UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to Rule 14a-12

|

MRI INTERVENTIONS, INC.

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

|

o

|

Fee paid previously with preliminary materials:

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by Registration Statement number, or the Form or Schedule and the date of its filing.

|

| |

(1)

|

Amount previously paid:

|

| |

(2)

|

Form, Schedule or Registration Statement no.:

|

MRI Interventions, Inc.

One Commerce Square, Suite 2550

Memphis, Tennessee 38103

May 1, 2013

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of MRI Interventions, Inc. to be held on Thursday, June 13, 2013 at 9:00 a.m., Central Time, at our principal executive office, One Commerce Square, Suite 2550, Memphis, Tennessee 38103.

With this letter, we have enclosed a copy of our Annual Report on Form 10-K for the year ended December 31, 2012, Notice of Annual Meeting of Stockholders, Proxy Statement and proxy card. These materials provide further information about our Annual Meeting. If you would like another copy of the Annual Report, please send your request to our Investor Relations Department, MRI Interventions, Inc., One Commerce Square, Suite 2550, Memphis, Tennessee 38103, and one will be mailed to you. It is also available on the Internet at www.cstproxy.com/mriinterventions/2013.

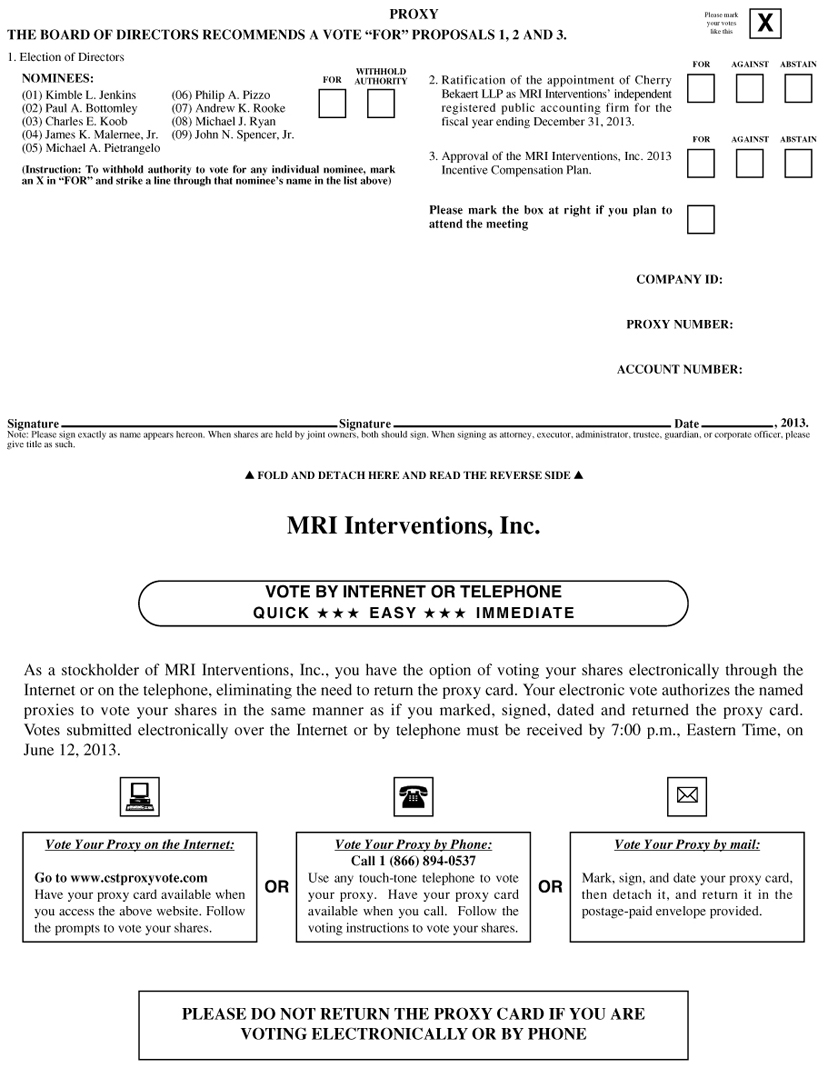

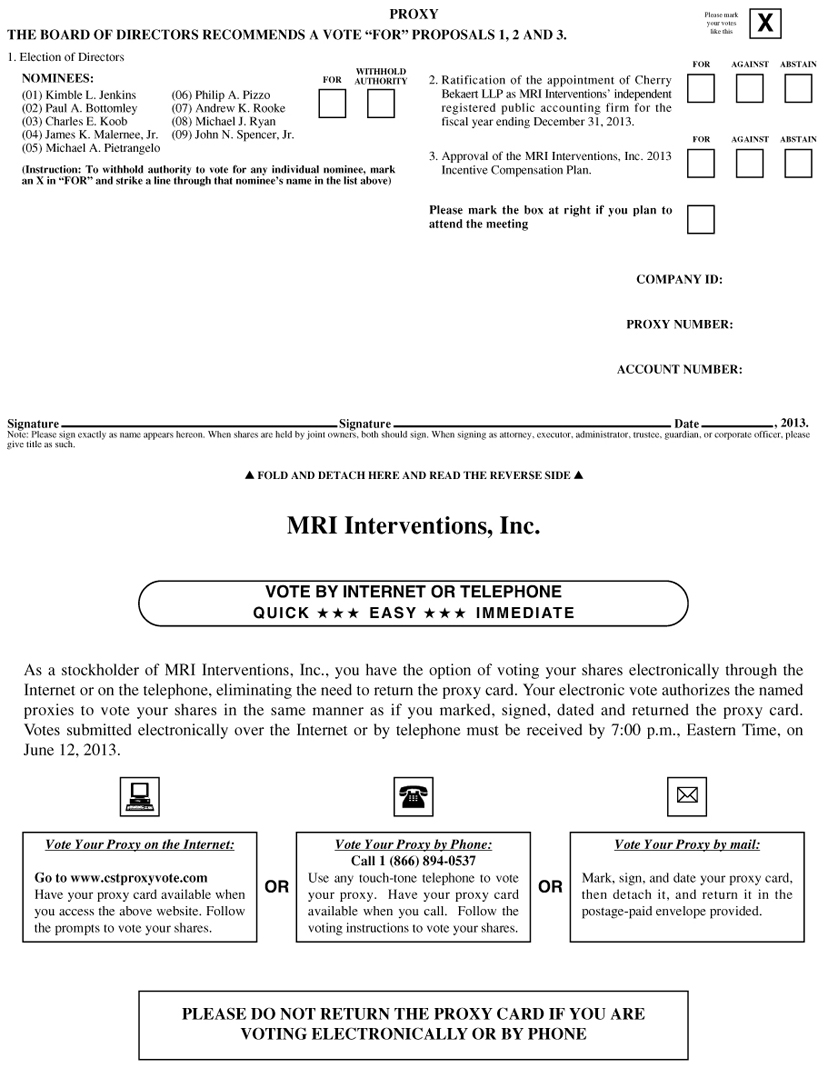

At this year’s Annual Meeting, the agenda includes: (1) the election of the nine directors named in the accompanying Proxy Statement, (2) a proposal to ratify the appointment of our independent registered public accounting firm, and (3) a proposal to approve our 2013 Incentive Compensation Plan. The Board of Directors recommends that you vote FOR election of the nominees for directors, FOR ratification of appointment of the independent registered public accounting firm and FOR the approval of our 2013 Incentive Compensation Plan. Executive officers and members of the Board of Directors will be present at the Annual Meeting to answer questions you may have.

It is important that your shares be represented and voted at the Annual Meeting, regardless of the size of your holdings. Accordingly, please complete, sign and date the enclosed proxy card and return it promptly in the enclosed postage-prepaid envelope to ensure your shares will be represented. If you do attend the Annual Meeting, you may, of course, withdraw your proxy should you wish to vote in person. Also, registered and most beneficial stockholders may vote by telephone or through the Internet. Instructions for using these convenient services are explained on the enclosed proxy card. Your vote is very important. I urge you to vote your proxy as soon as possible.

We look forward to seeing you at the Annual Meeting.

| |

Very truly yours, |

| |

|

| |

Kimble L. Jenkins

Chief Executive Officer and

Chairman of the Board of Directors

|

|

Your Vote Is Important

Please mark, sign and date your proxy card and return it promptly in the enclosed envelope, whether or not you plan to attend the meeting. Registered and most beneficial stockholders may also vote via telephone or through the Internet.

|

MRI Interventions, Inc.

One Commerce Square, Suite 2550

Memphis, Tennessee 38103

Notice of Annual Meeting of Stockholders

to be held June 13, 2013

The regular Annual Meeting of Stockholders of MRI Interventions, Inc. will be held on Thursday, June 13, 2013 at 9:00 a.m., Central Time, at our principal executive office, One Commerce Square, Suite 2550, Memphis, Tennessee 38103, for the following purposes:

|

|

1.

|

Election of Directors. To elect nine directors named in the accompanying Proxy Statement to serve until the 2014 Annual Meeting of Stockholders;

|

|

|

2.

|

Ratification of Auditors. To ratify the selection of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013;

|

|

|

3.

|

Approval of our 2013 Incentive Compensation Plan. To approve our 2013 Incentive Compensation Plan; and

|

|

|

4.

|

Other Business. To transact such other business as may properly come before the meeting or any adjournment of the meeting.

|

Only those stockholders of record at the close of business on April 19, 2013 are entitled to notice of, and to vote at, the Annual Meeting and any adjournment thereof. On that day, 57,320,447 shares of common stock were outstanding. Each share entitles the holder to one vote.

The accompanying Proxy Statement is being sent, beginning approximately May 1, 2013, to all stockholders of record at the close of business on April 19, 2013, the record date fixed by our Board of Directors. We have enclosed a copy of our Annual Report on Form 10-K with the accompanying Proxy Statement. Although the Annual Report and Proxy Statement are being mailed together, the Annual Report is not incorporated into, and should not be deemed part of, the accompanying Proxy Statement.

| |

By Order of the Board of Directors, |

| |

|

| |

Oscar L. Thomas

Vice President, Business Affairs and Secretary

|

Table of Contents

Page No.

|

General Information

|

1

|

|

Voting Matters

|

3

|

|

Proposal 1 — Election of Directors

|

7

|

|

Governance of the Company

|

12

|

|

Director Compensation

|

18

|

|

Proposal 2 — Ratification of the Appointment of our Independent Registered Public Accounting Firm

|

19

|

|

Report of the Audit Committee of the Board

|

21

|

|

Proposal 3 — Approval of our 2013 Incentive Compensation Plan

|

22

|

|

Executive Officers

|

26

|

|

Executive Compensation

|

27

|

|

Summary Compensation Table

|

27

|

|

Outstanding Equity Awards at Fiscal Year-End

|

28

|

|

Option Exercises

|

29

|

|

Potential Payments Upon Termination or Change in Control

|

29

|

|

Benefit Plans

|

31

|

|

Certain Relationships and Related Transactions

|

34

|

|

Security Ownership of Certain Beneficial Owners and Management

|

35

|

|

Section 16(a) Beneficial Ownership Reporting Compliance

|

37

|

|

Stockholder Proposals for 2014 Annual Meeting

|

37

|

|

Annual Report and Financial Information

|

38

|

|

Other Business

|

38

|

|

Appendix A —2013 Incentive Compensation Plan

|

A-1

|

MRI Interventions, Inc.

One Commerce Square, Suite 2550

Memphis, Tennessee 38103

Proxy Statement for Annual Meeting of Stockholders

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDERS MEETING TO BE HELD ON THURSDAY, JUNE 13, 2013:

THIS PROXY STATEMENT, THE PROXY CARD AND OUR 2012 ANNUAL REPORT ON FORM 10-K

ARE ALSO AVAILABLE ON THE INTERNET AT WWW.CSTPROXY.COM/MRIINTERVENTIONS/2013.

GENERAL INFORMATION

What is this document?

This document is the Proxy Statement of MRI Interventions, Inc. for the Annual Meeting of Stockholders to be held at 9:00 a.m., Central Time, on Thursday, June 13, 2013. A proxy card is included. This document and the form of proxy card are first being mailed or given to stockholders on or about May 1, 2013.

We refer to MRI Interventions, Inc. throughout this document as “we,” “us” or the “Company.”

What is the date and time of the Annual Meeting?

The Annual Meeting is scheduled to be held on Thursday, June 13, 2013, at 9:00 a.m. Central Time.

Where will the Annual Meeting be held?

The Annual Meeting is being held at our principal executive office, One Commerce Square, Suite 2550, Memphis, Tennessee 38103.

Why am I receiving this Proxy Statement?

You are receiving this Proxy Statement because you were one of our stockholders of record on April 19, 2013, the record date for our 2013 Annual Meeting. We are sending this Proxy Statement and the form of proxy card to solicit your proxy to vote upon certain matters at the Annual Meeting.

What is a proxy?

It is your legal designation of another person, called a “proxy,” to vote the stock you own. The document that designates someone as your proxy is also called a proxy or a proxy card.

Who is paying the costs to prepare this Proxy Statement and solicit my proxy?

The Company will pay all expenses of this solicitation, including the cost of preparing and mailing this Proxy Statement and the form of proxy card.

Who is soliciting my proxy, and will anyone be compensated to solicit my proxy?

Your proxy is being solicited by and on behalf of our Board of Directors, or our “Board.” In addition to solicitation by use of the mails, proxies may be solicited by our officers and employees in person or by telephone, electronic mail, facsimile transmission or other means of communication. Our officers and employees will not be additionally compensated, but they may be reimbursed for out-of-pocket expenses in connection with any solicitation. We also may reimburse custodians, nominees and fiduciaries for their expenses in sending proxies and proxy material to beneficial owners. We may incur the fees and expenses of hiring the services of a solicitation agent in connection with this proxy solicitation to the extent we determine that engaging a solicitation agent is in the best interest of the Company.

What is MRI Interventions, Inc., and where is it located?

We are a medical device company that develops and commercializes innovative platforms for performing minimally invasive surgical procedures in the brain and heart under direct, intra-procedural magnetic resonance imaging, or MRI, guidance. We have two product platforms. Our ClearPoint system, which is in commercial use, is used to perform minimally invasive surgical procedures in the brain. We anticipate that the ClearTrace system, which is still in development, will be used to perform minimally invasive surgical procedures in the heart. Both systems utilize intra-procedural MRI to guide the procedures and are designed to work in a hospital’s existing MRI suite. Our principal executive office is located in Memphis, Tennessee, and we conduct our principal operations, including component processing, final assembly, packaging and distribution activities for our ClearPoint system, at a facility located in Irvine, California.

Where is our common stock traded?

Our common stock is traded in the over-the-counter market and is quoted on the OTC Bulletin Board and OTC Markets under the symbol “MRIC.”

Will the Company’s directors be in attendance at the Annual Meeting?

The Company encourages, but does not require, its directors to attend annual meetings of stockholders, recognizing that from time to time scheduling conflicts may occur that will prevent a director from attending. The Company currently anticipates that some of its directors will attend the 2013 Annual Meeting.

VOTING MATTERS

Who is entitled to attend and vote at the Annual Meeting?

Only stockholders of record at the close of business on the record date, April 19, 2013, are entitled to receive notice of the Annual Meeting and to vote the shares for which they are stockholders of record on that date at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. A list of our stockholders will be open to the examination of any stockholder, for any purpose germane to the Annual Meeting, at our principal executive office for a period of ten days prior to the Annual Meeting. On April 19, 2013, we had 57,320,447 shares of common stock outstanding.

Stockholders of Record: Shares Registered in Your Name. If on April 19, 2013 your shares were registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below, to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If on April 19, 2013 your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on and what does the Board recommend?

| You will be asked to vote on the following three items: |

|

|

Our Board recommends that you vote: |

| |

|

|

|

|

|

| o |

To elect the nine nominees named herein to serve on our Board of Directors until the 2014 Annual Meeting of Stockholders;

|

|

|

o |

“FOR” the election of each of the nine nominees named herein to serve on our Board of Directors;

|

| |

|

|

|

|

|

| o |

To ratify the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013; and

|

|

|

o |

“FOR” the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013; and

|

| |

|

|

|

|

|

| o |

To approve our 2013 Incentive Compensation Plan.

|

|

|

o |

“FOR” the approval of our 2013 Incentive Compensation Plan.

|

May other matters be raised at the Annual Meeting; how will the meeting be conducted?

We currently are not aware of any business to be acted upon at the Annual Meeting other than the three matters described above. Under Delaware law and our governing documents, no other business aside from procedural matters may be raised at the Annual Meeting unless proper notice has been given to the Company by the stockholders. If other business is properly raised, your proxies have authority to vote as they think best, including to adjourn the meeting.

The Chairman has broad authority to conduct the Annual Meeting so that the business of the meeting is carried out in an orderly and timely manner. In doing so, he has broad discretion to establish reasonable rules for discussion, comments and questions during the meeting. The Chairman is also entitled to rely upon applicable law regarding disruptions or disorderly conduct to ensure that the Annual Meeting proceeds in a manner that is fair to all participants.

How do I vote?

For Proposal No. 1, you may either vote “FOR” each nominee named herein to serve on the Board of Directors or you may withhold your vote for any nominee that you specify. For Proposal Nos. 2 and 3, you may vote “FOR” or “AGAINST”, or abstain from voting. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone or vote by proxy on the Internet. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

|

|

·

|

To vote in person, come to the Annual Meeting, and we will give you a ballot when you arrive.

|

|

|

·

|

To vote using the enclosed proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the postage paid envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

|

|

|

·

|

To vote over the telephone, call the toll-free number (for residents of the United States) listed on your proxy card and follow the instructions provided by the recorded message. Your vote must be received by 7:00 p.m. Eastern Time on June 12, 2013 to be counted.

|

|

|

·

|

You can choose to vote your shares at any time using the Internet site listed on your proxy card. This site will give you the opportunity to make your selections and confirm that your instructions have been followed. We have designed our Internet voting procedures to authenticate your identity by use of a unique control number found on the enclosed proxy card. To take advantage of the convenience of voting on the Internet, you must subscribe to one of the various commercial services that offer access to the Internet. Costs normally associated with electronic access, such as usage and telephone charges, will be borne by you. We do not charge any separate fees for access to the Internet voting site. Your vote must be received by 7:00 p.m. Eastern Time on June 12, 2013 to be counted.

|

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, you should have received a proxy card and voting instructions with these proxy materials from that organization, rather than from the Company. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other nominee. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

What if I return a proxy card but do not make specific choices?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record and return a signed and dated proxy card without marking any voting selections, your shares will be voted as follows:

|

|

·

|

“FOR” the election of each of the nine nominees named herein to serve on the Board of Directors;

|

|

|

·

|

“FOR” the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013; and

|

|

|

·

|

“FOR” the approval of our 2013 Incentive Compensation Plan.

|

If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your proxy card) will vote your shares as recommended by our Board or, if no recommendation is given, will vote your shares using his or her best judgment.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee and you do not provide the broker or other nominee that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. On certain “routine” matters, brokerage firms have the discretionary authority to vote shares for which their customers do not provide voting instructions. Proposal No. 2, the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm, is considered a routine matter for this purpose. Proposal Nos. 1 and 3, however, are not considered to be routine matters, and, therefore, your shares will not be voted on those matters unless you instruct your brokerage firm to vote in a timely manner.

Can I change my mind and revoke my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any of the following ways:

|

|

·

|

You may submit another properly completed proxy bearing a later date;

|

|

|

·

|

You may send a written notice that you are revoking your proxy to our Investor Relations Department, MRI Interventions, Inc., One Commerce Square, Suite 2550, Memphis, Tennessee 38103; and

|

|

|

·

|

You may attend the Annual Meeting and notify the election officials at the Annual Meeting that you wish to revoke your proxy and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy.

|

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank to revoke your proxy.

What if I receive more than one proxy card?

Multiple proxy cards mean that you have more than one account with brokers or our transfer agent. Please vote all of your shares. We also recommend that you contact your broker or our transfer agent to consolidate as many accounts as possible under the same name and address. Our transfer agent is Continental Stock Transfer & Trust Company, 17 Battery Place, 8th Floor, New York, New York 10004, and it may be reached at (212) 509-4000.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count “FOR,” “WITHHOLD” and broker non-votes with respect to Proposal No. 1, and “FOR” and “AGAINST” votes, abstentions and broker non-votes with respect to Proposal Nos. 2 and 3. A broker non-vote occurs when a nominee, such as a broker or bank, holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary authority to vote with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner. In the event that a broker, bank, custodian, nominee or other record holder of our common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum for the transaction of business at the Annual Meeting. Abstentions will be counted towards the tabulation of shares present in person or represented by proxy and entitled to vote and will have the same effect as “AGAINST” votes on Proposal Nos. 2 and 3. Although broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum, broker non-votes will not be counted for purposes of determining the number of shares present in person or represented by proxy and entitled to vote with respect to a particular proposal. Thus, a broker non-vote will not affect the outcome of the vote on any Proposal.

What is the vote required for each proposal?

|

|

·

|

For Proposal No. 1, the election of directors, the nine nominees receiving the most “FOR” votes (among votes properly cast in person or by proxy) will be elected to serve on our Board of Directors.

|

|

|

·

|

To be approved, Proposal No. 2, the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013, must receive a “FOR” vote from at least a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote. However, the Audit Committee is not bound by a vote either for or against the firm. The Audit Committee will consider a vote against the firm by the stockholders in selecting our independent registered public accounting firm in the future.

|

|

|

·

|

To be approved, Proposal No. 3, the approval of our 2013 Incentive Compensation Plan, must receive a “FOR” vote from at least a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote.

|

How many shares must be present to constitute a quorum for the Annual Meeting?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are represented by stockholders present at the Annual Meeting or by proxy. On April 19, 2013, the record date, there were 57,320,447 shares outstanding and entitled to vote. Thus, at least 28,660,224 shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum. If there is no quorum, either the Chairman of the meeting or a majority of the votes present in person or represented by proxy at the Annual Meeting may adjourn the Annual Meeting to another date.

How many votes do I have and can I cumulate my votes?

You have one vote for every share of our common stock that you own. Cumulative voting is not allowed.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final results are expected to be published in a current report on Form 8-K filed by the Company with the Securities and Exchange Commission, or the SEC, on or before the fourth business day following the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days following the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

PROPOSAL 1 — ELECTION OF DIRECTORS

What is the structure of our Board?

Pursuant to Delaware law and our governing documents, the business and affairs of the Company are managed under the direction of our Board. The Board is the ultimate decision-making and oversight body of the Company, except with respect to matters reserved to the stockholders. The directors are charged with the responsibility of exercising their fiduciary duties to act in the best interest of the Company and our stockholders. The Board selects and oversees members of executive management who have the authority and responsibility for the conduct of the day-to-day operations of the business.

The number of directors that constitutes our Board is fixed from time to time by a resolution adopted by the affirmative vote of a majority of the authorized number of directors at any regular or special meeting of the Board. On an annual basis, the Corporate Governance and Nominating Committee will consider the size and composition of the Board and report to the Board the results of its review and any recommendations for change. Currently, our Board is fixed at nine directors. Our directors stand for election at each annual meeting of the stockholders and serve on our Board until the next annual meeting of the stockholders and until a successor has been duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal.

How are nominees evaluated; what are the minimum qualifications?

The Corporate Governance and Nominating Committee is responsible for recommending to the Board the type of skills and characteristics required of directors, based on the needs of the Company from time to time. In evaluating candidates for director, the Corporate Governance and Nominating Committee considers several factors, including relevant experience, intelligence, independence, commitment, compatibility with the Chief Executive Officer and the Board culture, prominence and understanding of the Company’s business, as well as any other factors it deems relevant. The Board will nominate individuals to serve on our Board only from director candidates screened and approved by the Corporate Governance and Nominating Committee and recommended to the Board.

The directors’ experiences, qualifications and skills that the Corporate Governance and Nominating Committee considered in their nomination are included in their individual biographies.

What role does diversity play in the selection of members of our Board?

In evaluating potential candidates for Board membership, the Corporate Governance and Nominating Committee considers, among other things, relevant experience, education, intelligence, independence and commitment. Our Board believes in a governing style that emphasizes respect for diversity in perspective and includes individuals from diverse backgrounds. Our Board believes that diversity is important because various points of view contribute to a more effective, engaged Board and better decision-making processes.

Who are the nominees this year?

Upon the recommendation of the Corporate Governance and Nominating Committee, our Board has nominated the following nine persons to serve as directors: Kimble L. Jenkins, Paul A. Bottomley, Charles E. Koob, James K. Malernee, Jr., Michael A. Pietrangelo, Philip A. Pizzo, Andrew K. Rooke, Michael J. Ryan and John N. Spencer, Jr. Bruce C. Conway resigned as a director effective April 12, 2013, and, therefore, Mr. Conway has not been nominated for re-election at the Annual Meeting. Mr. Conway elected to step down from our Board simply to give a highly qualified director candidate, Philip A. Pizzo, M.D., the opportunity to serve on the Board. Accordingly, the Board elected Dr. Pizzo as a director on April 12, 2013, to fill the vacancy created by Mr. Conway’s resignation, and the Board is nominating Dr. Pizzo for re-election at the Annual Meeting. If elected, each nominee will serve on our Board until the 2014 Annual Meeting of Stockholders or until his earlier death, resignation or removal. We anticipate that each of these nominees will be available for election, but if a situation arises in which he is unavailable, the proxy will be voted in accordance with the best judgment of the named proxies unless directed otherwise.

What are the backgrounds and qualifications of this year's nominees?

Information about the following nine individuals nominated as directors is provided below.

|

Director Nominees

|

|

Age

|

|

Kimble L. Jenkins

|

|

51

|

|

Paul A. Bottomley

|

|

60

|

|

Charles E. Koob

|

|

68

|

|

James K. Malernee, Jr.

|

|

65

|

|

Michael A. Pietrangelo

|

|

70

|

|

Philip A. Pizzo

|

|

68

|

|

Andrew K. Rooke

|

|

56

|

|

Michael J. Ryan

|

|

34

|

|

John N. Spencer, Jr.

|

|

72

|

Kimble L. Jenkins joined our Board in September 2002 and presently serves as our Chairman. Mr. Jenkins has served as our President since January 2003, and he has also served as our Chief Executive Officer since September 2004. Mr. Jenkins served in those offices on a part-time basis until May 2008, at which time Mr. Jenkins began serving as our President and Chief Executive Officer on a full-time basis. Prior to May 2008, Mr. Jenkins was also a Managing Director with the investment bank Morgan Keegan & Company, Inc., where he founded that firm’s Private Equity Group in 1998. Mr. Jenkins has over 20 years of experience building and working with growth stage companies. Mr. Jenkins holds a Bachelor of Arts from Brown University and a Juris Doctorate from Georgetown University Law Center. As our Chief Executive Officer, Mr. Jenkins offers unique insight and vision into our operations, our competition and the medical device industry.

Paul A. Bottomley is a founder of the company and has been a member of our Board since December 1998. Dr. Bottomley joined The Johns Hopkins University, or “Johns Hopkins,” in 1994. Since 1997, Dr. Bottomley has served as the Director of the Division of MR Research in the Department of Radiology at Johns Hopkins. Previously, Dr. Bottomley worked at General Electric Company’s Research and Development Center from 1980 to 1994 where he played a key role in the development of their MRI clinical product and was awarded the Center’s highest honor, its Coolidge Medal and Fellowship, for these developments in 1990. He was awarded the Society of Magnetic Resonance in Medicine’s Gold Medal for his contributions to MRI in 1989. He holds over 30 U.S. patents and has written more than 150 scientific journal publications. Dr. Bottomley also serves as a consultant to us. As a pioneer in MRI research, Dr. Bottomley offers expertise in the practical application of our technologies and the commercial opportunities for our products and product candidates.

Charles E. Koob joined our Board in August 2008. From 1970 to 2008, Mr. Koob practiced competition, trade regulation and antitrust law at the law firm of Simpson Thacher & Bartlett and served as the co-head of the firm’s litigation department for a portion of his tenure. For much of his career, Mr. Koob served as a strategic advisor for the boards of directors of many public companies. Mr. Koob presently serves on the board of directors of MiMedx Group, Inc., a publicly traded biomedical products company, DemeRx, Inc., a privately held biotechnology company, and Stanford Hospital & Clinics, the major teaching hospital for Stanford University and its School of Medicine. As a byproduct of Mr. Koob’s sophisticated former legal practice, Mr. Koob offers expertise in the areas of corporate governance, contract negotiation and organizational and strategic leadership.

James K. Malernee, Jr. joined our Board in March 2010. Dr. Malernee is a cofounder of Cornerstone Research, Inc., a consulting firm specializing in analytical support to attorneys in all phases of commercial litigation and regulatory proceedings, and he currently serves as Chairman of that firm. Over the last twenty years with Cornerstone Research, he has directed research on complex business issues related to a wide variety of cases. In recent years, Dr. Malernee has specialized in securities matters, supervising hundreds of cases dealing with material disclosure, loss causation, insider trading, mergers and acquisitions, targeted repurchases, minority buyouts, stock trading behavior, valuation and class certification. Dr. Malernee has served as a board member and consultant to major corporations, and he has taught finance at the University of Texas at Austin and business strategy at the Stanford Graduate School of Business. Dr. Malernee is also a consultant to RealPage, Inc., a publicly traded provider of property management solutions. Through his academic and professional pursuits, Dr. Malernee offers expertise in finance and business strategy as well as an understanding of corporate disclosure and governance practices.

Michael A. Pietrangelo joined our Board in March 2010. From 1972 through 1989, Mr. Pietrangelo was employed by Schering-Plough Corporation in various capacities, including President of the Personal Care Products Group. From 1989 to 1990, he served as President and Chief Operating Officer of Western Publishing Company. From 1990 to 1994, Mr. Pietrangelo was the President and Chief Executive Officer of CLEO, Inc., a subsidiary of Gibson Greetings, Inc. From 1994 until 1998, he served as President of Johnson Products Company, a subsidiary of IVAX Corporation. Since 1998, Mr. Pietrangelo has practiced law at Pietrangelo Cook PLC. Mr. Pietrangelo previously served as a director of Medicis Pharmaceutical Corporation, a publicly traded pharmaceutical company, prior to its acquisition by Valeant Pharmaceuticals International, Inc. in December 2012. Mr. Pietrangelo currently serves on the board of directors of the American Parkinson Disease Association, a not-for-profit organization focused on serving the Parkinson’s community, and Universal Insurance Holdings, Inc., a publicly traded insurance holding company. Mr. Pietrangelo also serves as the managing partner of Theraplex Company LLC, a privately held skin care products company. As a result of his diverse professional background, Mr. Pietrangelo offers a unique combination of legal expertise and operational acumen.

Philip A. Pizzo joined our Board in April 2013. Dr. Pizzo served as Dean of the Stanford School of Medicine from April 2001 to December 1, 2012, where he was also the Carl and Elizabeth Naumann Professor of Pediatrics and of Microbiology and Immunology. Dr. Pizzo has devoted much of his distinguished medical career to the diagnosis, management, prevention and treatment of childhood cancers and the infectious complications that occur in children whose immune systems are compromised by cancer and AIDS. He has also been a leader in academic medicine, championing programs and policies to improve the future of science, education and healthcare in the United States and beyond. Before joining Stanford, Dr. Pizzo was the physician-in-chief of Children’s Hospital in Boston and chair of the Department of Pediatrics at Harvard Medical School from 1996 to 2001. He is the author of more than 500 scientific articles and 16 books and monographs. Dr. Pizzo presently serves on the board of directors, or the equivalent governing body, of the University of Rochester, a private university, and Koc University, a private university located in Istanbul, Turkey. Dr. Pizzo offers a deep understanding of medical sciences and innovation, as well as physicians and other health care providers who are central to the use and development of our products.

Andrew K. Rooke joined our Board in July 2011. Mr. Rooke owns and manages Rooke Fiduciary Management, a private trust company, which specializes in the investment management of publicly held securities and the oversight of a multitude of trust investments. Mr. Rooke is also President and a director of Withington Foundation, a private foundation. Over the years, he has acquired, managed and sold a number of private companies as well as commercial real estate properties. Mr. Rooke was also previously employed by the former securities firm Kidder, Peabody & Co. With significant experience in financing, analyzing, investing in and managing investments in public and private companies, Mr. Rooke offers expertise in strategic and financial matters.

Michael J. Ryan joined our Board in May 2011. Mr. Ryan is Director of Corporate Business Development at Boston Scientific Corporation, where he leads business development activities in the field of neuromodulation. Prior to joining Boston Scientific in 2005, Mr. Ryan was a Senior Consultant at Decision Resources, providing management consulting services to the pharmaceutical and biotech industries. With his background, Mr. Ryan offers insight into the medical device industry, particularly as it relates to neurological applications.

John N. Spencer, Jr. joined our Board in March 2010. Mr. Spencer is a certified public accountant and was a partner of Ernst & Young LLP where he spent more than 38 years until his retirement in 2000. Mr. Spencer serves on the board of directors of GeoVax Labs, Inc., a publicly traded biotechnology company, and until April 2009, served on the board of directors of Firstwave Technologies, Inc., formerly a publicly traded customer relationship management software company. In addition, he serves as a consultant to various companies, primarily relating to financial accounting and reporting matters. By virtue of his experience at Ernst & Young, where he was the partner in charge of its life sciences practice for the southeastern United States, together with his continuing expertise as a director of, and a consultant to, other publicly traded and privately held companies, Mr. Spencer offers expertise in accounting, finance and the medical device industry.

How are our directors compensated?

Board Fees

Directors who are our employees are not entitled to receive any fees for serving as directors. As of January 1, 2013, directors who are not our employees receive the following Board and Committee fees:

|

Board of Directors:

|

|

|

|

|

Annual retainer per director

|

|

$ |

15,000 |

|

|

Fee per meeting of the Board (in-person)

|

|

$ |

1,000 |

|

|

Fee per meeting of the Board (telephonic)

|

|

$ |

500 |

|

| |

|

|

|

|

|

Audit Committee:

|

|

|

|

|

|

Annual retainer for chairperson

|

|

$ |

8,000 |

|

|

Annual retainer for other members

|

|

$ |

4,000 |

|

|

Fee per meeting

|

|

$ |

0 |

|

| |

|

|

|

|

|

Compensation Committee:

|

|

|

|

|

|

Annual retainer for chairperson

|

|

$ |

6,000 |

|

|

Annual retainer for other members

|

|

$ |

3,000 |

|

|

Fee per meeting

|

|

$ |

0 |

|

| |

|

|

|

|

|

Corporate Governance and Nominating Committee:

|

|

|

|

|

|

Annual retainer for chairperson

|

|

$ |

6,000 |

|

|

Annual retainer for other members

|

|

$ |

3,000 |

|

|

Fee per meeting

|

|

$ |

0 |

|

The above retainers are paid in quarterly installments, in arrears. The Company also reimburses each non-employee director for reasonable travel and other expenses in connection with attending Board meetings.

Stock Options

Upon an individual becoming a non-employee director for the first time, the new director will receive a stock option grant entitling him/her to purchase 45,000 shares of the Company’s common stock. Such options will vest in equal annual installments over three years.

Any individual who serves as a non-employee director on the day following an annual meeting of the Company’s stockholders will receive a stock option grant entitling him/her to purchase 20,000 shares of the Company’s common stock. Such options will vest on the earlier of the first anniversary of the grant date or the day immediately preceding the next annual meeting of stockholders.

The exercise price of all options granted to directors will equal the “fair market value” of the Company’s common stock on the date of grant.

Are there stock ownership guidelines for directors?

We currently do not have any stock ownership guidelines. The Board expects each director to develop a meaningful ownership position in the Company over time but does not believe it is appropriate to specify the level of stock ownership for individual directors.

Are there any family relationships between our directors and our executive officers?

There are no family relationships between or among any of our directors and executive officers.

How many votes are needed to elect directors?

The nine nominees receiving the most “FOR” votes among votes properly cast in person or by proxy at the Annual Meeting will be elected (assuming a quorum of a majority of the outstanding shares of common stock is present) to serve on our Board.

What does the Board recommend?

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR IDENTIFIED ABOVE.

GOVERNANCE OF THE COMPANY

What is corporate governance and how do we implement it?

Corporate governance is a set of rules established by us to ensure that our directors, executive officers and employees conduct the Company’s business in a legal, impartial and ethical manner. Our Board has a strong commitment to sound and effective corporate governance practices. We are incorporated under the laws of the State of Delaware. We have not applied to list our securities on a national securities exchange or an inter-dealer quotation system which has requirements that a majority of our Board be independent. However, for purposes of determining independence, we have adopted the provisions of Nasdaq Marketplace Rule 5605. Our management and our Board have reviewed and continue to monitor our corporate governance practices in light of Delaware corporate law, U.S. federal securities laws and Nasdaq Marketplace Rule 5605.

What documents establish and implement our corporate governance practices?

Our charters of our Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee, Code of Business Conduct and Ethics, Guidelines on Governance Issues, Guidelines for Corporate Disclosure, Related Party Transactions Policy, Securities Trading Policy and Whistleblower Policy were adopted by us for the purpose of increasing transparency in our governance practices as well as promoting honest and ethical conduct, promoting full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by us, and promoting compliance with all applicable rules and regulations that apply to us and our officers and directors.

Our Code of Business Conduct and Ethics applies to all of our employees, officers (including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions) and directors. We intend to disclose future amendments to certain provisions of our Code of Business Conduct and Ethics, or waivers of such provisions, applicable to any principal executive officer, principal financial officer, principal accounting officer or controller, persons performing similar functions or our directors on our website at www.mriinterventions.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

Where can I access the Company’s corporate governance documents?

Our charters of our Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee, Code of Business Conduct and Ethics, Guidelines on Governance Issues, Guidelines for Corporate Disclosure, Related Party Transactions Policy, Securities Trading Policy and Whistleblower Policy may be accessed at the “Investors” tab of our website at www.mriinterventions.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement. In addition, any stockholder or other interested party may request, without charge, a copy of the Company’s corporate governance documents by submitting a written request for any of such materials to our Investor Relations Department, MRI Interventions, Inc., One Commerce Square, Suite 2550, Memphis, Tennessee 38103.

How often did our Board meet in 2012?

Our Board held seven meetings during 2012. Directors are expected to attend each meeting of our Board and each meeting of those Committees on which they serve. In addition to meetings, our Board and its Committees review and act upon matters through written consent procedures. All of the directors attended 75% or more of the total number of meetings of the Board and those Committees on which they served during the last fiscal year.

Our 2012 Annual Meeting of Stockholders was held on February 10, 2012. At that time, we were not a reporting company under the Securities Exchange Act of 1934, or the “Exchange Act”, and our common stock was not publicly traded. As a private company, none of our directors attended the 2012 Annual Meeting of Stockholders. When we subsequently became a reporting company under the Exchange Act, we adopted a policy for attendance by our Board at our stockholder annual meetings that encourages directors, if practicable and time permitting, to attend our stockholder annual meetings.

Who are our independent directors?

We have not applied to list our securities on a national securities exchange or an inter-dealer quotation system which has requirements that a majority of our Board be independent. However, for purposes of determining independence, we have adopted the provisions of Nasdaq Marketplace Rule 5605. Our Board undertook a review of the composition of our Board and its Committees and the independence of each director. Based upon information requested from and provided by each director concerning his background, employment and affiliations, including family relationships, our Board has determined that none of Drs. Bottomley, Malernee or Pizzo or Messrs. Koob, Pietrangelo, Rooke or Spencer, representing seven of our nine directors who are nominated for re-election at the Annual Meeting, has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under Rule 5605(a)(2) of the Nasdaq Marketplace Rules. Furthermore, our Board determined that Mr. Conway, who served on our Board during 2012 and until his resignation effective April 12, 2013, was an “independent” director under the Nasdaq Marketplace Rules during such period of time. In making such determinations, our Board considered the relationships that each such director has with us and all other facts and circumstances the Board deemed relevant in determining independence, including the beneficial ownership of our capital stock by each director.

What is the leadership structure of the Board, and why is it appropriate for the Company?

Our Chief Executive Officer also serves as the Chairman of the Board. The Board does not have a fixed policy as to whether the role of the Chief Executive Officer and Chairman of the Board should be separate. Both the Chairman and Chief Executive Officer positions are currently held by Mr. Jenkins. When the Chairman of the Board is a member of Company management, the Chairman of the Corporate Governance and Nominating Committee, who is an independent director, acts ex officio as the Lead Independent Director of the Board, with the responsibility for coordinating the activities of the other independent directors and for performing the duties specified in our Guidelines on Governance Issues and such other duties as are assigned from time to time by the Board.

The Lead Independent Director has broad responsibility and authority, including, without limitation, to:

|

|

·

|

serve as the principal liaison on Board-wide issues between the independent members of the Board and the Chairman of the Board;

|

|

|

·

|

preside at all meetings of the Board at which the Chairman of the Board is not present, including executive sessions of the independent members of the Board; and

|

|

|

·

|

call meetings of the independent members of the Board.

|

Mr. Koob, as the Chairman of the Corporate Governance and Nominating Committee, served as the Lead Independent Director to preside over executive sessions of independent directors during fiscal year 2012. The independent directors met in executive session at least one time during fiscal year 2012.

Our Board believes that this leadership structure—a combined Chairman of the Board and Chief Executive Officer and a Lead Independent Director—is the most appropriate structure for us at this time. Because the Chief Executive Officer has extensive knowledge of our business, our Board has concluded that he is in the best position to lead most effectively by serving in the key position of Chairman of the Board. In addition, the Chief Executive Officer is able to act as a conduit between the Board and management to plan and execute Board meetings, to provide updates between Board meetings, as necessary, and to efficiently execute Board directives. We believe that this leadership structure reduces the potential for confusion about leadership roles and duplication of efforts. Finally, this structure allows a single person to speak for and lead the Company and our Board, while also providing for effective oversight by an independent Board through a Lead Independent Director.

What role does our Board play in the oversight of risk management?

Our Board implements its risk oversight function both as a whole and through its Committees. Throughout the year, our Board and the Committees to which it has delegated responsibility conduct risk assessments and discuss identified risks and how to eliminate or mitigate such risks.

Our Board and its Committees oversee risks associated with their respective principal areas of focus, as summarized below. All Committees report to the full Board as appropriate, including when a matter rises to the level of a material risk.

|

|

|

Primary Areas of Risk Oversight

|

|

Full Board

|

|

Strategic, financial and execution risks associated with annual operating and long term strategic plans, major litigation and regulatory exposures and other current matters that may present material risk to our operations, plans, prospects or reputation.

|

| |

|

|

Audit Committee

|

|

Risks relating to the Company’s financial statements, financial reporting process, accounting and legal matters.

|

| |

|

|

Compensation Committee

|

|

Risks related to the Company’s compensation structure and benefits plan administration.

|

| |

|

|

Corporate Governance and Nominating Committee

|

|

Risks relating to the Company’s corporate governance policies and programs and succession planning.

|

While our Board and its Committees oversee our risk management, our management is responsible for day-to-day risk management. Management communicates regularly with our Board and its Committees on any material risks and how they are being managed.

How can you communicate with our Board?

Stockholders and other interested parties may send communications to our Board or any Committee of the Board by writing to our Board or the Committee, c/o MRI Interventions, Inc., One Commerce Square, Suite 2550, Memphis, Tennessee 38103, Attention: Secretary. The Secretary will distribute all stockholder and other interested party communications to the intended recipients and/or distribute to the entire Board, as appropriate.

In addition, stockholders and other interested parties may also contact the Lead Independent Director or the non-management directors as a group by writing to the Lead Independent Director, c/o MRI Interventions, Inc., One Commerce Square, Suite 2550, Memphis, Tennessee 38103, Attention: Secretary. The Secretary will forward all stockholder and other interested party communications to the Lead Independent Director who will review and, if addressed to the non-management directors, distribute all stockholder and other interested party communications to the non-management directors as a group.

What are our complaint procedures?

Complaints and concerns about our accounting, internal accounting controls or auditing matters may be submitted, confidentially and anonymously, to the Company’s Compliance Officer, Oscar Thomas, at MRI Interventions, Inc., One Commerce Square, Suite 2550, Memphis, Tennessee 38103; Telephone No.: (901) 522-9344; Email: othomas@mriinterventions.com. Alternatively, complaints and concerns about our accounting, internal accounting controls or auditing matters may be submitted, confidentially and anonymously, by calling our Whistleblower Hotline at (877) 778-5463 or by using our confidential web-based service at www.reportit.net.

What Committees have been established by our Board?

Our Board currently has three standing Committees: the Audit Committee; the Compensation Committee; and the Corporate Governance and Nominating Committee.

What are the responsibilities of the Audit Committee?

Our Audit Committee consists of Messrs. Pietrangelo and Spencer and Dr. Malernee. Mr. Spencer serves as the Chairman of the Audit Committee. The functions of the Audit Committee include:

|

|

•

|

overseeing the audit and other services of our independent registered public accounting firm and being directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm, who will report directly to the Audit Committee;

|

|

|

•

|

reviewing and pre-approving the engagement of our independent registered public accounting firm to perform audit services and any permissible non-audit services;

|

|

|

•

|

overseeing compliance with the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as required;

|

|

|

•

|

reviewing our annual and quarterly financial statements and reports and discussing the financial statements and reports with our independent registered public accounting firm and management;

|

|

|

•

|

reviewing and approving all related person transactions;

|

|

|

•

|

reviewing with our independent registered public accounting firm and management significant issues that may arise regarding accounting principles and financial statement presentation, as well as matters concerning the scope, adequacy and effectiveness of our internal controls over financial reporting;

|

|

|

•

|

establishing procedures for the receipt, retention and treatment of complaints received by us regarding internal controls over financial reporting, accounting or auditing matters; and

|

|

|

•

|

preparing the Audit Committee report for inclusion in our proxy statement for our annual meeting.

|

Our Board has determined that at this time Mr. Spencer is an audit committee financial expert within the meaning of SEC regulations. Furthermore, our Board has determined that all the members of the Audit Committee satisfy the independence, experience and other requirements established by the Nasdaq Marketplace Rules, which were adopted by the Company. Our Audit Committee met five times during 2012. Both our independent registered public accounting firm and management periodically meet privately with our Audit Committee. A copy of the charter for our Audit Committee is posted on our website at www.mriinterventions.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

What are the responsibilities of the Compensation Committee?

Our Compensation Committee currently consists of Messrs. Koob and Pietrangelo and Dr. Pizzo. Mr. Pietrangelo serves as the Chairman of our Compensation Committee. The functions of the Compensation Committee include:

|

|

•

|

determining the compensation and other terms of employment of our Chief Executive Officer and other executive officers and reviewing and approving our performance goals and objectives relevant to such compensation;

|

|

|

•

|

administering and implementing our incentive compensation plans and equity-based plans, including approving option grants, restricted stock and other awards;

|

|

|

•

|

evaluating and recommending to our Board the equity incentive-compensation plans, equity-based plans and similar programs advisable for us, as well as modifications or terminations of our existing plans and programs;

|

|

|

•

|

reviewing and approving the terms of any employment-related agreements, severance arrangements, change-in-control and similar agreements/provisions and any amendments, supplements or waivers to the foregoing agreements with our Chief Executive Officer and other executive officers;

|

|

|

•

|

to the extent required, reviewing and discussing the Compensation Discussion & Analysis for our annual report and proxy statement with management and determining whether to recommend to our Board the inclusion of the Compensation Discussion & Analysis in the annual report and proxy statement; and

|

|

|

•

|

to the extent required, preparing a report on executive compensation for inclusion in our proxy statement for our annual meeting.

|

Each member of our Compensation Committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code. Furthermore, our Board has determined that Messrs. Koob and Pietrangelo and Dr. Pizzo each satisfy the independence standards for compensation committees established by the Nasdaq Marketplace Rules. Mr. Bruce C. Conway, who resigned from our Board effective April 12, 2013, also qualified as a non-employee director and an outside director and satisfied the independence standards under the Nasdaq Marketplace Rules during 2012 when he served as a member of our Compensation Committee. Our Compensation Committee met six times during 2012. A copy of the charter for our Compensation Committee is posted on our website at www.mriinterventions.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

With respect to director compensation, our Compensation Committee is responsible for reviewing the compensation paid to members of the Board and recommending modifications to Board compensation that the Compensation Committee determines are appropriate and advisable to the Board for its approval from time to time. In this regard, the Compensation Committee may request that management report to the Compensation Committee periodically on the status of the Board’s compensation in relation to other similarly situated companies.

In determining compensation for our executive officers, the Compensation Committee typically considers, but is not required to accept, the recommendations of our Chief Executive Officer regarding the performance and proposed base salary and bonus and equity awards for the other executive officers, as well as himself. The Compensation Committee may also request the assistance of our Chief Financial Officer in evaluating the financial, accounting and tax implications of various compensation awards paid to the executive officers. However, our Chief Financial Officer does not recommend or determine the amounts or types of compensation paid to the executive officers. Our Chief Executive Officer and certain of our other executive officers may attend Compensation Committee meetings, as requested by the Compensation Committee. None of our executive officers, including our Chief Executive Officer, attend any portion of the Compensation Committee meetings during which his or her compensation is established and approved.

During 2012, neither the Company nor the Compensation Committee retained any compensation consultant to advise the Compensation Committee on executive and/or director compensation. Rather, the Compensation Committee and our Chief Executive Officer have applied subjective discretion to make compensation decisions. They have not used a specific formula or matrix to set compensation in relation to compensation paid by other medical device companies. Our Compensation Committee designed our executive compensation program based on the Compensation Committee’s general knowledge of compensation practices and the application of such knowledge to successfully attract and retain our executive officers. Our Compensation Committee has not established any percentile targets for the levels of compensation provided to our executive officers. To date, the Compensation Committee has not performed reviews of our compensation programs with those of similarly-situated companies, nor has it engaged in benchmarking of compensation paid to our executive officers. Our historical approach has been to consider compensation practices and relevant factors rather than establishing compensation at specific benchmark percentiles. This has enabled us to respond to dynamics in the labor market and provided us with flexibility in maintaining and enhancing our executive officers’ engagement, focus, motivation and enthusiasm for our future. However, we expect to build some of these objective practices into our compensation approach over time.

What are the responsibilities of the Corporate Governance and Nominating Committee?

Our Corporate Governance and Nominating Committee consists of Messrs. Koob and Rooke and Dr. Malernee. The functions of the Corporate Governance and Nominating Committee include:

|

|

•

|

evaluating director performance on the Board and applicable Committees of the Board;

|

|

|

•

|

interviewing, evaluating, nominating and recommending individuals for membership on our Board;

|

|

|

•

|

evaluating nominations by stockholders of candidates for election to our Board;

|

|

|

•

|

reviewing and recommending to our Board any amendments to our corporate governance documents; and

|

|

|

•

|

making recommendations to the Board regarding management succession planning.

|

Our Board has determined that Messrs. Koob and Rooke and Dr. Malernee each satisfy the independence standards for the corporate governance and nominating committees established by the Nasdaq Marketplace Rules. The Corporate Governance and Nominating Committee met one time during 2012. A copy the charter for our Corporate Governance and Nominating Committee is posted on our website at www.mriinterventions.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

When evaluating director candidates, the Corporate Governance and Nominating Committee considers several factors, including relevant experience, intelligence, independence, commitment, compatibility with the Chief Executive Officer and the Board culture, prominence and understanding of the Company’s business, as well as any other factors the Corporate Governance and Nominating Committee deems relevant at the time. The Corporate Governance and Nominating Committee makes a recommendation to the full Board as to any persons it believes should be nominated by our Board, and our Board determines the nominees after considering the recommendation and report of the Corporate Governance and Nominating Committee. During 2012, the Corporate Governance and Nominating Committee did not engage any third party to assist it in identifying or evaluating nominees for election to our Board.

Any director or executive officer of the Company may recommend a candidate to the Corporate Governance and Nominating Committee for its consideration. The Corporate Governance and Nominating Committee will also consider nominees to our Board recommended by stockholders if stockholders comply with our advance notice requirements in our bylaws. Our bylaws provide that a stockholder who wishes to nominate a person for election as a director at a meeting of stockholders must deliver timely written notice to our Secretary. This notice must contain, as to each nominee, all of the information relating to such person as would be required to be disclosed in a proxy statement meeting the requirements of Regulation 14A under the Exchange Act, and certain other information, including the name and address of the stockholder delivering the notice as it appears on the Company’s books; the class and number of shares owned beneficially and of record by such stockholder; information about derivative instruments beneficially owned by such stockholder and any opportunity to profit or share in any profit derived from any increase or decrease in the value of the shares of our stock; any proxy, contract, arrangement, understanding or relationship pursuant to which such stockholder has a right to vote any shares of our stock; any short interest in any of our securities held by such stockholder; any rights to dividends on shares of our stock owned beneficially or of record by such stockholder that are separated or separable from the underlying shares of stock; any proportionate interest in shares of our stock or derivative instruments held by a general or limited partnership in which such stockholder is, or owns a beneficial interest in, the general partner; any performance-related fees that such stockholder is entitled to based on the value of our securities; any arrangement or understanding between such stockholder and proposed nominee; and whether such stockholder intends to deliver a solicitation notice, as more fully described in our bylaws. The foregoing summary does not include all requirements a stockholder must satisfy in order to nominate a candidate to the Board. Stockholders who wish to recommend a nominee to our Board should carefully read our bylaws, which are available at the “Investors” tab of our website at www.mriinterventions.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

Stockholder nominations must be submitted in accordance with the deadlines set forth under the caption “STOCKHOLDER PROPOSALS FOR THE 2014 ANNUAL MEETING” located on page 37 of this Proxy Statement. Stockholder nominations should be sent to MRI Interventions, Inc., One Commerce Square, Suite 2550, Memphis, Tennessee 38103, Attention: Secretary.

DIRECTOR COMPENSATION

The following table sets forth information with respect to the compensation of our non-employee directors in 2012.

|

Name

|

|

Fees Earned

or Paid in

Cash

($)

|

|

|

Option

Awards

($)(1)

|

|

|

All Other

Compensation

($)

|

|

|

Total

($)

|

|

|

Paul A. Bottomley

|

|

$ |

8,500 |

|

|

$ |

19,800 |

|

|

$ |

60,000 |

(2) |

|

$ |

88,050 |

|

|

Bruce C. Conway(3)

|

|

|

10,625 |

|

|

|

19,800 |

|

|

|

102,850 |

(4) |

|

|

133,275 |

|

|

Charles E. Koob

|

|

|

12,750 |

|

|

|

19,800 |

|

|

|

— |

|

|

|

32,550 |

|

|

James K. Malernee, Jr.

|

|

|

11,750 |

|

|

|

19,800 |

|

|

|

— |

|

|

|

31,550 |

|

|

Michael A. Pietrangelo

|

|

|

13,750 |

|

|

|

19,800 |

|

|

|

— |

|

|

|

33,550 |

|

|

Andrew K. Rooke

|

|

|

9,875 |

|

|

|

19,800 |

|

|

|

411,400 |

(4) |

|

|

441,075 |

|

|

Michael J. Ryan

|

|

|

8,500 |

|

|

|

19,800 |

|

|

|

— |

|

|

|

28,300 |

|

|

John N. Spencer, Jr.

|

|

|

11,375 |

|

|

|

19,800 |

|

|

|

— |

|

|

|

31,175 |

|

|

(1)

|

These amounts do not represent cash compensation paid to the named individuals. These non-cash amounts represent the aggregate grant date fair value of option awards as computed in accordance with the Financial Accounting Standard Board Accounting Standards Codification, or ASC, Topic 718. For a discussion of the assumptions made in the valuation of the awards, see the discussion under “Management’s Discussion and Analysis of Financial Condition and Results of Operations–Critical Accounting Policies and Significant Judgments and Estimates–Share-based Compensation” and note 2 to the audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2012.

|

|

(2)

|

This amount represents compensation under Dr. Bottomley’s consulting agreement.

|

|

(3)

|

Mr. Conway resigned as a director of the Company effective as April 12, 2013. Mr. Conway elected to step down from our Board simply to give a highly qualified director candidate, Dr. Philip A. Pizzo, the opportunity to serve on the Board. Mr. Conway’s resignation was not the result of any disagreement with the Company, its management or its operations, policies or practices.

|

|

(4)

|

This amount does not represent cash compensation paid to the named individual. This non-cash amount represents the aggregate grant date fair value of a warrant issued to the named individual, as computed in accordance with ASC Topic 718. The warrant was not issued in connection with the named individual’s service as a director. For a discussion of the assumptions made in the valuation of the grant, see the discussion under “Management’s Discussion and Analysis of Financial Condition and Results of Operations–Critical Accounting Policies and Significant Judgments and Estimates–Share-based Compensation” and note 2 to the audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2012.

|

PROPOSAL 2 — RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Has the Audit Committee selected our independent registered public accounting firm for 2013?

The Audit Committee has reappointed Cherry Bekaert LLP as our independent registered public accounting firm to audit and certify our financial statements for the fiscal year ending December 31, 2013.

Is stockholder approval required for the appointment of the independent registered public accounting firm for 2013?

Stockholder ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm is not required by our bylaws or other governing documents. The Board is submitting the appointment of Cherry Bekaert LLP to our stockholders for ratification as a matter of good corporate governance. However, the Audit Committee is not bound by a vote either for or against the proposal. The Audit Committee will consider a vote against Cherry Bekaert LLP by our stockholders in selecting our independent registered public accounting firm in the future. Even if our stockholders do ratify the appointment, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it believes that such a change would be in the best interest of the Company and our stockholders.

Will representatives of Cherry Bekaert LLP attend the Annual Meeting?

Representatives of Cherry Bekaert LLP are not expected to be present at the Annual Meeting.