© 2 0 2 4 C L E A R P O I N T N E U R O 1

© 2 0 2 4 C L E A R P O I N T N E U R O 2 This presentation and discussion contain forward-looking statements within the context of the federal securities laws, including the Company’s expectation for revenues, gross margin, the adequacy of cash and cash equivalent balances to support operations and meet future obligations, the future market of its products and services, and other performance and results. These forward looking statements are based on management’s current expectations and are subject to the risks inherent in the business, which may cause the Company's actual results to differ materially from those expressed in or implied by forward-looking statements. Particular uncertainties and risks include those relating to: global and political instability, supply chain disruptions, labor shortages, and macroeconomic and inflationary conditions; future revenue from sales of the Company’s products and services; the Company’s ability to market, commercialize and achieve broader market acceptance for new products and services offered by the Company; the ability of our biologics and drug delivery partners to achieve commercial success, including their use of the Company’s products and services in their delivery of therapies; the Company’s expectations, projections and estimates regarding expenses, future revenue, capital requirements, and the availability of and the need for additional financing; the Company’s ability to obtain additional funding to support its research and development programs; the ability of the Company to manage the growth of its business; the Company’s ability to attract and retain its key employees; and risks inherent in the research, development, and regulatory approval of new products. More detailed information on these and additional factors that could affect the Company’s actual results are described in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and the Company’s Quarterly Report on Form 10-Q for the three months ended September 30, 2023, both of which have been filed with the Securities and Exchange Commission, and the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which the Company intends to file with the Securities and Exchange Commission on or before March 31, 2024. The Company does not assume any obligation to update these forward-looking statements.

© 2 0 2 4 C L E A R P O I N T N E U R O 3

• • • • • • • • • • • *Including owned and licensed patents 4

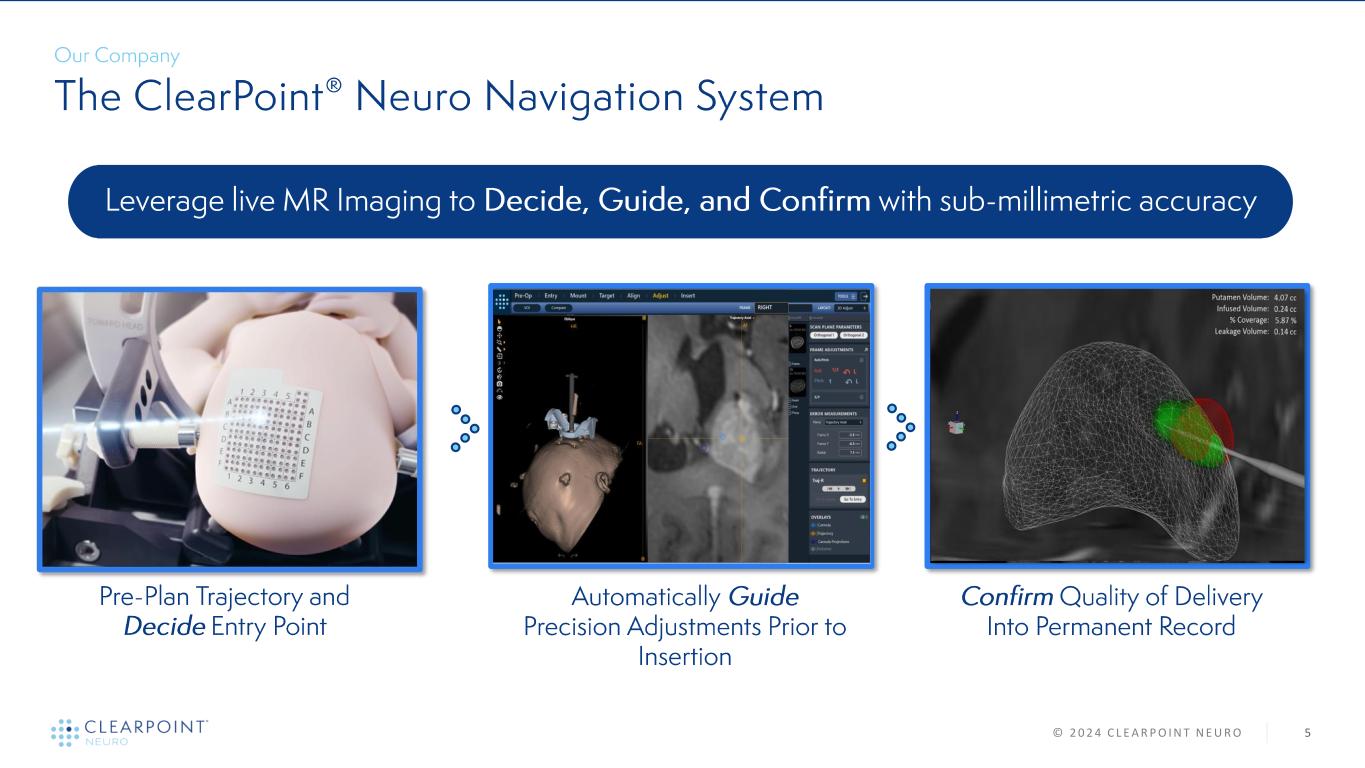

5© 2 0 2 4 C L E A R P O I N T N E U R O

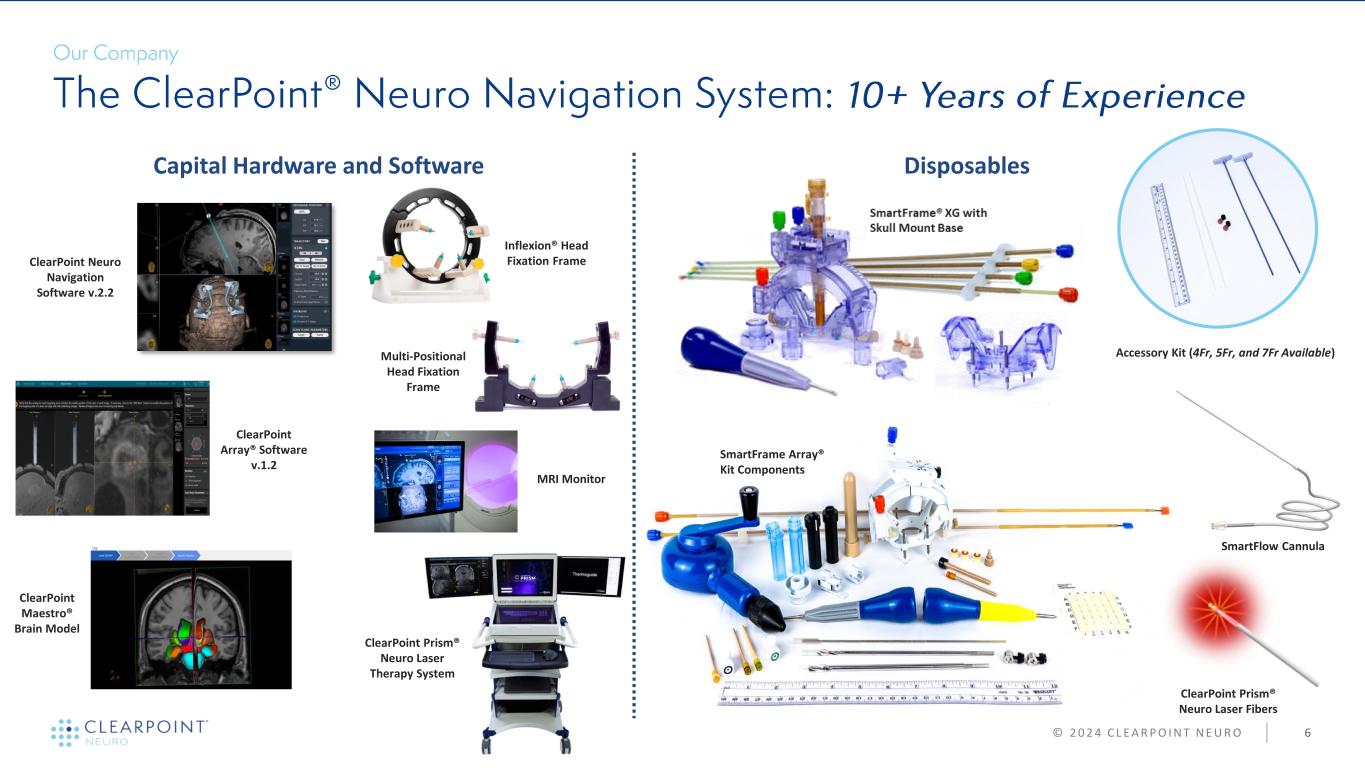

ClearPoint Neuro Navigation Software v.2.2 ClearPoint Array® Software v.1.2 ClearPoint Maestro® Brain Model Inflexion® Head Fixation Frame ClearPoint Prism® Neuro Laser Therapy System MRI Monitor Multi-Positional Head Fixation Frame Accessory Kit (4Fr, 5Fr, and 7Fr Available) SmartFrame Array® Kit Components Capital Hardware and Software Disposables 6© 2 0 2 4 C L E A R P O I N T N E U R O SmartFlow Cannula ClearPoint Prism® Neuro Laser Fibers

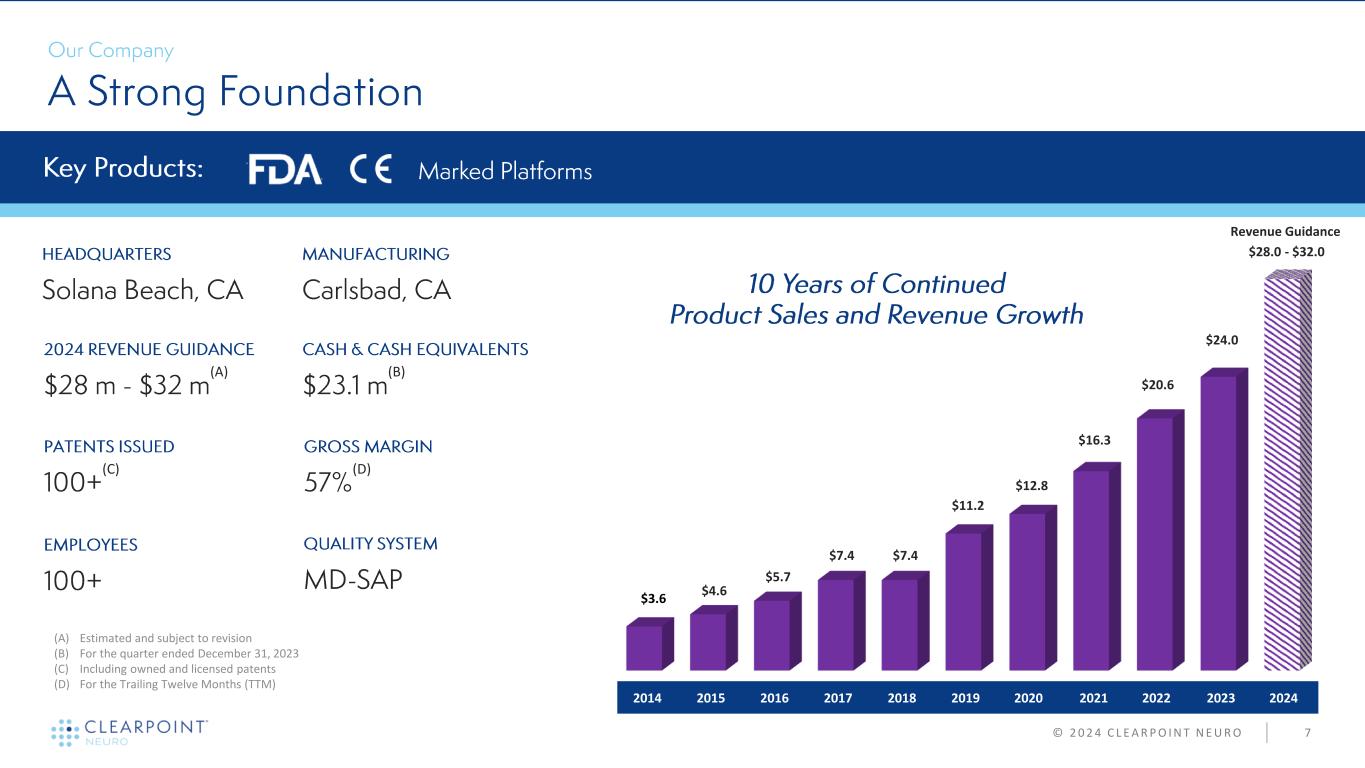

7 (A) (B) (D) © 2 0 2 4 C L E A R P O I N T N E U R O (A) Estimated and subject to revision (B) For the quarter ended December 31, 2023 (C) Including owned and licensed patents (D) For the Trailing Twelve Months (TTM) (C) $3.6 Revenue Guidance $4.6 $5.7 $7.4 $7.4 $11.2 $12.8 $16.3 $20.6 $24.0 $28.0 - $32.0 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

© 2 0 2 1 C L E A R P O I N T N E U R O 8 • 1,500 sq. ft Class 8 Clean Room with Expansion Capability • 1,300 sq. ft Dedicated R&D Lab Space • ISO 13485/MDSAP/EU MDR Certified Quality System • Successful Audit Outcomes from Global Regulatory Bodies and Pharma • Training Facility with over 100 Surgeons and Pharma Scientist Visitors 8© 2 0 2 4 C L E A R P O I N T N E U R O

© 2 0 2 4 C L E A R P O I N T N E U R O 9

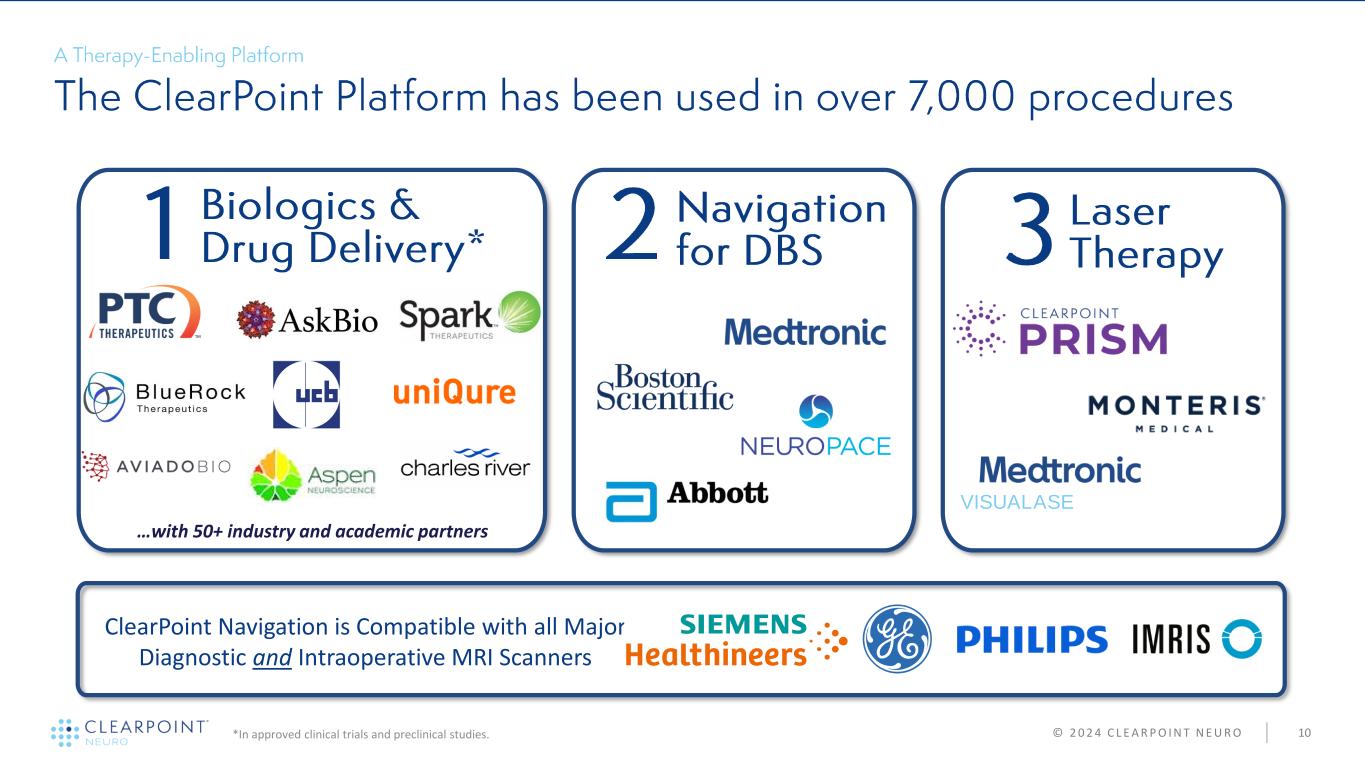

© 2 0 2 4 C L E A R P O I N T N E U R O 10 VISUALASE ClearPoint Navigation is Compatible with all Major Diagnostic and Intraoperative MRI Scanners …with 50+ industry and academic partners *In approved clinical trials and preclinical studies.

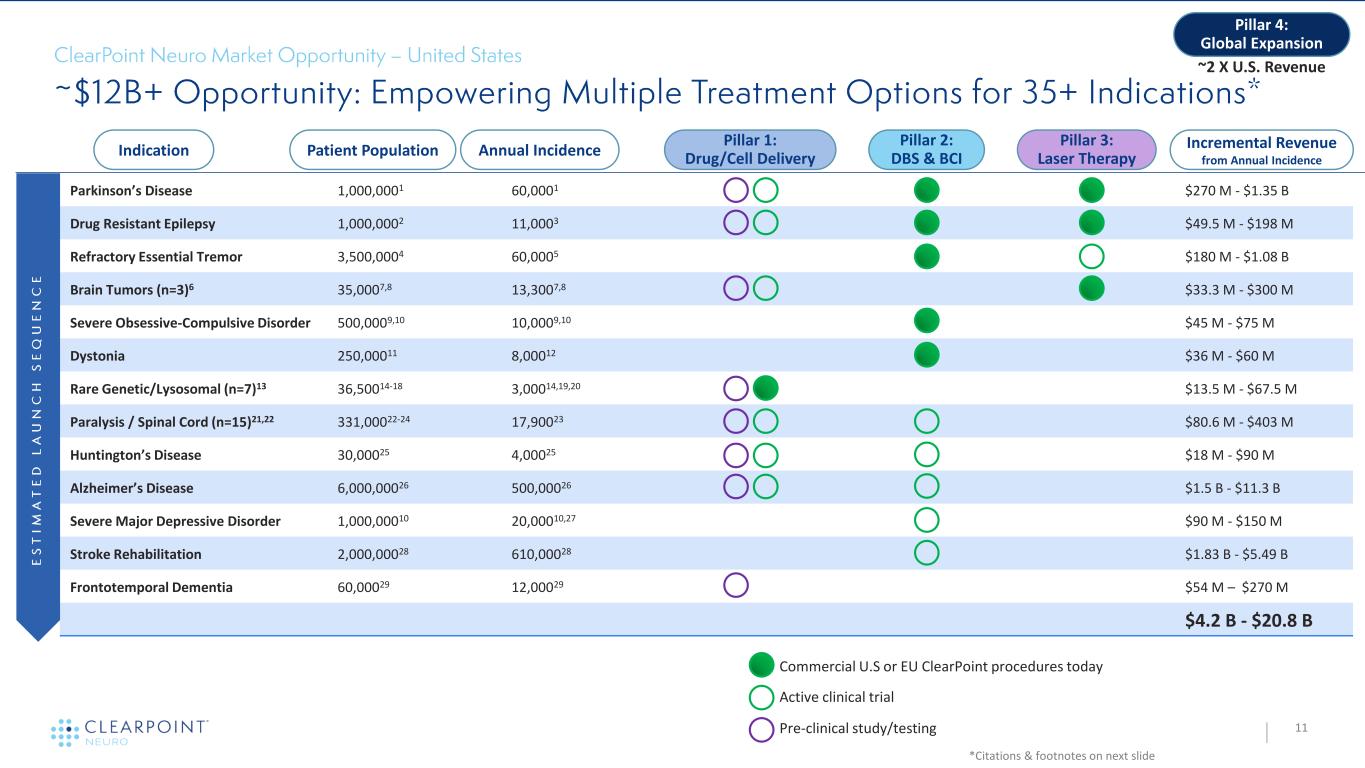

Parkinson’s Disease 1,000,0001 60,0001 • $270 M - $1.35 B Drug Resistant Epilepsy 1,000,0002 11,0003 • $49.5 M - $198 M Refractory Essential Tremor 3,500,0004 60,0005 $180 M - $1.08 B Brain Tumors (n=3)6 35,0007,8 13,3007,8 $33.3 M - $300 M Severe Obsessive-Compulsive Disorder 500,0009,10 10,0009,10 $45 M - $75 M Dystonia 250,00011 8,00012 $36 M - $60 M Rare Genetic/Lysosomal (n=7)13 36,50014-18 3,00014,19,20 $13.5 M - $67.5 M Paralysis / Spinal Cord (n=15)21,22 331,00022-24 17,90023 $80.6 M - $403 M Huntington’s Disease 30,00025 4,00025 $18 M - $90 M Alzheimer’s Disease 6,000,00026 500,00026 $1.5 B - $11.3 B Severe Major Depressive Disorder 1,000,00010 20,00010,27 $90 M - $150 M Stroke Rehabilitation 2,000,00028 610,00028 $1.83 B - $5.49 B Frontotemporal Dementia 60,00029 12,00029 $54 M – $270 M $4.2 B - $20.8 B 11 *Citations & footnotes on next slide Indication Patient Population Annual Incidence Pillar 2: DBS & BCI Pillar 3: Laser Therapy Pillar 1: Drug/Cell Delivery Incremental Revenue from Annual Incidence Pillar 4: Global Expansion Commercial U.S or EU ClearPoint procedures today ~2 X U.S. Revenue Active clinical trial Pre-clinical study/testing

© 2 0 2 4 C L E A R P O I N T N E U R O 12 1. “Parkinson’s Disease Statistics,” Parkinson’s News Today, https://parkinsonsnewstoday.com/parkinsons-disease-statistics/#:~:text=An%20estimated%20seven%20to%2010,who%20are%2080%20and%20older 2. Neurona Therapeutics. (2021 November 4). Neurona Therapeutics Receives IND Clearance to Initiate Phase 1/2 Clinical Trial of Neural Cell Therapy NRTX-1001 in Chronic Focal Epilepsy Patients [Press release] https://www.neuronatherapeutics.com/wp-content/uploads/2021/11/2021_11_01_-INDClearance_FINALVersion.pdf 3. Asadi-Pooya AA, Stewart GR, Abrams DJ, Sharan A. Prevalence and Incidence of Drug-Resistant Mesial Temporal Lobe Epilepsy in the United States. World Neurosurg. 2017;99:662-666. 4. Zesiewicz TA, Chari A, Jahan I, Miller AM, Sullivan KL. Overview of essential tremor. Neuropsychiatr Dis Treat. 2010;6:401-408. Published 2010 Sep 7. 5. Diaz NL, Louis ED. Survey of medication usage patterns among essential tremor patients: movement disorder specialists vs. general neurologists. Parkinsonism Relat Disord. 2010;16(9):604-607. 6. Includes: Glioblastoma, Diffuse Intrinsic Pontine Glioma and deep small eloquent brain tumors. 7. “Glioblastoma Multiforme,” American Association of Neurological Surgeons, https://www.aans.org/en/Patients/Neurosurgical-Conditions-and-Treatments/Glioblastoma-Multiforme 8. “About DIPG/DMG,” DIPG/DMG Registry, https://dipgregistry.org/patients-families/about-dipg-dmg/ 9. Medtronic Clinical Summary – Reclaim DBS for Chronic Extreme OCD M947128A001. 10. Mantovani A, Lisanby SH. Brain stimulation in the treatment of anxiety disorders. In: Simpson HB, Neria Y, Lewis-Fernández R, Schneier F, eds. Anxiety Disorders: Theory, Research and Clinical Perspectives. Cambridge: Cambridge University Press; 2010:323-335. 11. https://www.aans.org/en/Patients/Neurosurgical-Conditions-and-Treatments/Dystonia 12. Medtronic DBS Therapy for Dystonia - Clinical Summary 2015. 13. Includes: AADC deficiency, Friedreich’s ataxia, Angelman syndrome, multiple system atrophy, metachromatic leukodystrophy, and spinocerebellar ataxia type 3. 14. "Multiple System Atrophy," Medscape, https://emedicine.medscape.com/article/1154583-overview#a6 15. PTC Therapeutics November 30, 2021 Corporate Presentation, https://ir.ptcbio.com/static-files/0fd5d54f-55b8-416b-8006-4eb4c0d82f45 16. “Spinocerebellar ataxia type 3,” Orphanet, https://www.orpha.net/consor/cgi-bin/OC_Exp.php?lng=EN&Expert=98757 17. Lysogene Corporate Presentation at 38th Annual J.P. Morgan Healthcare Conference on Jan 13, 2020, http://www.lysogene.com/wp-content/uploads/2020/01/jpm-2020-corporate-presentation_final.pdf 18. “Metachromatic Leukodystrophy,” National Organization of Rare Disorders, https://rarediseases.org/rare-diseases/metachromatic-leukodystrophy/ 19. “Aromatic L’Amino Acid Decarboxylase Deficiency,” National Organization for Rare Disorders, https://rarediseases.org/rare-diseases/aromatic-l-amino-acid-decarboxylase-deficiency/ 20. Puckett Y, Mallorga-Hernández A, Montaño AM. Epidemiology of mucopolysaccharidoses (MPS) in United States: challenges and opportunities. Orphanet J Rare Dis. 2021;16(1):241. Published 2021 May 29. 21. Includes: stroke, spinal cord injury, multiple sclerosis, cerebral palsy, other (traumatic brain injury, complications from surgery, amyotrophic lateral sclerosis, neurofibromatosis, Chiari malformation, syringomyelia, postpolio syndrome, spinal muscular atrophy, Friedreich’s ataxia, transverse myelitis, and spina bifida). 22. Armour BS, Courtney-Long EA, Fox MH, Fredine H, Cahill A. Prevalence and Causes of Paralysis-United States, 2013. Am J Public Health. 2016;106(10):1855-1857. 23. Wyndaele M, Wyndaele JJ. Incidence, prevalence and epidemiology of spinal cord injury: what learns a worldwide literature survey?. Spinal Cord. 2006;44(9):523-529. 24. National Spinal Cord Injury Statistical Center (NSCISC): 2020 Annual Report and 2021 Facts and Figures. https://www.nscisc.uab.edu/ 25. “Huntington’s Disease,” Mov Disord. 2019 Jun; 34(6): 858–865. 26. “Alzheimer’s Disease: Facts & Figures,” Brightfocus Foundation, https://www.brightfocus.org/alzheimers/article/alzheimers-disease-facts-figures 27. Goodman WK, Alterman RL. Deep brain stimulation for intractable psychiatric disorders. Annu Rev Med. 2012;63:511-524. 28. “Stroke Facts,” Center for Disease Control and Prevention, https://www.cdc.gov/stroke/facts.htm 29. Onyike CU, Diehl-Schmid J. The epidemiology of frontotemporal dementia. Int Rev Psychiatry. 2013;25(2):130-137.

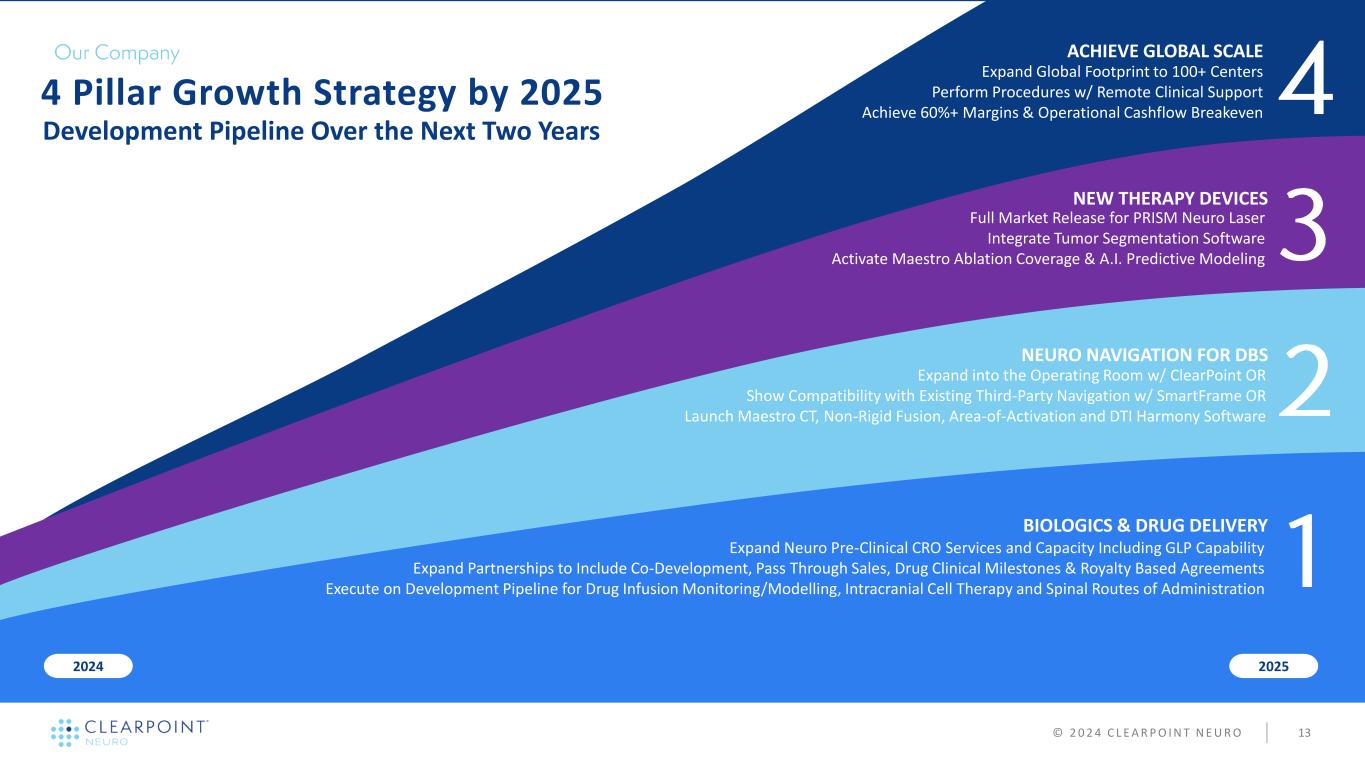

NEW THERAPY DEVICES NEURO NAVIGATION FOR DBS BIOLOGICS & DRUG DELIVERY 20252024 4 Pillar Growth Strategy by 2025 Development Pipeline Over the Next Two Years Full Market Release for PRISM Neuro Laser Integrate Tumor Segmentation Software Activate Maestro Ablation Coverage & A.I. Predictive Modeling ACHIEVE GLOBAL SCALE Expand Global Footprint to 100+ Centers Perform Procedures w/ Remote Clinical Support Achieve 60%+ Margins & Operational Cashflow Breakeven © 2 0 2 4 C L E A R P O I N T N E U R O 13 Expand Neuro Pre-Clinical CRO Services and Capacity Including GLP Capability Expand Partnerships to Include Co-Development, Pass Through Sales, Drug Clinical Milestones & Royalty Based Agreements Execute on Development Pipeline for Drug Infusion Monitoring/Modelling, Intracranial Cell Therapy and Spinal Routes of Administration Expand into the Operating Room w/ ClearPoint OR Show Compatibility with Existing Third-Party Navigation w/ SmartFrame OR Launch Maestro CT, Non-Rigid Fusion, Area-of-Activation and DTI Harmony Software

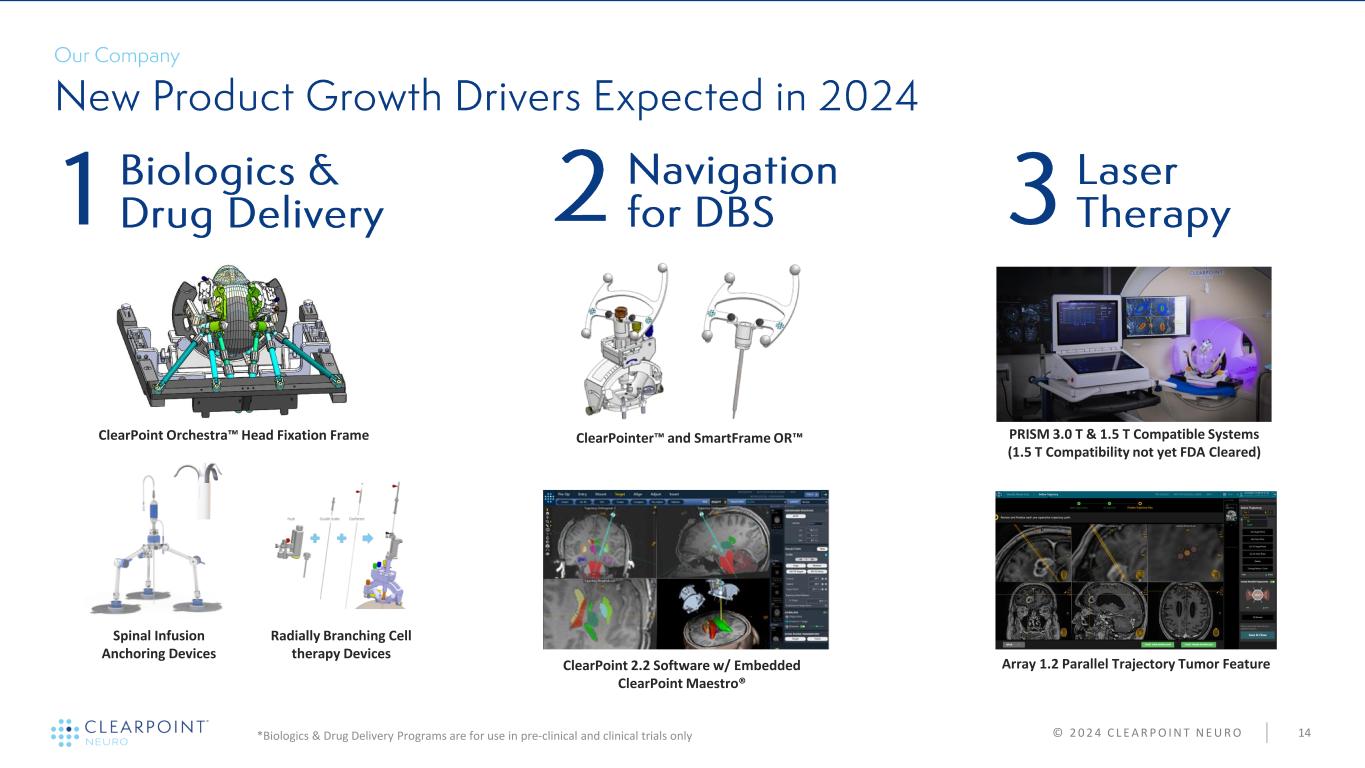

© 2 0 2 4 C L E A R P O I N T N E U R O 14 Radially Branching Cell therapy Devices ClearPoint Orchestra Head Fixation Frame Spinal Infusion Anchoring Devices PRISM 3.0 T & 1.5 T Compatible Systems (1.5 T Compatibility not yet FDA Cleared) Array 1.2 Parallel Trajectory Tumor Feature *Biologics & Drug Delivery Programs are for use in pre-clinical and clinical trials only ClearPoint 2.2 Software w/ Embedded ClearPoint Maestro® ClearPointer and SmartFrame OR

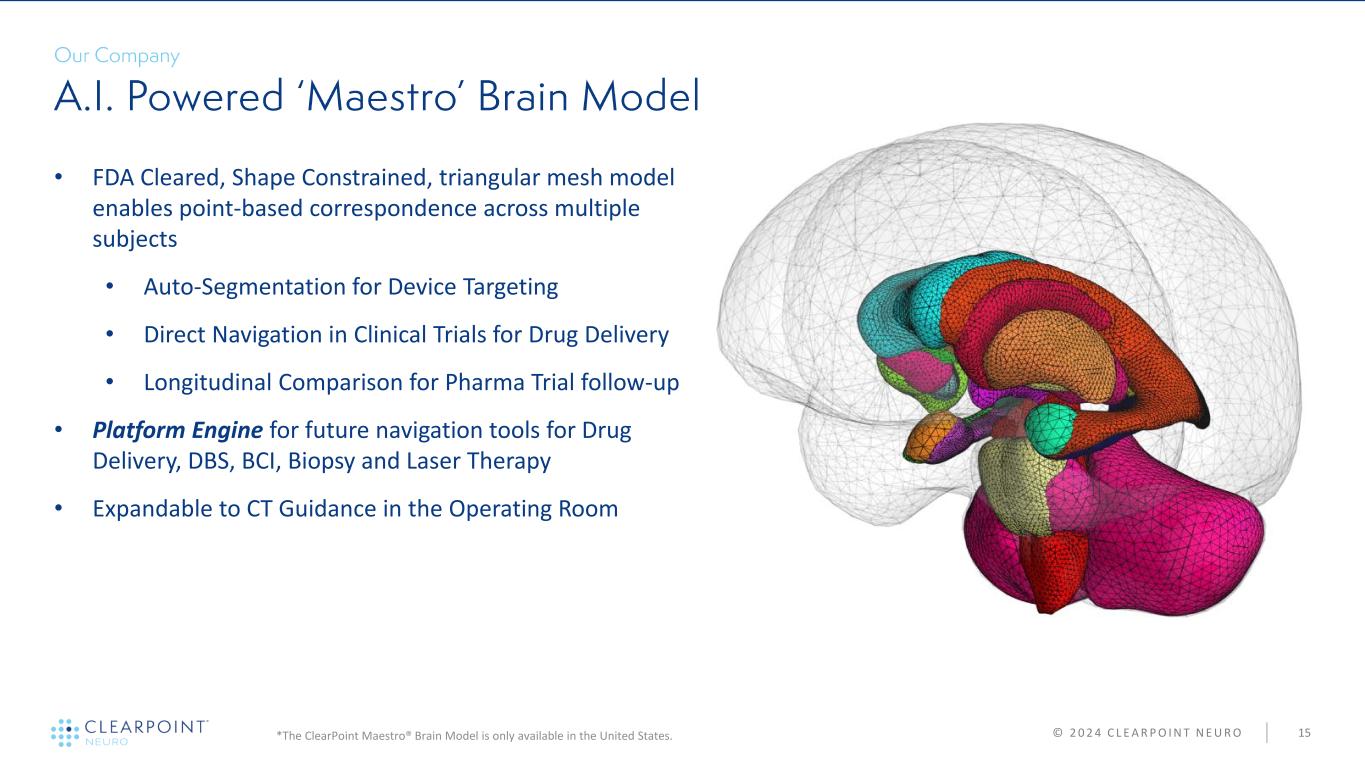

© 2 0 2 4 C L E A R P O I N T N E U R O 15 • FDA Cleared, Shape Constrained, triangular mesh model enables point-based correspondence across multiple subjects • Auto-Segmentation for Device Targeting • Direct Navigation in Clinical Trials for Drug Delivery • Longitudinal Comparison for Pharma Trial follow-up • Platform Engine for future navigation tools for Drug Delivery, DBS, BCI, Biopsy and Laser Therapy • Expandable to CT Guidance in the Operating Room *The ClearPoint Maestro® Brain Model is only available in the United States.

© 2 0 2 4 C L E A R P O I N T N E U R O 16 Unique platform technology with 10+ years of commercial experience enabling Precision MRI-Guided Therapies to restore quality of life for some of the most debilitating disorders Large, growing number of customer and partner sites of 75+ leading Neurosurgery and research centers worldwide, on pace to be in 100+ by 2025 Expandable Platform through advanced A.I. and machine learning software applications and strategic partnerships Pipeline of new revenue streams through the expansion into the Operating Room, Launch of our own PRISM Laser Therapy, Maestro Brain Model Deployment and addition of pre-clinical services and capacity including GLP Total potential addressable market > $12B for our products, pipeline and partnerships A growing and passionate team of embedded scientists and specialists