

Your proxy is being solicited by and on behalf of our Board of Directors, or our “Board.” We have retained the services of Morrow Sodali, a professional proxy solicitation firm, to aid in the solicitation of proxies for an estimated fee of $9,000 plus expenses. Morrow Sodali may conduct this proxy solicitation by mail, telephone, facsimile, e-mail, other electronic channels of communication, or otherwise.

In addition to solicitation by the proxy solicitor and by the use of mail, proxies may be solicited by our officers and employees by telephone, electronic mail, facsimile transmission or other means of communication. Our officers and employees will not be additionally compensated, but they may be reimbursed for out-of-pocket expenses in connection with any solicitation. We may also reimburse custodians, nominees and fiduciaries for their expenses in sending proxies and proxy material to beneficial owners.

What is ClearPoint Neuro, Inc., and where is it located?

We are a commercial-stage medical device company that develops and commercializes innovative platforms for performing minimally invasive surgical procedures in the brain under direct, intra-procedural magnetic resonance imaging, or “MRI,” guidance. In 2021, our efforts expanded beyond the MRI suite to encompass development and commercialization of new neurosurgical device products for the operating room setting. Our ClearPoint® system, which is in commercial use in the United States, the United Kingdom, and the European Union, is used to perform minimally invasive surgical procedures in the brain. Our SmartFlow® cannula has been used in approved clinical trials to inject gene and cell therapies directly into the brain, thus bypassing the blood-brain barrier. In 2021, we began offering a growing list of consulting services to our biologics and drug delivery customers, including clinical support and training, protocol consultation, customized device development, and other solutions to optimize pre-clinical and clinical workflows.

Our principal executive office is located at 120 S. Sierra Avenue, Suite 100, Solana Beach, California 92075. We also conduct other operations, including component processing, final assembly, packaging and distribution activities for our ClearPoint products, at a facility in Irvine, California.

Where is our common stock traded?

Our common stock is traded on The Nasdaq Capital Market under the symbol “CLPT.”

Will the Company’s directors be in attendance at the Annual Meeting?

The Company encourages, but does not require, its directors to attend annual meetings of stockholders, recognizing that from time-to-time scheduling conflicts may occur that will prevent a director from attending. We expect that all of our Board members will attend the Annual Meeting, if possible.

VOTING MATTERS

Who is entitled to attend and vote at the Annual Meeting?

Only stockholders of record at the close of business on the record date, March 27, 2023, are entitled to receive notice of the Annual Meeting and to vote the shares for which they are stockholders of record on that date at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. A list of our stockholders will be open to the examination of any stockholder, for any purpose germane to the Annual Meeting, at our principal executive office during ordinary business hours for a period of ten days prior to the Annual Meeting. Please contact Ellisa Cholapranee at (888) 287-9109 to coordinate your review. On March 27, 2023, we had 24,582,251 shares of common stock outstanding.

Stockholders of Record: Shares Registered in Your Name. If at the close of business on March 27, 2023, your shares were registered directly in your name with Continental, then you are a stockholder of record. As a stockholder of record, you may submit your vote online at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to authorize a proxy to vote your shares by following the instructions in the Notice or in this proxy statement to ensure that your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If at the close of business on March 27, 2023, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares online at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on and what does the Board recommend?

| | | | | | | | |

You will be asked to vote on the following items: | | Our Board recommends that you vote: |

| | |

◦Proposal No. 1: To elect the eight nominees named herein to serve on our Board of Directors until the 2024 Annual Meeting of Stockholders; | | ◦“FOR” Proposal No. 1, the election of each of the eight nominees named herein to serve on our Board of Directors; |

◦Proposal No. 2: To ratify the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; | | ◦“FOR” Proposal No. 2, the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; |

◦Proposal No. 3: To cast an advisory (non-binding) vote to approve the compensation of our named executive officers; | | ◦“FOR” Proposal No. 3, the approval of the compensation of our named executive officers; |

◦Proposal No. 4: To approve an amendment to our Amended and Restated Certificate of Incorporation. | | ◦“FOR” Proposal No. 4, the approval of an amendment to our Amended and Restated Certificate of Incorporation. |

May other matters be raised at the Annual Meeting? How will the meeting be conducted?

We currently are not aware of any business to be acted upon at the Annual Meeting other than the four matters described above. Under Delaware law and our governing documents, no other business aside from procedural matters may be raised at the Annual Meeting unless proper notice has been given to us by the stockholders. If other business is properly raised, your proxies have authority to vote in their discretion, including to adjourn the Annual Meeting.

The Chairman of the Annual Meeting has broad authority to conduct the Annual Meeting so that the business of the Annual Meeting is carried out in an orderly and timely manner. In doing so, he has broad discretion to establish reasonable rules for discussion, comments and questions during the Annual Meeting. The Chairman of the Annual Meeting is also entitled to rely upon applicable law regarding disruptions or disorderly conduct to ensure that the Annual Meeting proceeds in a manner that is fair to all participants.

Do any of the proposals entitle me to a dissenter’s right of appraisal?

Our stockholders are not entitled to dissenters’ rights in connection with any of the proposals to be voted on at the Annual Meeting. Furthermore, we do not intend to independently provide our stockholders with any such rights.

How do I vote?

For Proposal No. 1, you may either vote “FOR” each nominee named herein to serve on the Board or you may withhold your vote for any nominee that you specify. For Proposal No. 2, Proposal No. 3 and Proposal No. 4, you may vote “FOR” or “AGAINST” or abstain from voting. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you may vote online at the Annual Meeting, vote by proxy on the Internet, or by using a Proxy Card that you may request. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and submit your vote online even if you have already voted by proxy.

•To vote at the Annual Meeting, follow the instructions above to attend and submit your vote.

•To authorize a proxy to vote your shares using a Proxy Card, simply complete, sign and date the Proxy Card that may be delivered and return it promptly in the envelope provided. To request a Proxy Card, follow the instructions on the Notice. If you return your signed Proxy Card to us before the Annual Meeting, we will vote your shares as you direct.

•You can choose to vote your shares at any time using the Internet site identified on your Notice. This site will give you the opportunity to make your selections and confirm that your instructions have been followed. We have designed our Internet voting procedures to authenticate your identity by use of a unique control number found on your Notice. To take advantage of the convenience of voting on the Internet, you must subscribe to one of the various commercial services that offer access to the Internet. Costs normally associated with electronic access, such as usage and telephone charges, will be borne by you. We do not charge any separate fees for access to the Internet voting site. Your vote must be received by 11:59 p.m. Eastern Time on May 23, 2023 to be counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, you should have received a notice and voting instructions from that organization, rather than from us. Simply follow the instructions in that notice to ensure that your vote is counted. Alternatively, you may vote over the Internet as instructed by your broker or bank. To vote at the Annual Meeting, you must obtain a legal proxy from your broker, bank or other nominee and contact Continental to have a control number generated for the Annual Meeting by following the instructions set forth on page 1 of this Proxy Statement under “How do I access and attend the Annual Meeting?”.

What if I return a Proxy Card or otherwise vote but do not make specific choices?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record and return a signed and dated Proxy Card or otherwise vote without marking any voting selections, your shares will be voted as follows:

•“FOR” the election of each of the eight nominees named herein to serve on the Board of Directors;

•“FOR” the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023;

•“FOR” the approval of the compensation of our named executive officers; and

•“FOR” the approval of an amendment to our Amended and Restated Certificate of Incorporation.

If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your Proxy Card) will vote your shares as recommended by our Board or, if no recommendation is given, will vote your shares using such individual’s best judgment.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee and you do not provide that organization with voting instructions, that organization will determine if it has the discretionary authority to vote on the particular matter. On certain “routine” matters, brokerage firms have the discretionary authority to vote shares for which their customers do not provide voting instructions. We believe Proposal No. 2, the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm, and Proposal No. 4, the approval of an amendment to our Amended and Restated Certificate of Incorporation, are considered routine matters for this purpose. However, Proposal No. 1, the election of directors, and Proposal No. 3, the approval of the compensation of our named executive officers, are not considered to be routine matters. Your broker or other nominee cannot vote without instructions on non-routine matters, and, therefore, we expect broker non-votes on Proposal No. 1 and No. 3. Accordingly, if you own shares through your broker, bank or other nominee, please be sure to instruct that organization how to vote to ensure that your vote is counted on all of the proposals.

Can I change my mind and revoke my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting.

If you are the record holder of your shares, you may revoke your proxy in any of the following ways:

•You may submit another properly completed proxy bearing a later date;

•You may send a written notice that you are revoking your proxy to ClearPoint Neuro, Inc., Attn: Corporate Secretary, 120 S. Sierra Avenue, Suite 100, Solana Beach, California 92075; or

•You may attend and vote online at the Annual Meeting. The last submitted vote will be the one recorded for the holder.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by that organization to revoke your proxy.

What if I receive more than one Notice?

Multiple Notices mean that you have more than one account with brokers or our transfer agent. Please vote all of your shares. We also recommend that you contact your broker or our transfer agent to consolidate as many accounts as possible under the same name and address. Our transfer agent is Continental Stock Transfer & Trust Company, One State Street, 30th Floor, New York, New York 10004-1561, and can be reached at (212) 509-4000.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count “FOR” and “WITHHOLD” votes and broker non-votes with respect to Proposal No. 1, “FOR” and “AGAINST” votes and abstentions with respect to Proposal No. 2 and Proposal No. 4, and “FOR” and “AGAINST” votes, abstentions and broker non-votes with respect to Proposal No. 3. A broker non-vote occurs when a nominee, such as a broker or bank, holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary authority to vote with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner. In the event that a broker, bank, custodian, nominee or other record holder of our common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum for the transaction of business at the Annual Meeting. Abstentions will be counted towards the tabulation of shares present at the Annual Meeting or represented by proxy and entitled to vote and will have the same effect as “AGAINST” votes on Proposal No. 2, Proposal No. 3 and Proposal No. 4. Although broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum, broker non-votes will not be counted for purposes of determining the number of shares present at the Annual Meeting or represented by proxy and entitled to vote with respect to a particular proposal. Therefore, a broker non-vote will not affect the outcome of the vote on any of the proposals.

What is the vote required for each proposal?

•For Proposal No. 1, the election of the eight nominees named herein to serve on our Board, the eight nominees receiving the most “FOR” votes (among votes properly cast at the Annual Meeting or by proxy) will be elected to our Board.

•To be approved, Proposal No. 2, the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, must receive a “FOR” vote from at least a majority of the shares present at the Annual Meeting or represented by proxy at the Annual Meeting and entitled to vote. However, the Audit Committee is not bound by a vote either “FOR” or “AGAINST” the firm. The Audit Committee will consider a vote against the firm by the stockholders in selecting our independent registered public accounting firm in the future.

•To be approved, Proposal No. 3, the compensation of our named executive officers, must receive a “FOR” vote from at least a majority of the shares present at the Annual Meeting or represented by proxy at the Annual Meeting and entitled to vote. Although the vote is non-binding, the Board and the Compensation Committee will review the voting results and take them into consideration in connection with their ongoing evaluation of the Company’s compensation practices and when making future decisions regarding executive compensation.

•To be approved, Proposal No. 4, the approval of an amendment to our Amended and Restated Certificate of Incorporation must receive a “FOR” vote from at least a majority of the outstanding shares of our common stock.

How many shares must be present to constitute a quorum for the Annual Meeting?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are represented by stockholders present at the Annual Meeting or by proxy. On March 27, 2023, the record date, there were 24,582,251 shares outstanding and entitled to vote. Thus, at least 12,291,127 shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the Annual Meeting. Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum. If there is no quorum, either the Chairman of the meeting or a majority of the votes present at the Annual Meeting or represented by proxy at the Annual Meeting may adjourn the Annual Meeting to another date.

How many votes do I have and can I cumulate my votes?

You have one vote for every share of our common stock that you own. Cumulative voting is not allowed.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final results are expected to be published in a Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission, or the “SEC,” on or before the fourth business day following the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days following the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

What is the structure of our Board?

Pursuant to Delaware law and our governing documents, our business and affairs are managed under the direction of our Board. Our Board is our ultimate decision-making and oversight body, except with respect to matters reserved to the stockholders. The directors are charged with the responsibility of exercising their fiduciary duties to act in our best interest and the best interest of our stockholders. Our Board selects and oversees members of executive management who have the authority and responsibility for the conduct of the day-to-day operations of the business.

The number of directors that constitutes our Board is fixed from time to time by a resolution adopted by the affirmative vote of a majority of the authorized number of directors at any regular or special meeting of our Board. On an annual basis, the Corporate Governance and Nominating Committee will consider the size and composition of our Board and report to our Board the results of its review and any recommendations for change. Currently, our Board is fixed at eight directors. Our directors stand for election at each annual meeting of the stockholders and serve on our Board until the next annual meeting of the stockholders and until a successor has been duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal.

How are nominees evaluated? What are the minimum qualifications?

The Corporate Governance and Nominating Committee is responsible for recommending to the Board the type of skills and qualifications required of directors, based on our needs from time to time. In evaluating candidates for director, the Corporate Governance and Nominating Committee may consider several factors, including relevant experience, education, independence, commitment, prominence and understanding of the Company’s business, as well as any other factors it deems relevant. The Board will nominate individuals to serve on our Board only from director candidates screened and approved by the Corporate Governance and Nominating Committee and recommended to the Board.

The directors’ experiences, qualifications and skills that the Corporate Governance and Nominating Committee considered in their nomination are included in their individual biographies.

What role does diversity play in the selection of members of our Board?

In evaluating potential candidates for Board membership, the Corporate Governance and Nominating Committee considers, among other things, relevant experience, education, independence and commitment. Our Board will also consider diversity in their assessment of potential candidates, including diversity of personal background, professional experience, qualifications and skills. Our Board believes that diversity is important because various points of view contribute to richer discussion, better decision making, and a more effective Board. Among our eight nominees for election to the Board, three self-identify as women and two self-identify as individuals from underrepresented communities (meaning, an individual who self-identifies as Black, African American, Hispanic, Latino, Asian, Pacific Islander, Native American, Native Hawaiian, or Alaska Native, or who self-identifies as gay, lesbian, bisexual, or transgender).

Diversity Matrix. The following table summarizes certain self-identified characteristics of our directors, in accordance with Nasdaq Listing Rules 5605(f) and 5606. Each term used in the table has the meaning given to it in the rule and related instructions.

| | | | | | | | | | | | | | |

| ClearPoint Neuro, Inc. Board Diversity Matrix as of April 14, 2023 |

| Total Number of Directors | 8 |

| Part I: Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender |

| Directors | 3 | 5 | 0 | 0 |

| Part II: Demographic Background | | | | |

| African American or Black | 0 | 0 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 1 | 0 | 0 | 0 |

| Hispanic or Latinx | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 2 | 5 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 1 |

| Did Not Disclose Demographic Background | 0 |

Who are the nominees this year?

Upon the recommendation of the Corporate Governance and Nominating Committee, our Board has nominated the following eight persons to serve as directors: Joseph M. Burnett, R. John Fletcher, Lynnette C. Fallon, Pascal E.R. Girin, B. Kristine Johnson, Matthew B. Klein, Linda M. Liau and Timothy T. Richards. If elected, each nominee identified above will serve on our Board until the 2024 Annual Meeting of Stockholders or until his or her earlier death, resignation or removal. We anticipate that each of these nominees will be available for election, but if a situation arises in which he or she is unavailable, the proxy will be voted in accordance with the best judgment of the named proxies unless directed otherwise.

What are the backgrounds and qualifications of this year’s nominees?

Information about the following eight individuals nominated as directors is provided below.

| | | | | | | | |

Director Nominees | | Age |

Joseph M. Burnett | | 46 |

R. John Fletcher | | 77 |

Lynnette C. Fallon | | 63 |

Pascal E.R. Girin | | 63 |

B. Kristine Johnson | | 71 |

Matthew B. Klein | | 51 |

Linda M. Liau | | 56 |

Timothy T. Richards | | 65 |

Joseph M. Burnett joined us as President and Chief Executive Officer and became a member of our Board of Directors in November 2017. Before joining our Company, Mr. Burnett served as Vice President and General Manager of Neuro Diagnostics and Therapy at Royal Philips, a publicly-traded global health technology company, since March 2016. Prior to serving in such role, Mr. Burnett was the Senior Vice President and Business Leader of Image Guided Therapy Devices at Royal Philips and General Manager of Volcano Corporation (a Royal Philips company) from February 2015 to March 2016. Before joining Royal Philips, Mr. Burnett worked for Volcano Corporation, where he served in various positions from November 2004 to February 2015, most recently as Executive Vice President and General Manager of its Coronary & Systems Business Unit. Prior to joining Volcano Corporation, Mr. Burnett served as an R&D Engineer and Product Manager at Guidant Corporation from August 1999 to November 2004 and worked as a Bio-Medical Engineering Researcher at Duke University from May 1998 to May 1999. Mr. Burnett holds an MBA from The Fuqua School of Business at Duke University and a B.S.E. degree in Bio-Medical Engineering from Duke University. As our Chief Executive Officer, and as a result of his substantial leadership experience and expertise in the medical device industry and

neurology, we believe Mr. Burnett offers a unique understanding of our business and industry that is invaluable to our Board.

R. John Fletcher joined our Board in May 2017 and currently serves as Chairman of our Board. Mr. Fletcher founded Fletcher Spaght in 1983 where, as Managing Partner emeritus, he remains active in both the consulting practice and venture capital activities, with analytical insights and creative solutions derived from his years of experience with clients, portfolio companies and the investment community. Mr. Fletcher works across Fletcher Spaght’s practice groups, with a focus on healthcare. He has particular interests in devices, specifically in cardiology, cardiac surgery, and orthopedics, as well as in biopharma and healthcare IT. Prior to founding Fletcher Spaght, Mr. Fletcher was a Senior Manager at The Boston Consulting Group, advising a broad range of companies in healthcare and high technology industries. Mr. Fletcher serves on the Boards of Directors of KORU Medical Systems (Nasdaq: KRMD), Vyant Bio, Inc. (Nasdaq: VYNT), Metabolon and OptiNose, Inc. (Nasdaq:OPTN), and served on the Board of Directors of Spectranetics until it was acquired by Royal Philips in August 2017. He serves on the Board of Advisors of Beth Israel Deaconess Medical Center and the Whitehead Institute at MIT. Mr. Fletcher received his MBA from Southern Illinois University, and a BBA in Marketing from George Washington University. He was an Instructor for courses in international business and a Ph.D. Candidate at the Wharton School of the University of Pennsylvania. He served as a Captain and jet pilot in the U.S. Air Force and continues to be active in aviation. We believe Mr. Fletcher brings strategic insight, leadership and a wealth of experience in healthcare to our Board. He has experience as a director on several publicly traded company Boards. Mr. Fletcher was named 2018 Director of the Year by The National Association of Corporate Directors (NACD) for his work leading to the turnaround at Spectranetics, as well as his contributions leading the success of other companies.

Lynnette C. Fallon joined our Board in July 2021. Ms. Fallon is Executive Vice President, HR/Legal, General Counsel and Secretary of Axcelis Technologies, Inc. (Nasdaq: ACLS), a provider of equipment and service solutions for the semiconductor manufacturing industry, with locations in 8 countries. Ms. Fallon has held her current position since May 2005, having initially joined Axcelis in 2001 as a Senior Vice President and General Counsel. As a member of Axcelis’ executive team for more than 20 years, Ms. Fallon has been involved with business development, financial and tax management, investor relations, public offerings, M&A, risk management, executive compensation, and all aspects of international corporate compliance. Before joining Axcelis, Ms. Fallon worked at the Boston law firm of Palmer & Dodge LLP, as a partner since 1992, prior to which she was an associate since 1987. During her more than 10 years at Palmer & Dodge, Ms. Fallon’s work was primarily for clients in the biotech industry. She was head of Palmer & Dodge’s business law department for the three years prior to joining Axcelis. Ms. Fallon’s M&A and financial transaction experience began in 1984 at a Wall Street boutique firm, doing tax-driven LBOs, venture capital and private equity transactions. She holds a J.D., cum laude, from the School of Law at Boston University and a B.A. with departmental and general honors, Phi Beta Kappa, from Vassar College. We believe that Ms. Fallon is qualified to serve on our Board given her extensive business and leadership experience and her legal expertise.

Pascal E.R. Girin joined our Board in September 2014. Mr. Girin possesses over two decades of management and executive experience in the field of medical technology. Since September 2016, Mr. Girin has served as President and CEO of Balt SAS, a private company specializing in the treatment of neurovascular diseases, where he was recruited to lead the company’s global expansion. Mr. Girin served as Executive Vice President and Chief Operating Officer of Wright Medical Technology, Inc. from November 2012 until October 2015, at which time the company successfully merged with Tornier N.V. and formed Wright Medical Group N.V. Prior to joining Wright Medical, Mr. Girin served as President and Chief Executive Officer of Keystone Dental Inc. from February 2011 to June 2012, at which time the company successfully merged with Southern Implants Inc. From October 2010 to February 2011, Mr. Girin served as Executive Vice President and Chief Operating Officer of Keystone Dental Inc. From July 2010 to September 2010, Mr. Girin served as Chief Operating Officer of ev3 Inc. following its acquisition by a wholly owned subsidiary of Covidien Group S.a.r.l. Prior to that time, Mr. Girin served as Executive Vice President and Chief Operating Officer of ev3 Inc. from January 2010 to July 2010, as Executive Vice President and President, Worldwide Neurovascular and International of ev3 Neurovascular Inc. from July 2008 to January 2010, as Senior Vice President and President, International of ev3 International from July 2005 to July 2008, and as General Manager, Europe of ev3 Inc. from September 2003 to July 2005. From September 1998 to August 2003, Mr. Girin served in various capacities at BioScience Europe Baxter Healthcare Corporation, most recently as Vice President. Mr. Girin received an engineering education at the French Ecole des Mines. From November 2010 until November 2, 2012, Mr. Girin had served as a director of Tornier N.V., a publicly traded global medical device company, as well as a member of its Nominating, Corporate Governance and Compliance Committees. With nearly three decades of experience as an executive and director in the medical device industry, both in the U.S. and in Europe, we believe Mr. Girin brings invaluable industry experience and leadership qualities to our Board, as well as insight into international markets.

B. Kristine Johnson joined our Board in September 2019. Ms. Johnson is President and General Partner of Affinity Capital Management, a venture capital firm that has invested primarily in seed and early-stage health care companies in the U.S. She has held this position since 2000. Prior to working for Affinity Capital Management, Ms. Johnson was employed for seventeen years at Medtronic, Inc., a manufacturer of cardiac pacemakers, neurological and spinal devices and other medical products, serving most recently as Senior Vice President and Chief Administrative Officer from 1998 to 1999. Her experience at Medtronic also includes service as President of the Vascular business and President of the Tachyarrhythmia Management business, among other roles. Ms. Johnson is Board Chair of Atricure, Inc. (Nasdaq: ATRC) and also serves on the Boards of Directors of ViewRay, Inc. (Nasdaq: VRAY) and Paragon28, Inc. (NYSE: FNA). She was previously lead director of the Piper Sandler Board and was recognized in 2018 by NACD for excellence in the boardroom. Ms. Johnson earned a bachelor’s degree, summa cum laude, from St. Olaf College. She is also a recipient of the college’s Distinguished Alumni Award. We believe that Ms. Johnson’s extensive experience with health care companies and her leadership experience qualify her to serve on our Board.

Matthew B. Klein joined our Board in April 2020. Dr. Klein serves as the Chief Executive Officer and President of PTC Therapeutics, Inc., or “PTC”. Dr. Klein joined PTC in October 2019 as Global Head Gene and Mitochondrial Therapies, became Chief Development Officer in April 2020, and assumed the role of Chief Operating Officer in January 2022. Prior to joining PTC, Dr. Klein was Chief Executive Officer and a Director of BioElectron Technology Corporation, or “BioElectron,” from 2018 to 2019. Dr. Klein served as the Chief Medical Officer of BioElectron from 2013 to 2019 and was Senior Vice President, Clinical Science at BioElectron from 2012 to 2013. Dr. Klein has a B.A. from the University of Pennsylvania, an M.D. from Yale University School of Medicine and an M.S. in epidemiology from the University of Washington School of Public Health. We believe that Dr. Klein is qualified to serve on our Board because of his medical background, leadership experience and gene therapy and biopharmaceutical industry expertise.

Linda M. Liau joined our Board in November 2021. She is Professor and W. Eugene Stern Chair of the Department of Neurosurgery at the David Geffen School of Medicine at UCLA. She is also the Co-Director of the UCLA Brain Tumor Center and Principal Investigator and Director of the NCI-designated UCLA Brain Tumor SPORE (Specialized Program of Research Excellence). Dr. Liau has authored over 200 peer-reviewed research articles and is internationally recognized for her achievements in understanding the immunology of malignant brain tumors and pioneering the use of dendritic cell-based vaccines for glioblastoma. Clinically, she has developed novel ways to map brain function during awake brain tumor surgeries using functional MRI (fMRI) correlates and specializes in surgery for brain tumors in eloquent areas. Dr. Liau received her B.S. and B.A. degrees from Brown University. She earned her M.D. degree from Stanford University and a Ph.D. in Neuroscience from UCLA. After completing her residency and fellowship training in neurosurgery at UCLA, she joined the faculty at the UCLA School of Medicine. While practicing, she earned an MBA from the UCLA Anderson School of Management. We believe that Dr. Liau’s expertise in neurosurgery and her vast leadership experience qualify her to serve on our Board.

Timothy T. Richards joined our Board in March 2014. Mr. Richards serves as the Chief Business Officer at Jana Care, a venture capital funded company focused on chronic kidney and heart disease testing and monitoring. Prior to joining Jana Care, Mr. Richards was Chief Commercial Officer for YourBio Health (formerly Seventh Sense BioSystems, Inc.), and former President of Facet Technologies, LLC, a privately held supplier to major diagnostic companies. Additionally, Mr. Richards held executive-level positions within the Covidien organization, first as U.S. President of the Patient Care & Safety Products business unit and subsequently as President of VNUS Medical Technologies following its acquisition by Covidien in 2009. From October 2003 through October 2008, Mr. Richards served as Senior Vice President, Chief Marketing Officer and a member of the Executive Board of B. Braun Medical, Inc. Before joining B. Braun Medical, he held a number of progressive leadership positions throughout the U.S. and in Asia with Becton Dickinson and Company. We believe Mr. Richards brings to our Board extensive leadership experience and expertise in general management, manufacturing and R&D operations, commercial management and strategy in relevant markets and technologies.

How are our directors compensated?

Board Fees

Directors who are our employees are not entitled to receive any fees for serving as directors. Directors who are not our employees receive the following Board and Committee fees:

| | | | | |

Board of Directors: | |

Annual retainer for chairperson | $ | 75,000 | |

Annual retainer per director | $ | 40,000 | |

| |

Audit Committee: | |

Annual retainer for chairperson | $ | 20,000 | |

Annual retainer for other members | $ | 10,000 | |

| |

Compensation Committee: | |

Annual retainer for chairperson | $ | 15,000 | |

Annual retainer for other members | $ | 7,500 | |

| |

Corporate Governance and Nominating Committee: | |

Annual retainer for chairperson | $ | 12,000 | |

Annual retainer for other members | $ | 7,500 | |

The above retainers are paid in quarterly installments, in arrears. Each director may elect to have us pay all or a portion of the director’s fees in shares of our common stock, in lieu of cash, in accordance with the rules and procedures established from time to time by our Board. We also reimburse each director for reasonable travel and other expenses in connection with attending Board meetings.

Equity Awards

Upon an individual becoming a non-employee director for the first time, the new director will receive a restricted stock award grant valued at $90,000 and a stock option grant equal to two-thirds (2/3) the number of shares of restricted stock award shares granted, rounded to the closest whole number of shares. Such options and restricted stock awards will vest on the first anniversary of the grant. Any individual who serves as a non-employee director on the day following an annual meeting of our stockholders will receive a restricted stock award grant valued at $90,000 and a stock option grant equal to two-thirds (2/3) the number of shares of restricted stock award shares granted, rounded to the closest whole number of shares. Such options and restricted stock will vest on the earlier of the first anniversary of the grant date or the day immediately preceding the next annual meeting of stockholders. The exercise price of all options granted to directors will equal the “fair market value” of our common stock on the date of grant.

Are there stock ownership guidelines for our directors and executive officers?

Yes, to further align the interests of our directors and executive officers with our stockholders and to promote the Company’s commitment to sound corporate governance, we adopted the ClearPoint Neuro, Inc. Executive Officer and Director Stock Ownership Guidelines in June 2021. Pursuant to these guidelines, each executive officer and director is required to be in compliance with the guidelines by the later of the date the guidelines were adopted or five years from their appointment to an executive position or the board. Our Chief Executive Officer is required to own shares with a value equal to 500% of his base salary. The requirement for the Section 16 officers is to own shares with a value equal to 300% of their base salary and for non-employee directors, 400% of their annual base retainer, excluding committee retainers, if any. Under the guidelines, beneficial ownership includes shares owned directly by the individual or the individual’s family members residing in the same household; shares held in trust for the benefit of the individual, the individual’s family members residing in the same household; and vested stock options and other awards.

Are there any family relationships between our directors and our executive officers?

There are no family relationships between or among any of our directors and executive officers.

How many votes are needed to elect directors?

The eight nominees receiving the most “FOR” votes among votes properly cast at the Annual Meeting or by proxy at the Annual Meeting will be elected to serve on our Board (assuming a quorum of a majority of the outstanding shares of common stock is present).

What does the Board recommend?

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR IDENTIFIED ABOVE.

GOVERNANCE OF THE COMPANY

What is corporate governance and how do we implement it?

Corporate governance is a set of rules established by us to ensure that our directors, executive officers and employees conduct our business in a legal, impartial and ethical manner. Our Board has a strong commitment to sound and effective corporate governance practices. We are incorporated under the laws of the state of Delaware, and our common stock is listed on The Nasdaq Capital Market, which has requirements that a majority of our Board be independent. Accordingly, for purposes of determining independence, we are subject to the provisions of Nasdaq Marketplace Rule 5605. Our management and our Board have reviewed and continue to monitor our corporate governance practices in light of Delaware corporate law, U.S. federal securities laws and Nasdaq Marketplace Rule 5605.

What documents establish and implement our corporate governance practices?

We adopted the charters of our Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee, Code of Business Conduct and Ethics, Guidelines on Governance Issues, Guidelines for Corporate Disclosure, Related Party Transactions Policy, Insider Trading Compliance Policy, and Compliance Reporting (Whistleblower) Policy for the purpose of increasing transparency in our governance practices as well as promoting honest and ethical conduct, promoting full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by us, and promoting compliance with all applicable rules and regulations that apply to us and our officers and directors.

Our Code of Business Conduct and Ethics applies to all of our employees, officers (including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions) and directors. We intend to disclose future amendments to certain provisions of our Code of Business Conduct and Ethics, or waivers of such provisions, applicable to any principal executive officer, principal financial officer, principal accounting officer or controller, persons performing similar functions or our directors on our website at www.clearpointneuro.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

Where can I access the Company’s corporate governance documents?

The charters of our Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee may be accessed at the “Investors” tab of our website at www.clearpointneuro.com, as well as our Code of Business Conduct and Ethics and Fourth Amended and Restated Bylaws. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement. In addition, any stockholder or other interested party may request, without charge, a copy of our corporate governance documents by submitting a written request for any of such materials to ClearPoint Neuro, Inc., Attn: Corporate Secretary, 120 S. Sierra Avenue, Suite 100, Solana Beach, California 92075.

How often did our Board meet in 2022?

Our Board held six meetings during 2022. Directors are expected to attend each meeting of our Board and each meeting of those Committees on which they serve. All directors attended 75% or more of the total number of meetings of the Board and those Committees on which they served during the period in which they served as directors in 2022. In addition to meetings, our Board and its Committees review and act upon matters through written consent procedures.

Our 2022 Annual Meeting of Stockholders was held on May 24, 2022, and eight members of our Board attended our 2022 Annual Meeting of Stockholders. We have a policy for attendance by members of our Board at our stockholder annual meetings that encourages directors, if practicable and time permitting, to attend our stockholder annual meetings. We expect that all of our Board members will attend the 2023 Annual Meeting of Stockholders, if possible.

Who are our independent directors?

Since our common stock is listed on The Nasdaq Capital Market, for purposes of determining director independence, we are subject to the provisions of the Nasdaq Marketplace Rules. Our Board undertook a review of the composition of our Board and its Committees and the independence of each director. Based upon information requested from and provided by each director concerning the director’s background, employment and affiliations, including family relationships, our Board has determined that none of Dr. Liau, Messrs. Fletcher, Girin and Richards or Mss. Fallon and Johnson, representing six of the eight directors who are nominated for re-election at the Annual Meeting, has a relationship

that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under Rule 5605(a)(2) of the Nasdaq Marketplace Rules. In making such determination, our Board considered the relationships that each such director has with us and all other facts and circumstances the Board deemed relevant in determining independence, including the beneficial ownership of our capital stock by each director.

What is the leadership structure of the Board, and why is it appropriate for the Company?

Mr. Fletcher presently serves as the Chairman of the Board. Mr. Burnett currently serves as our Chief Executive Officer. Our Board does not have a fixed policy as to whether the role of the Chief Executive Officer and Chairman of the Board should be separate. When the Chairman of the Board is not “independent” within the meaning of Rule 5605(a)(2) of the Nasdaq Marketplace Rules, the chairperson of our Corporate Governance and Nominating Committee, who is independent, acts ex officio as the Lead Independent Director of the Board, with the responsibility for coordinating the activities of the other independent directors and for performing the duties specified in our Guidelines on Governance Issues and such other duties as are assigned from time to time by the Board.

The Lead Independent Director has broad responsibility and authority, including, without limitation, to:

•serve as the principal liaison on Board-wide issues between the independent members of the Board and the Chairman of the Board;

•preside at all meetings of the Board at which the Chairman of the Board is not present, including executive sessions of the independent members of the Board; and

•call meetings of the independent members of the Board.

Our Board has determined that the current separation of Chairman of the Board and Chief Executive Officer is the most appropriate structure at this time as it provides an effective balance between oversight of management and day-to-day leadership. The Board may, at a future date, combine the Chairman of the Board and Chief Executive Officer roles if the Board determines that such a leadership structure would be more beneficial.

What role does our Board play in the oversight of risk management?

Our Board implements its risk oversight function both as a whole and through its Committees. Our Board and the Committees to which it has delegated responsibility conduct risk assessments and discuss identified risks and how to eliminate or mitigate such risks.

Our Board and its Committees oversee risks associated with their respective principal areas of focus, as summarized below. All Committees report to the full Board as appropriate, including when a matter rises to the level of a material risk.

| | | | | | | | |

Board/Committee | | Primary Areas of Risk Oversight |

Full Board | | Strategic, financial and execution risks associated with annual operating and long-term strategic plans, major litigation and other current matters that may present material risk to our operations, plans, prospects or reputation. |

| | |

Audit Committee | | Risks relating to our financial statements, financial reporting process, accounting, legal matters, cybersecurity, and regulatory exposure. |

| | |

| Compensation Committee | | Risks related to our compensation structure and benefits plan administration. |

| | |

| Corporate Governance and Nominating Committee | | Risks relating to our corporate governance policies and programs and succession planning. |

While our Board and its Committees oversee our risk management, our management is responsible for day-to-day risk management. Management communicates with our Board and its Committees on any material risks and how they are being managed.

How can you communicate with our Board?

Stockholders and other interested parties may send communications to our Board or any Committee of the Board by writing to the Board or the Committee, c/o ClearPoint Neuro, Inc., Attn: Corporate Secretary, 120 S. Sierra Avenue, Suite 100, Solana Beach, California 92075. The Corporate Secretary will distribute all stockholder and other interested party communications to the intended recipients and/or distribute to the entire Board, as appropriate.

In addition, stockholders and other interested parties may also contact the Chairman of the Board of Director or the non-management directors as a group by writing to the Chairman of the Board of Directors, c/o ClearPoint Neuro, Inc., Attn: Corporate Secretary, 120 S. Sierra Avenue, Suite 100, Solana Beach, California 92075. The Corporate Secretary will forward all stockholder and other interested party communications to the Chairman of the Board of Directors who will review and, if addressed to the non-management directors, distribute all stockholder and other interested party communications to the non-management directors as a group.

What are our complaint procedures?

Complaints and concerns about our accounting, internal accounting controls or auditing matters may be submitted to ClearPoint Neuro, Inc., Attention: Audit Committee Chair, 120 S. Sierra Avenue, Suite 100, Solana Beach, California 92075. Alternatively, complaints and concerns about our accounting, internal accounting controls or auditing matters may be submitted, confidentially and anonymously, by calling our Whistleblower Hotline at (877) 778-5463 or by using our confidential web-based service at www.reportit.net.

What committees have been established by our Board?

Our Board currently has three standing Committees: the Audit Committee; the Compensation Committee; and the Corporate Governance and Nominating Committee.

What are the responsibilities of the Audit Committee?

Our Audit Committee currently consists of Messrs. Girin and Fletcher and Ms. Fallon. Ms. Fallon serves as the Chair of our Audit Committee.

The functions of the Audit Committee include:

•overseeing the audit and other services of our independent registered public accounting firm and being directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm, who will report directly to the Audit Committee;

•reviewing and pre-approving the engagement of our independent registered public accounting firm to perform audit services and any permissible non-audit services;

•overseeing compliance with the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as required;

•reviewing our annual and quarterly financial statements and reports and discussing the financial statements and reports with our independent registered public accounting firm and management;

•reviewing and approving all related person transactions pursuant to our Related Party Transactions Policy;

•reviewing with our independent registered public accounting firm and management significant issues that may arise regarding accounting principles and financial statement presentation, as well as matters concerning the scope, adequacy and effectiveness of our internal control over financial reporting;

•establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters; and

•preparing the Audit Committee report for inclusion in our proxy statement for our annual meeting.

Our Board has determined that Mr. Fletcher is an audit committee financial expert within the meaning of SEC rules. Furthermore, our Board has determined that all the members of the Audit Committee satisfy the independence, experience and other requirements established by the Nasdaq Marketplace Rules, which were adopted by the Company. Our Audit Committee met four times during 2022. Both our independent registered public accounting firm and

management periodically meet privately with our Audit Committee. A copy of the charter for our Audit Committee is posted on our website at www.clearpointneuro.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

What are the responsibilities of the Compensation Committee?

Our Compensation Committee currently consists of Dr. Liau, Ms. Johnson and Mr. Richards. Ms. Johnson serves as the Chair of our Compensation Committee.

The functions of the Compensation Committee include:

•determining the compensation and other terms of employment of our Chief Executive Officer and other executive officers and reviewing and approving our performance goals and objectives relevant to such compensation;

•administering and implementing our incentive compensation plans and equity-based plans, including approving option grants, restricted stock awards and other equity-based awards;

•evaluating and recommending to our Board the equity incentive compensation plans, equity-based plans and similar programs advisable for us, as well as modifications or terminations of our existing plans and programs;

•reviewing and approving the terms of any employment-related agreements, severance arrangements, change-in-control and similar agreements/provisions, and any amendments, supplements or waivers to the foregoing agreements, with our Chief Executive Officer and other executive officers;

•to the extent required, reviewing and discussing the Compensation Discussion & Analysis for our annual report and proxy statement with management and determining whether to recommend to our Board of Directors the inclusion of the Compensation Discussion & Analysis in the annual report and proxy statement; and

•to the extent required, preparing a report on executive compensation for inclusion in our proxy statement for our annual meeting.

Each member of our Compensation Committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended, or the “Exchange Act,” and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended, or the “Code.” Furthermore, our Board has determined that Dr. Liau, Ms. Johnson and Mr. Richards each satisfy the independence standards for compensation committees established by the Nasdaq Marketplace Rules. Our Compensation Committee met nine times during 2022. A copy of the charter for our Compensation Committee is posted on our website at www.clearpointneuro.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

With respect to director compensation, our Compensation Committee is responsible for reviewing the compensation paid to members of the Board and recommending modifications to director compensation that the Compensation Committee determines are appropriate and advisable to the Board for its approval from time to time. In this regard, the Compensation Committee may request from time to time that an external compensation consultant provide the status of of the Board’s compensation in relation to other similarly situated companies.

In determining compensation for our executive officers, the Compensation Committee typically considers, but is not required to accept, the recommendations of our Chief Executive Officer regarding the performance and proposed base salary and bonus and equity awards for the other executive officers, as well as himself. The Compensation Committee may also request the assistance of our Chief Financial Officer in evaluating the financial, accounting and tax implications of various compensation awards paid to the executive officers. However, our Chief Financial Officer does not determine the amounts or types of compensation paid to the executive officers. The Compensation Committee also considers input from its external compensation consultant as discussed below. Our Chief Executive Officer and certain of our other executive officers may attend Compensation Committee meetings, as requested by the Compensation Committee. None of our executive officers, including our Chief Executive Officer, attend any portion of the Compensation Committee meetings during which the executive officer’s compensation is established and approved.

Our Compensation Committee also has the authority to engage its own external compensation consultant as needed and engaged Haigh & Company as an independent consultant in 2022. We conducted a conflict of interest assessment prior to the Compensation Committee engaging Haigh & Company, which verified, in our Compensation Committee’s judgment, Haigh & Company’s independence and that no conflicts of interest existed. During 2022, Haigh &

Company provided information, analysis and advice on our ClearPoint Neuro, Inc. Non-Employee Director Compensation Plan. In consideration of Haigh & Company's advice, our Board, upon recommendation of our Compensation Committee, approved modifications to the annual cash and equity compensation for non-employee directors of our Company. During 2022, Haigh & Company also provided benchmarking data for the executive officers and senior leadership team. The data included information on the type and level of compensation provided by peer companies for various positions. The data was considered by the Compensation Committee and informed its actions with respect to salary and bonus for the Company's executive officers and senior leadership team.

What are the responsibilities of the Corporate Governance and Nominating Committee?

Our Corporate Governance and Nominating Committee currently consists of Messrs. Fletcher, Girin and Richards and Ms. Fallon. Mr. Richards serves as the Chair of our Corporate Governance and Nominating Committee.

The functions of the Corporate Governance and Nominating Committee include:

•evaluating director performance on the Board and applicable Committees of the Board;

•interviewing, evaluating, nominating and recommending individuals for membership on our Board;

•evaluating nominations by stockholders of candidates for election to our Board;

•reviewing and recommending to our Board any amendments to our corporate governance documents; and

•making recommendations to the Board regarding management succession planning.

Our Board has determined that Messrs. Fletcher, Girin and Richards and Ms. Fallon each satisfy the independence standards for corporate governance and nominating committees established by the Nasdaq Marketplace Rules. The Corporate Governance and Nominating Committee met four times during 2022. A copy of the charter for our Corporate Governance and Nominating Committee is posted on our website at www.clearpointneuro.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

When evaluating director candidates, the Corporate Governance and Nominating Committee may consider several factors, including relevant experience, education, independence, and commitment. The Corporate Governance and Nominating Committee will also consider diversity in their assessment of potential candidates, including diversity of personal background, professional experience, qualifications and skills. The Corporate Governance and Nominating Committee makes a recommendation to the full Board as to any person it believes should be nominated by our Board, and our Board determines the nominees after considering the recommendation and report of the Corporate Governance and Nominating Committee. During 2022, the Corporate Governance and Nominating Committee did not engage any third party to assist it in identifying or evaluating nominees for election to our Board.

Any director or executive officer of the Company may recommend a candidate to the Corporate Governance and Nominating Committee for its consideration. The Corporate Governance and Nominating Committee will also consider nominees to our Board recommended by stockholders if stockholders comply with the advance notice requirements in our bylaws. Our bylaws provide that a stockholder who wishes to nominate a person for election as a director at a meeting of stockholders must deliver timely written notice to our Corporate Secretary. This notice must contain, as to each nominee, all of the information relating to such person as would be required to be disclosed in a proxy statement meeting the requirements of Regulation 14A under the Exchange Act (including such person’s written consent to being named in a proxy statement as a nominee and to serving as a director, if elected); a written representation and agreement by the nominee regarding voting commitments, certain compensation arrangements and compliance with our applicable policies and guidelines for directors; and a questionnaire completed and signed by the nominee.