|

PROSPECTUS SUPPLEMENT NO. 4 (to Prospectus dated January 29, 2016)

|

Filed Pursuant to Rule 424(b)(3) Registration No. 333-209009 |

MRI Interventions, Inc.

29,356,679 Shares of Common Stock

This prospectus supplement relates to the prospectus dated January 29, 2016, as supplemented by prospectus supplement no. 1 dated March 22, 2016, prospectus supplement no. 2 dated March 25, 2016 and prospectus supplement no. 3 dated April 4, 2016, which permits the resale of up to 16,309,270 outstanding shares of our common stock, and 13,047,409 shares of our common stock issuable upon the exercise of outstanding warrants, by the selling securityholders identified in the prospectus, as amended and supplemented from time to time. We will pay the expenses of registering the shares, but we are not selling any shares of common stock in this offering and therefore will not receive any proceeds from this offering. We will, however, receive the exercise price of the warrants, if and when the warrants are exercised for cash by the securityholders.

This prospectus supplement is being filed to update, amend and supplement the information previously included in the prospectus with the information contained in our Definitive Proxy Statement filed with the Securities and Exchange Commission on April 25, 2016 (the “Proxy Statement”). Accordingly, we have attached the Proxy Statement to this prospectus supplement. You should read this prospectus supplement together with the prospectus, which is to be delivered with this prospectus supplement.

Our common stock is traded in the over-the-counter market and is quoted on the OTCQB Marketplace and the OTC Bulletin Board under the symbol MRIC. On April 22, 2016, the last reported sale price of our common stock was $0.37 per share.

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our common stock involves risk. See “Risk Factors” beginning on page 6 of the prospectus, as amended and supplemented by the “Risk Factors” beginning on page 21 of our Annual Report on Form 10-K for the year ended December 31, 2015, which is included in prospectus supplement no. 2, to read about factors you should consider before buying shares of our common stock.

_______________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is April 25, 2016.

__________________________________________________________________

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Rule 14a-12

MRI

Interventions, INC.

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o Fee paid previously with preliminary materials:

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by Registration Statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

MRI Interventions, Inc.

5 Musick

Irvine, California 92618

April 25, 2016

Dear Stockholder:

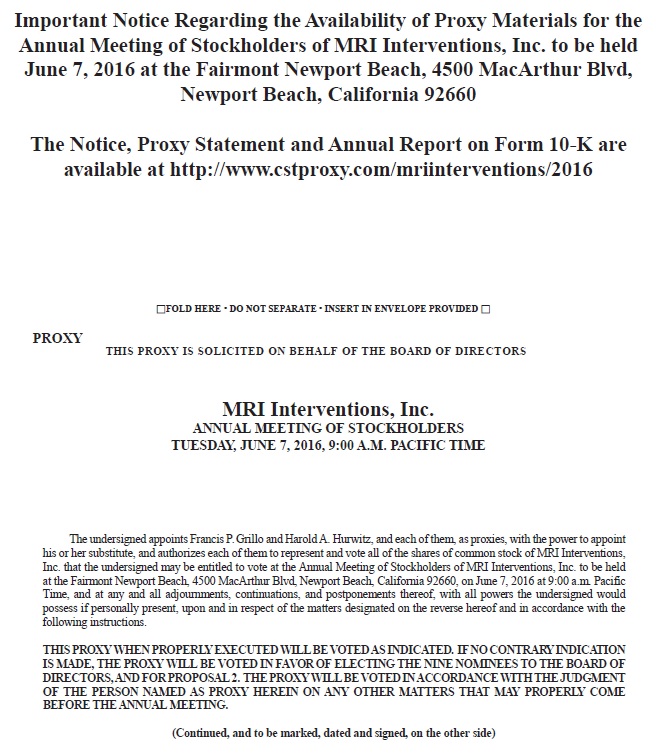

You are cordially invited to attend the Annual Meeting of Stockholders of MRI Interventions, Inc. to be held on Tuesday, June 7, 2016 at 9:00 a.m., Pacific Time, at the Fairmont Newport Beach, 4500 MacArthur Blvd., Newport Beach, California 92660.

With this letter, we have enclosed a copy of our Annual Report on Form 10-K for the year ended December 31, 2015, Notice of Annual Meeting of Stockholders, Proxy Statement and Proxy Card. These materials provide further information about our Annual Meeting. If you would like another copy of our Annual Report, please send your request to MRI Interventions, Inc., Attn: Corporate Secretary, 5 Musick, Irvine, California 92618, and one will be mailed to you. It is also available on the Internet at www.cstproxy.com/mriinterventions/2016.

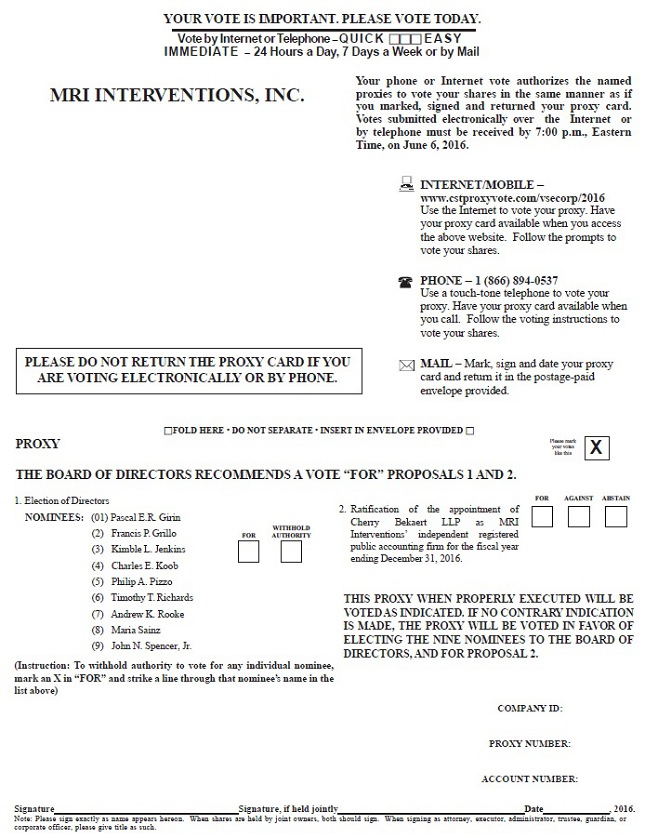

At this year’s Annual Meeting, the agenda includes: (1) the election of the nine directors named in the accompanying Proxy Statement; and (2) a proposal to ratify the appointment of our independent registered public accounting firm. The Board of Directors recommends that you vote FOR the election of the nine directors named in the accompanying Proxy Statement, and FOR the ratification of the appointment of our independent registered public accounting firm. Executive officers of the company will be present at the Annual Meeting to answer any appropriate questions you may have.

It is important that your shares be represented and voted at the Annual Meeting, regardless of the size of your holdings. Accordingly, please complete, sign and date the enclosed Proxy Card and return it promptly in the enclosed postage-paid envelope to ensure your shares will be represented. If you attend the Annual Meeting, you may, of course, withdraw your proxy should you wish to vote in person. Also, all registered stockholders and most beneficial stockholders may vote by telephone or through the Internet. Instructions for using these convenient services are explained on the enclosed Proxy Card. Your vote is very important. We urge you to vote your proxy as soon as possible.

We look forward to seeing you at the Annual Meeting.

Very truly yours,

Francis P. Grillo

Chief Executive Officer and President

|

Your Vote Is Important Please mark, sign and date your Proxy Card and return it promptly in the enclosed postage-paid envelope, whether or not you plan to attend the meeting. Registered stockholders and most beneficial stockholders may also vote via telephone or through the Internet. |

MRI Interventions, Inc.

5 Musick

Irvine, California 92618

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 7, 2016

The regular Annual Meeting of Stockholders of MRI Interventions, Inc. will be held on Tuesday, June 7, 2016 at 9:00 a.m., Pacific Time, at the Fairmont Newport Beach, 4500 MacArthur Blvd., Newport Beach, California 92660, for the following purposes:

| 1. | Election of our Directors. To elect the nine directors named herein to serve until the 2016 Annual Meeting of Stockholders; |

| 2. | Ratification of our Auditors. To ratify the selection of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; and |

| 3. | Other Business. To transact such other business as may properly come before the Annual Meeting or any adjournment of the meeting. |

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE PROPOSALS.

Only those stockholders of record at the close of business on April 14, 2016 are entitled to notice of, and to vote at, the Annual Meeting and any adjournment thereof. On that day, 95,889,044 shares of common stock were outstanding. Each share entitles the holder to one vote.

The accompanying Proxy Statement is being sent, beginning approximately April 25, 2016, to all stockholders of record at the close of business on April 14, 2015, the record date fixed by our Board of Directors. We have enclosed a copy of our Annual Report with the accompanying Proxy Statement. Although the Annual Report and Proxy Statement are being mailed together, the Annual Report is not incorporated into, and should not be deemed part of, the accompanying Proxy Statement.

By Order of the Board of Directors,

Harold A. Hurwitz

Chief Financial Officer and Secretary

Table of Contents

Page No.

| General Information | 1 | |

| Voting Matters | 3 | |

| Proposal 1 — Election of Directors | 7 | |

| Governance of the Company | 12 | |

| Director Compensation | 18 | |

| Proposal 2 — Ratification of the Appointment of our Independent Registered Public Accounting Firm | 19 | |

| Report of the Audit Committee of the Board | 21 | |

| Executive Officers | 22 | |

| Executive Compensation | 23 | |

| Equity Compensation Plan Information | 27 | |

| Benefit Plans | 28 | |

| Certain Relationships and Related Transactions | 31 | |

| Security Ownership of Certain Beneficial Owners and Management | 33 | |

| Section 16(a) Beneficial Ownership Reporting Compliance | 34 | |

| Stockholder Proposals for 2017 Annual Meeting | 34 | |

| Annual Report and Financial Information | 35 | |

| Other Business | 35 |

MRI Interventions, Inc.

5 Musick

Irvine, California 92618

Proxy Statement for Annual Meeting of Stockholders

Important

notice regarding the availability of proxy materials for

the stockholders meeting to be held on TUESDAY, JUNE 7, 2016:

this proxy

statement, THE proxy card and OUR 2015 annual report ON

FORM 10-K are ALSO available ON THE internet at

WWW.CSTPROXY.COM/MRIINTERVENTIONS/2016.

GENERAL INFORMATION

What is this document?

This document is the Proxy Statement of MRI Interventions, Inc. for the 2016 Annual Meeting of Stockholders, or the “Annual Meeting,” to be held at 9:00 a.m., Pacific Time, on Tuesday, June 7, 2016. This document and the enclosed Proxy Card are first being mailed or given to stockholders on or about April 25, 2016.

We refer to MRI Interventions, Inc. throughout this document as “we,” “us” or the “Company.”

What is the date and time of the Annual Meeting?

The Annual Meeting is scheduled to be held on Tuesday, June 7, 2016, at 9:00 a.m. Pacific Time.

Where will the Annual Meeting be held?

The Annual Meeting is being held at the Fairmont Newport Beach, 4500 MacArthur Blvd., Newport Beach, California 92660.

Why am I receiving this Proxy Statement?

You are receiving this Proxy Statement because you were one of our stockholders of record on April 14, 2016, the record date for the Annual Meeting. We are sending this Proxy Statement and the form of Proxy Card to solicit your proxy to vote upon certain matters at the Annual Meeting.

What is a proxy?

It is your legal designation of another person, called a “proxy,” to vote the stock you own. The document that designates someone as your proxy is also called a proxy, or a “Proxy Card.”

Who is paying the costs to prepare this Proxy Statement and solicit my proxy?

We will pay all expenses of this solicitation, including the cost of preparing and mailing this Proxy Statement and the form of Proxy Card.

| 1 |

Who is soliciting my proxy, and will anyone be compensated to solicit my proxy?

Your proxy is being solicited by and on behalf of our Board of Directors, or our “Board.” In addition to solicitation by use of the mails, proxies may be solicited by our officers and employees in person or by telephone, electronic mail, facsimile transmission or other means of communication. Our officers and employees will not be additionally compensated, but they may be reimbursed for out-of-pocket expenses in connection with any solicitation. We also may reimburse custodians, nominees and fiduciaries for their expenses in sending proxies and proxy material to beneficial owners.

What is MRI Interventions, Inc., and where is it located?

We are a medical device company that develops and commercializes innovative platforms for performing minimally invasive surgical procedures in the brain and heart under direct, intra-procedural magnetic resonance imaging, or “MRI,” guidance. We have two product platforms. Our ClearPoint system, which is in commercial use, is used to perform minimally invasive surgical procedures in the brain. We anticipate that our ClearTrace system, which is a product candidate still in development, will be used to perform minimally invasive surgical procedures in the heart. In 2015, we suspended development of our ClearTrace system so that we could focus on our resources on our ClearPoint system. Both systems utilize intra-procedural MRI to guide the procedures and are designed to work in a hospital’s existing MRI suite. Our principal executive office is located at 5 Musick, Irvine, California 92618, and we also conduct our principal operations, including component processing, final assembly, packaging and distribution activities for our ClearPoint system, at that facility.

Where is our common stock traded?

Our common stock is traded in the over-the-counter market and quoted on the OTCQB Venture Marketplace organized by the OTC Markets Group Inc., as well as the OTC Bulletin Board, under the symbol “MRIC.”

Will the Company’s directors be in attendance at the Annual Meeting?

The Company encourages, but does not require, its directors to attend annual meetings of stockholders, recognizing that from time-to-time scheduling conflicts may occur that will prevent a director from attending. We expect that all of our Board members will attend the Annual Meeting, if possible.

| 2 |

VOTING MATTERS

Who is entitled to attend and vote at the Annual Meeting?

Only stockholders of record at the close of business on the record date, April 14, 2016, are entitled to receive notice of the Annual Meeting and to vote the shares for which they are stockholders of record on that date at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. A list of our stockholders will be open to the examination of any stockholder, for any purpose germane to the Annual Meeting, at our principal executive office for a period of ten days prior to the Annual Meeting. On April 14, 2016, we had 95,889,044 shares of common stock outstanding.

Stockholders of Record: Shares Registered in Your Name. If at the close of business on April 14, 2016 your shares were registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed Proxy Card or vote by proxy over the telephone or on the Internet as instructed below, to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If at the close of business on April 14, 2016 your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on and what does the Board recommend?

|

You will be asked to vote on the following items:

o Proposal No. 1: To elect the nine nominees named herein to serve on our Board of Directors until the 2017 Annual Meeting of Stockholders; and

o Proposal No. 2: To ratify the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.

|

Our Board recommends that you vote:

o “FOR” Proposal No. 1, the election of each of the nine nominees named herein to serve on our Board of Directors; and

o “FOR” Proposal No. 2, the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.

|

May other matters be raised at the Annual Meeting? How will the meeting be conducted?

We currently are not aware of any business to be acted upon at the Annual Meeting other than the two matters described above. Under Delaware law and our governing documents, no other business aside from procedural matters may be raised at the Annual Meeting unless proper notice has been given to us by the stockholders. If other business is properly raised, your proxies have authority to vote in their discretion, including to adjourn the Annual Meeting.

The Chairman of the Annual Meeting has broad authority to conduct the Annual Meeting so that the business of the Annual Meeting is carried out in an orderly and timely manner. In doing so, he has broad discretion to establish reasonable rules for discussion, comments and questions during the Annual Meeting. The Chairman of the Annual Meeting is also entitled to rely upon applicable law regarding disruptions or disorderly conduct to ensure that the Annual Meeting proceeds in a manner that is fair to all participants.

| 3 |

Do any of the proposals entitle me to a dissenter’s right of appraisal?

Our stockholders are not entitled to dissenters’ rights in connection with any of the proposals to be voted on at the Annual Meeting. Furthermore, we do not intend to independently provide our stockholders with any such rights.

How do I vote?

For Proposal No. 1, you may either vote “FOR” each nominee named herein to serve on the Board or you may withhold your vote for any nominee that you specify. For Proposal No. 2, you may vote “FOR” or “AGAINST” or abstain from voting. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy using the enclosed Proxy Card, vote by proxy over the telephone or vote by proxy on the Internet. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

| · | To vote in person, come to the Annual Meeting, and we will give you a ballot when you arrive. |

| · | To vote using the enclosed Proxy Card, simply complete, sign and date the enclosed Proxy Card and return it promptly in the postage paid envelope provided. If you return your signed Proxy Card to us before the Annual Meeting, we will vote your shares as you direct. |

| · | To vote over the telephone, call the toll-free number (for residents of the United States) listed on your Proxy Card and follow the instructions provided by the recorded message. Your vote must be received by 7:00 p.m. Eastern Time on June 6, 2016 to be counted. |

| · | You can choose to vote your shares at any time using the Internet site identified on your Proxy Card. This site will give you the opportunity to make your selections and confirm that your instructions have been followed. We have designed our Internet voting procedures to authenticate your identity by use of a unique control number found on the enclosed Proxy Card. To take advantage of the convenience of voting on the Internet, you must subscribe to one of the various commercial services that offer access to the Internet. Costs normally associated with electronic access, such as usage and telephone charges, will be borne by you. We do not charge any separate fees for access to the Internet voting site. Your vote must be received by 7:00 p.m. Eastern Time on June 6, 2016 to be counted. |

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, you should have received a Proxy Card and voting instructions with these proxy materials from that organization, rather than from us. Simply complete and mail the Proxy Card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other nominee. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

What if I return a Proxy Card but do not make specific choices?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record and return a signed and dated Proxy Card without marking any voting selections, your shares will be voted as follows:

| · | “FOR” the election of each of the nine nominees named herein to serve on the Board of Directors; and |

| · | “FOR” the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016. |

| 4 |

If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your Proxy Card) will vote your shares as recommended by our Board or, if no recommendation is given, will vote your shares using his or her best judgment.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee and you do not provide that organization with voting instructions, that organization will determine if it has the discretionary authority to vote on the particular matter. On certain “routine” matters, brokerage firms have the discretionary authority to vote shares for which their customers do not provide voting instructions. We believe Proposal No. 2, the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm, is considered a routine matter for this purpose. However, Proposal No. 1, the election of directors, is not considered to be a routine matter. Your broker or other nominee cannot vote without instructions on non-routine matters, and, therefore, we expect broker non-votes on Proposal No. 1. Accordingly, if you own shares through your broker, bank or other nominee, please be sure to instruct that organization how to vote to ensure that your vote is counted on all of the proposals.

Can I change my mind and revoke my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting.

If you are the record holder of your shares, you may revoke your proxy in any of the following ways:

| · | You may submit another properly completed proxy bearing a later date; |

| · | You may send a written notice that you are revoking your proxy to MRI Interventions, Inc., Attn: Corporate Secretary, 5 Musick, Irvine, California 92618; or |

| · | You may attend the Annual Meeting and notify the election officials at the Annual Meeting that you wish to revoke your proxy and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by that organization to revoke your proxy.

What if I receive more than one Proxy Card?

Multiple Proxy Cards mean that you have more than one account with brokers or our transfer agent. Please vote all of your shares. We also recommend that you contact your broker or our transfer agent to consolidate as many accounts as possible under the same name and address. Our transfer agent is Continental Stock Transfer & Trust Company, 17 Battery Place, 8th Floor, New York, New York 10004, and it can be reached at (212) 509-4000.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count “FOR” and “WITHHOLD” votes and broker non-votes with respect to Proposal No. 1, and “FOR” and “AGAINST” votes, abstentions and broker non-votes with respect to Proposal No. 2. A broker non-vote occurs when a nominee, such as a broker or bank, holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary authority to vote with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner. In the event that a broker, bank, custodian, nominee or other record holder of our common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

| 5 |

Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum for the transaction of business at the Annual Meeting. Abstentions will be counted towards the tabulation of shares present in person or represented by proxy and entitled to vote and will have the same effect as “AGAINST” votes on Proposal No. 2. Although broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum, broker non-votes will not be counted for purposes of determining the number of shares present in person or represented by proxy and entitled to vote with respect to a particular proposal. Therefore, a broker non-vote will not affect the outcome of the vote on Proposal Nos. 1 and 2.

What is the vote required for each proposal?

| · | For Proposal No. 1, the election of the nine nominees named herein to serve on our Board, the nine nominees receiving the most “FOR” votes (among votes properly cast in person or by proxy) will be elected to our Board. |

| · | To be approved, Proposal No. 2, the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016, must receive a “FOR” vote from at least a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote. However, the Audit Committee is not bound by a vote either “FOR” or “AGAINST” the firm. The Audit Committee will consider a vote against the firm by the stockholders in selecting our independent registered public accounting firm in the future. |

How many shares must be present to constitute a quorum for the Annual Meeting?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are represented by stockholders present at the Annual Meeting or by proxy. On April 14, 2015, the record date, there were 95,889,044 shares outstanding and entitled to vote. Thus, at least 47,944,523 shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum. If there is no quorum, either the Chairman of the meeting or a majority of the votes present in person or represented by proxy at the Annual Meeting may adjourn the Annual Meeting to another date.

How many votes do I have and can I cumulate my votes?

You have one vote for every share of our common stock that you own. Cumulative voting is not allowed.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final results are expected to be published in a Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission, or the “SEC,” on or before the fourth business day following the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days following the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

| 6 |

PROPOSAL No. 1

ELECTION OF DIRECTORS

What is the structure of our Board?

Pursuant to Delaware law and our governing documents, our business and affairs are managed under the direction of our Board. Our Board is our ultimate decision-making and oversight body, except with respect to matters reserved to the stockholders. The directors are charged with the responsibility of exercising their fiduciary duties to act in our best interest and our stockholders. Our Board selects and oversees members of executive management who have the authority and responsibility for the conduct of the day-to-day operations of the business.

The number of directors that constitutes our Board is fixed from time-to-time by a resolution adopted by the affirmative vote of a majority of the authorized number of directors at any regular or special meeting of our Board. On an annual basis, the Corporate Governance and Nominating Committee will consider the size and composition of our Board and report to our Board the results of its review and any recommendations for change. Currently, our Board is fixed at nine directors. Our directors stand for election at each annual meeting of the stockholders and serve on our Board until the next annual meeting of the stockholders and until a successor has been duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal.

How are nominees evaluated? What are the minimum qualifications?

The Corporate Governance and Nominating Committee is responsible for recommending to the Board the type of skills and qualifications required of directors, based on our needs from time-to-time. In evaluating candidates for director, the Corporate Governance and Nominating Committee may consider several factors, including relevant experience, education, independence, commitment, compatibility with the Chief Executive Officer and the Board culture, prominence and understanding of the Company’s business, as well as any other factors it deems relevant. The Board will nominate individuals to serve on our Board only from director candidates screened and approved by the Corporate Governance and Nominating Committee and recommended to the Board.

The directors’ experiences, qualifications and skills that the Corporate Governance and Nominating Committee considered in their nomination are included in their individual biographies.

What role does diversity play in the selection of members of our Board?

In evaluating potential candidates for Board membership, the Corporate Governance and Nominating Committee considers, among other things, relevant experience, education, independence and commitment. While our Board does not have a formal policy with respect to diversity, our Board believes in a governing style that emphasizes respect for diversity in perspective and includes individuals from diverse backgrounds. Our Board believes that diversity is important because various points of view contribute to a more effective, engaged Board and a better decision-making process.

How has the composition of the Board changed since January 1, 2015?

The composition of our Board has changed since January 1, 2015. Effective April 1, 2015, Michael J. Ryan elected to step down from the Board to allow Francis P. Grillo, our Chief Executive Officer and President, to serve as a member of the Board. The resignation of Mr. Ryan was not the result of any disagreement with us, our management or our operations, policies or practices.

| 7 |

Who are the nominees this year?

Upon the recommendation of the Corporate Governance and Nominating Committee, our Board has nominated the following nine persons to serve as directors: Pascal E.R. Girin; Francis P. Grillo; Kimble L. Jenkins; Charles E. Koob; Philip A. Pizzo; Timothy T. Richards; Andrew K. Rooke; Maria Sainz; and John N. Spencer, Jr. If elected, each nominee identified above will serve on our Board until the 2017 Annual Meeting of Stockholders or until his or her earlier death, resignation or removal. We anticipate that each of these nominees will be available for election, but if a situation arises in which he or she is unavailable, the proxy will be voted in accordance with the best judgment of the named proxies unless directed otherwise.

What are the backgrounds and qualifications of this year’s nominees?

Information about the following nine individuals nominated as directors is provided below.

| Director Nominees | Age | |

| Pascal E.R. Girin | 55 | |

| Francis P. Grillo | 53 | |

| Kimble L. Jenkins | 54 | |

| Charles E. Koob | 71 | |

| Philip A. Pizzo | 71 | |

| Timothy T. Richards | 58 | |

| Andrew K. Rooke | 59 | |

| Maria Sainz | 50 | |

| John N. Spencer, Jr. | 75 |

Pascal E.R. Girin joined our Board in September 2014. Mr. Girin possesses over two decades of management and executive experience in the field of medical technology. Mr. Girin most recently served as Executive Vice President and Chief Operating Officer of Wright Medical Technology, Inc. from November 2012 until October 2015, at which time the company successfully merged with Tornier N.V. and formed Wright Medical Group N.V. Prior to joining Wright Medical, Mr. Girin served as President and Chief Executive Officer of Keystone Dental Inc. from February 2011 to June 2012, at which time the company successfully merged with Southern Implants Inc. From October 2010 to February 2011, Mr. Girin served as Executive Vice President and Chief Operating Officer of Keystone Dental Inc. From July 2010 to September 2010, Mr. Girin served as Chief Operating Officer of ev3 Inc. following its acquisition by a wholly owned subsidiary of Covidien Group S.a.r.l. Prior to that time, Mr. Girin served as Executive Vice President and Chief Operating Officer of ev3 Inc. from January 2010 to July 2010, as Executive Vice President and President, Worldwide Neurovascular and International of ev3 Neurovascular Inc. from July 2008 to January 2010, as Senior Vice President and President, International of ev3 International from July 2005 to July 2008, and as General Manager, Europe of ev3 Inc. from September 2003 to July 2005. From September 1998 to August 2003, Mr. Girin served in various capacities at BioScience Europe Baxter Healthcare Corporation, most recently as Vice President. Mr. Girin received an engineering education at the French Ecole des Mines. From November 2010 until November 2, 2012, Mr. Girin had served as a director of Tornier N.V., a publicly traded global medical device company, as well as a member of its Nominating, Corporate Governance and Compliance Committee. With nearly three decades of experience as an executive and director in the medical device industry, both in the U.S. and in Europe, we believe Mr. Girin brings invaluable industry experience and leadership qualities to the Board, as well as insight into international markets.

Francis (Frank) P. Grillo joined us in October 2014 as President. Mr. Grillo also became our Chief Executive Officer effective January 1, 2015 and became a member of our Board in April 2015. Prior to joining our company, Mr. Grillo served as Vice President, Marketing and New Business Development of Intuitive Surgical, Inc., a publicly-traded medical technology company, since August 2008. Before joining Intuitive Surgical, Mr. Grillo worked for Kyphon Inc. from February 2006 to June 2008, most recently as Vice President, Marketing and Business Development. Kyphon was a publicly-traded medical technology company prior to its acquisition by Medtronic, Inc. in November 2007. Prior to Kyphon, from September 1996 to January 2006, Mr. Grillo held various positions at Boston Scientific Corporation, most recently as Vice President, Marketing, Women’s Health, Urology/Gynecology Division. As our Chief Executive Officer, and as a result of his substantial experience as an executive of medical device companies, we believe Mr. Grillo offers a unique understanding of our business and industry with a particular focus on driving adoption of new medical technologies.

| 8 |

Kimble L. Jenkins joined our Board in September 2002. Mr. Jenkins, who currently serves as the Chairman of our Board, previously served as our President from January 2003 to October 2014, and as our Chief Executive Officer from September 2004 through December 2014. Mr. Jenkins served in those two positions on a part-time basis until May 2008, at which time he began serving as President and Chief Executive Officer on a full-time basis. Since October 2014, Mr. Jenkins has also served as the President of Theraplex Company LLC, a privately held skin care products company. Prior to May 2008, Mr. Jenkins was a Managing Director with the investment bank Morgan Keegan & Company, Inc., where he founded that firm’s Private Equity Group in 1998. Mr. Jenkins has over 20 years of experience building and working with growth stage companies. As our former Chief Executive Officer, we believe Mr. Jenkins’ perspective into our business is an invaluable resource for our Board.

Charles E. Koob joined our Board in August 2008. From 1970 to 2008, Mr. Koob practiced competition, trade regulation and antitrust law at the law firm of Simpson Thacher & Bartlett and served as the co-head of the firm’s litigation department for a portion of his tenure. For much of his career, Mr. Koob served as a strategic advisor for the boards of directors of many public companies. Mr. Koob presently serves on the board of directors of MiMedx Group, Inc., a publicly traded biomedical products company, DemeRx, Inc., a privately held biotechnology company, and Stanford Hospital & Clinics, the major teaching hospital for Stanford University and its School of Medicine. As a byproduct of Mr. Koob’s sophisticated former legal practice, we believe Mr. Koob offers expertise in the areas of corporate governance and organizational and strategic leadership.

Philip A. Pizzo joined our Board in April 2013. Dr. Pizzo served as Dean of the Stanford School of Medicine from April 2001 to December 1, 2012, where he was also the Carl and Elizabeth Naumann Professor of Pediatrics and of Microbiology and Immunology. Dr. Pizzo has devoted much of his distinguished medical career to the diagnosis, management, prevention and treatment of childhood cancers and the infectious complications that occur in children whose immune systems are compromised by cancer and AIDS. He has also been a leader in academic medicine, championing programs and policies to improve the future of science, education and healthcare in the United States and beyond. Before joining Stanford, Dr. Pizzo was the physician-in-chief of Children’s Hospital in Boston and chair of the Department of Pediatrics at Harvard Medical School from 1996 to 2001. He is the author of more than 500 scientific articles and 16 books and monographs. Dr. Pizzo presently serves on the board of directors, or the equivalent governing body, of Global Blood Therapeutics, Inc., a publicly-traded, clinical-stage biopharmaceutical company, the University of Rochester, a private university, and Koc University, a private university located in Istanbul, Turkey. We believe Dr. Pizzo offers a deep understanding of medical sciences and innovation, as well as physicians and other healthcare providers who are central to the use of our products.

Timothy T. Richards joined our Board in March 2014. Since October 2012, Mr. Richards has worked for Seventh Sense BioSystems, Inc., a venture capital-backed start-up with a focus on point-of-care diagnostic testing, where he was recruited to build and develop the company’s business development and commercial organization. Currently, Mr. Richards serves as Seventh Sense BioSystems’ Chief Operating Officer. Prior to joining Seventh Sense BioSystems, from October 2011 through August 2012, Mr. Richards served as President of Facet Technologies, LLC, a privately-held supplier to major diagnostic companies, where he led the company’s manufacturing and supply chain platform. From November 2008 until May 2010, Mr. Richards held executive-level positions within the Covidien organization, first as U.S. President of the Patient Care & Safety Products business unit, and subsequently as President of VNUS Medical Technologies following its acquisition by Covidien in 2009. From October 2003 through October 2008, Mr. Richards served as Senior Vice President, Chief Marketing Officer and a member of the Executive Board of B. Braun Medical Inc., a leader in infusion therapy and pain management. Before joining B. Braun Medical, he held a number of progressive leadership positions throughout the U.S. and Asia with Becton Dickinson and Company. We believe Mr. Richards brings to the Board extensive leadership experience and expertise in general management, operations, commercial management and strategy in the medical device field.

Andrew K. Rooke joined our Board in July 2011. Mr. Rooke owns and manages Rooke Fiduciary Management, a private trust company, which specializes in the investment management of publicly held securities and the oversight of a multitude of trust investments. Mr. Rooke is also President and a director of Withington Foundation, a private foundation. Over the years, he has acquired, managed and sold a number of private companies as well as commercial real estate properties. Mr. Rooke was also previously employed by the former securities firm Kidder, Peabody & Co. With significant experience in financing, analyzing, investing in and managing investments in public and private companies, Mr. Rooke offers expertise in strategic and financial matters.

| 9 |

Maria Sainz joined our Board in January 2014. Since April 2012, Ms. Sainz has served as President and Chief Executive Officer of CardioKinetix, Inc., a privately-held medical device company based in Menlo Park, California that is pioneering a catheter-based treatment for heart failure. Beginning in April 2008, she served as President and Chief Executive Officer of Concentric Medical, Inc., a privately-held medical device company focused on developing endovascular devices for revascularizing stroke patients. Ms. Sainz held that position until October 2011, when Concentric Medical was acquired by Stryker Corporation, at which time she was named General Manager of the Stryker Neurovascular business unit, a position she held until April 2012. Prior to Concentric Medical, as an advisor to Boston Scientific Corporation’s Chief Operating Officer, Ms. Sainz led integration activities following Boston Scientific’s acquisition of Guidant Corporation. From February 2003 through June 2006, she served as President of Guidant Corporation’s Cardiac Surgery Division, during which time she successfully grew the multi-therapy division’s revenue from $90 million to $176 million. Prior to that, from January 2001 through February 2003, Ms. Sainz served as Vice President, Global Marketing for the Vascular Intervention Division of Guidant Corporation, where she was responsible for worldwide new product and market development activities. Ms. Sainz currently serves as a director of The Spectranetics Corporation, Orthofix International N.V. and Halyard Health Corporation, each a publicly-traded medical device company, as well as a director of CardioKinetix, Inc. Ms. Sainz brings to the Board over 20 years of experience in the medical device industry having held commercial and general management positions both in the United States and Europe.

John N. Spencer, Jr. joined our Board in March 2010. Mr. Spencer is a certified public accountant and was a partner of Ernst & Young LLP where he spent more than 38 years until his retirement in 2000. Mr. Spencer serves on the board of directors of GeoVax Labs, Inc., a publicly traded biotechnology company. In addition, he serves on the boards of directors of, and as a consultant for various accounting and financial reporting matters to, various privately owned companies. From November 2013 until February 2014, Mr. Spencer served as interim Chief Financial Officer of Applied Genetic Technologies Corporation, which is now a publicly traded biotechnology company, while such company was in registration with the SEC. By virtue of his experience at Ernst & Young, where he was the partner in charge of its life sciences practice for the southeastern United States, together with his continuing expertise as a director of, and a consultant to, other publicly traded and privately held companies, we believe Mr. Spencer offers expertise in accounting, finance and the medical device industry.

How are our directors compensated?

Board Fees

Directors who are our employees are not entitled to receive any fees for serving as directors. Directors who are not our employees receive the following Board and Committee fees:

| Board of Directors: | ||

| Annual retainer per director | $ | 15,000 |

| Fee per meeting of the Board (in-person) | $ | 1,000 |

| Fee per meeting of the Board (telephonic) | $ | 500 |

| Audit Committee: | ||

| Annual retainer for chairperson | $ | 8,000 |

| Annual retainer for other members | $ | 4,000 |

| Compensation Committee: | ||

| Annual retainer for chairperson | $ | 6,000 |

| Annual retainer for other members | $ | 3,000 |

| Corporate Governance and Nominating Committee: | ||

| Annual retainer for chairperson | $ | 6,000 |

| Annual retainer for other members | $ | 3,000 |

The above retainers are paid in quarterly installments, in arrears. Each director may elect to have us pay all or a portion of his or her fees in shares of our common stock, in lieu of cash, in accordance with the rules and procedures established from time-to-time by our Board.

We also reimburse each non-employee director for reasonable travel and other expenses in connection with attending Board meetings.

| 10 |

Stock Options

Upon an individual becoming a non-employee director for the first time, the new director will receive a stock option grant entitling him or her to purchase 45,000 shares of our common stock. Such options will vest in equal annual installments over three years.

Any individual who serves as a non-employee director on the day following an annual meeting of our stockholders will receive a stock option grant entitling him or her to purchase 20,000 shares of our common stock. Such options will vest on the earlier of the first anniversary of the grant date or the day immediately preceding the next annual meeting of stockholders.

The exercise price of all options granted to directors will equal the “fair market value” of our common stock on the date of grant.

Are there stock ownership guidelines for directors?

We currently do not have any stock ownership guidelines. The Board expects each director to develop a meaningful ownership position in us over time but does not believe it is appropriate to specify the level of stock ownership for individual directors.

Are there any family relationships between our directors and our executive officers?

There are no family relationships between or among any of our directors and executive officers.

How many votes are needed to elect directors?

The nine nominees receiving the most “FOR” votes among votes properly cast in person or by proxy at the Annual Meeting will be elected to serve on our Board (assuming a quorum of a majority of the outstanding shares of common stock is present).

What does the Board recommend?

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR IDENTIFIED ABOVE.

| 11 |

GOVERNANCE OF THE COMPANY

What is corporate governance and how do we implement it?

Corporate governance is a set of rules established by us to ensure that our directors, executive officers and employees conduct our business in a legal, impartial and ethical manner. Our Board has a strong commitment to sound and effective corporate governance practices. We are incorporated under the laws of the state of Delaware. We have not applied to list our securities on a national securities exchange which has requirements that a majority of our Board be independent. However, for purposes of determining independence, we have adopted the provisions of Nasdaq Marketplace Rule 5605. Our management and our Board have reviewed and continue to monitor our corporate governance practices in light of Delaware corporate law, U.S. federal securities laws and Nasdaq Marketplace Rule 5605.

What documents establish and implement our corporate governance practices?

We adopted the charters of our Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee, Code of Business Conduct and Ethics, Guidelines on Governance Issues, Guidelines for Corporate Disclosure, Related Party Transactions Policy, Securities Trading Policy and Whistleblower Policy for the purpose of increasing transparency in our governance practices as well as promoting honest and ethical conduct, promoting full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by us, and promoting compliance with all applicable rules and regulations that apply to us and our officers and directors.

Our Code of Business Conduct and Ethics applies to all of our employees, officers (including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions) and directors. We intend to disclose future amendments to certain provisions of our Code of Business Conduct and Ethics, or waivers of such provisions, applicable to any principal executive officer, principal financial officer, principal accounting officer or controller, persons performing similar functions or our directors on our website at www.mriinterventions.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

Where can I access the Company’s corporate governance documents?

The charters of our Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee may be accessed at the “Investors” tab of our website at www.mriinterventions.com, as well as our Code of Business Conduct and Ethics and Amended and Restated Bylaws. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement. In addition, any stockholder or other interested party may request, without charge, a copy of our corporate governance documents by submitting a written request for any of such materials to MRI Interventions, Inc., Attn: Corporate Secretary, 5 Musick, Irvine, California 92618.

How often did our Board meet in 2015?

Our Board held five meetings during 2015. Directors are expected to attend each meeting of our Board and each meeting of those Committees on which they serve. All directors attended 75% or more of the total number of meetings of the Board and those Committees on which they served during 2015. In addition to meetings, our Board and its Committees review and act upon matters through written consent procedures.

Our 2015 Annual Meeting of Stockholders was held on June 4, 2015, and seven members of our Board attended the 2015 Annual Meeting. We have a policy for attendance by members of our Board at our stockholder annual meetings that encourages directors, if practicable and time permitting, to attend our stockholder annual meetings. We expect that all of our Board members will attend the 2016 Annual Meeting of Stockholders, if possible.

| 12 |

Who are our independent directors?

We have not applied to list our securities on a national securities exchange which has requirements that a majority of our Board be independent. However, for purposes of determining director independence, we have adopted the provisions of the Nasdaq Marketplace Rules. Our Board undertook a review of the composition of our Board and its Committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board has determined that none of Dr. Pizzo, Ms. Sainz or Messrs. Girin, Koob, Rooke, Richards or Spencer, representing sevem of our nine directors who are nominated for re-election at the Annual Meeting, has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under Rule 5605(a)(2) of the Nasdaq Marketplace Rules. Furthermore, our Board previously determined that Michael J. Ryan, who served on our Board until his resignation effective April 2015, was an “independent” director under the Nasdaq Marketplace Rules during such periods of time. In making such determinations, our Board considered the relationships that each such director has with us and all other facts and circumstances the Board deemed relevant in determining independence, including the beneficial ownership of our capital stock by each director.

What is the leadership structure of the Board, and why is it appropriate for the Company?

Mr. Jenkins presently serves as the Chairman of the Board. Although Mr. Grillo currently serves as our Chief Executive Officer, Mr. Jenkins served as our Chief Executive Officer from September 2004 until December 2014. Our Board does not have a fixed policy as to whether the role of the Chief Executive Officer and Chairman of the Board should be separate. When the Chairman of the Board is not “independent” within the meaning of Rule 5605(a)(2) of the Nasdaq Marketplace Rules, the Chairman of the Corporate Governance and Nominating Committee, who is an independent director, acts ex officio as the Lead Independent Director of the Board, with the responsibility for coordinating the activities of the other independent directors and for performing the duties specified in our Guidelines on Governance Issues and such other duties as are assigned from time-to-time by the Board.

The Lead Independent Director has broad responsibility and authority, including, without limitation, to:

| · | serve as the principal liaison on Board-wide issues between the independent members of the Board and the Chairman of the Board; |

| · | preside at all meetings of the Board at which the Chairman of the Board is not present, including executive sessions of the independent members of the Board; and |

| · | call meetings of the independent members of the Board. |

Mr. Koob, as the Chairman of the Corporate Governance and Nominating Committee, served as the Lead Independent Director during 2015.

Our Board has determined that the current separation of Chairman of the Board and Chief Executive Officer is the most appropriate structure at this time as it provides an effective balance between oversight of management and day-to-day leadership. As our former Chief Executive Officer, Mr. Jenkins has considerable experience in the medical device industry and extensive knowledge about us and our operations, which is advantageous in leading the Board in the performance of its duties while allowing Mr. Grillo to execute our strategic plan and provide day-to-day leadership. The Board may, at a future date, combine the Chairman of the Board and Chief Executive Officer roles if the Board determines that such a leadership structure would be more beneficial. As noted above and in light of Mr. Jenkins’ former role as our Chief Executive Officer, the Chairman of the Corporate Governance and Nominating Committee will remain our Lead Independent Director.

What role does our Board play in the oversight of risk management?

Our Board implements its risk oversight function both as a whole and through its Committees. Our Board and the Committees to which it has delegated responsibility conduct risk assessments and discuss identified risks and how to eliminate or mitigate such risks.

Our Board and its Committees oversee risks associated with their respective principal areas of focus, as summarized below. All Committees report to the full Board as appropriate, including when a matter rises to the level of a material risk.

| 13 |

|

Board/Committee |

Primary Areas of Risk Oversight | |

| Full Board | Strategic, financial and execution risks associated with annual operating and long-term strategic plans, major litigation and regulatory exposures and other current matters that may present material risk to our operations, plans, prospects or reputation. | |

| Audit Committee | Risks relating to our financial statements, financial reporting process, accounting and legal matters. | |

| Compensation Committee | Risks related to our compensation structure and benefits plan administration. | |

| Corporate Governance and Nominating Committee |

Risks relating to our corporate governance policies and programs and succession planning. | |

While our Board and its Committees oversee our risk management, our management is responsible for day-to-day risk management. Management communicates with our Board and its Committees on any material risks and how they are being managed.

How can you communicate with our Board?

Stockholders and other interested parties may send communications to our Board or any Committee of the Board by writing to the Board or the Committee, c/o MRI Interventions, Inc., Attn: Corporate Secretary, 5 Musick, Irvine, California 92618. The Corporate Secretary will distribute all stockholder and other interested party communications to the intended recipients and/or distribute to the entire Board, as appropriate.

In addition, stockholders and other interested parties may also contact the Lead Independent Director or the non-management directors as a group by writing to the Lead Independent Director, c/o MRI Interventions, Inc., Attn: Corporate Secretary, 5 Musick, Irvine, California 92618. The Corporate Secretary will forward all stockholder and other interested party communications to the Lead Independent Director who will review and, if addressed to the non-management directors, distribute all stockholder and other interested party communications to the non-management directors as a group.

What are our complaint procedures?

Complaints and concerns about our accounting, internal accounting controls or auditing matters may be submitted to MRI Interventions, Inc., Attention: Audit Committee Chairman, 5 Musick, Irvine, California 92618. Alternatively, complaints and concerns about our accounting, internal accounting controls or auditing matters may be submitted, confidentially and anonymously, by calling our Whistleblower Hotline at (877) 778-5463 or by using our confidential web-based service at www.reportit.net.

What committees have been established by our Board?

Our Board currently has three standing Committees: the Audit Committee; the Compensation Committee; and the Corporate Governance and Nominating Committee.

What are the responsibilities of the Audit Committee?

Our Audit Committee currently consists of Messrs. Girin, Koob and Spencer. Mr. Spencer serves as the Chairman of the Audit Committee. The functions of the Audit Committee include:

| · | overseeing the audit and other services of our independent registered public accounting firm and being directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm, who will report directly to the Audit Committee; |

| · | reviewing and pre-approving the engagement of our independent registered public accounting firm to perform audit services and any permissible non-audit services; |

| 14 |

| · | overseeing compliance with the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as required; |

| · | reviewing our annual and quarterly financial statements and reports and discussing the financial statements and reports with our independent registered public accounting firm and management; |

| · | reviewing and approving all related person transactions pursuant to our Related Party Transactions Policy; |

| · | reviewing with our independent registered public accounting firm and management significant issues that may arise regarding accounting principles and financial statement presentation, as well as matters concerning the scope, adequacy and effectiveness of our internal control over financial reporting; |

| · | establishing procedures for the receipt, retention and treatment of complaints received by us regarding internal control over financial reporting, accounting or auditing matters; and |

| · | preparing the Audit Committee report for inclusion in our proxy statement for our annual meeting. |

Our Board has determined that, at this time, Mr. Spencer and Mr. Koob are audit committee financial experts within the meaning of SEC rules. Furthermore, our Board has determined that all the members of the Audit Committee satisfy the independence, experience and other requirements established by the Nasdaq Marketplace Rules, which were adopted by the Company. Mr. Ryan, who resigned from our Board and our Audit Committee effective April 2015, also satisfied the independence, experience and other requirements established by the Nasdaq Marketplace Rules during 2015 when he served as a member of our Audit Committee. Our Audit Committee met four times during 2015. Both our independent registered public accounting firm and management periodically meet privately with our Audit Committee. A copy of the charter for our Audit Committee is posted on our website at www.mriinterventions.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

What are the responsibilities of the Compensation Committee?

Our Compensation Committee currently consists of Messrs. Richards and Spencer and Dr. Pizzo. Mr. Richards serves as the Chairman of our Compensation Committee. The functions of the Compensation Committee include:

| · | determining the compensation and other terms of employment of our Chief Executive Officer and other executive officers and reviewing and approving our performance goals and objectives relevant to such compensation; |

| · | administering and implementing our incentive compensation plans and equity-based plans, including approving option grants, restricted stock awards and other equity-based awards; |

| · | evaluating and recommending to our Board the equity incentive compensation plans, equity-based plans and similar programs advisable for us, as well as modifications or terminations of our existing plans and programs; |

| · | reviewing and approving the terms of any employment-related agreements, severance arrangements, change-in-control and similar agreements/provisions, and any amendments, supplements or waivers to the foregoing agreements, with our Chief Executive Officer and other executive officers; |

| · | to the extent required, reviewing and discussing the Compensation Discussion & Analysis for our annual report and proxy statement with management and determining whether to recommend to our Board the inclusion of the Compensation Discussion & Analysis in the annual report and proxy statement; and |

| 15 |

| · | to the extent required, preparing a report on executive compensation for inclusion in our proxy statement for our annual meeting. |

Each member of our Compensation Committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended, or the “Exchange Act,” and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended, or the “Code.” Furthermore, our Board has determined that Messrs. Richards and Spencer and Dr. Pizzo each satisfy the independence standards for compensation committees established by the Nasdaq Marketplace Rules. Our Compensation Committee met two times during 2015. A copy of the charter for our Compensation Committee is posted on our website at www.mriinterventions.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

With respect to director compensation, our Compensation Committee is responsible for reviewing the compensation paid to members of the Board and recommending modifications to Board compensation that the Compensation Committee determines are appropriate and advisable to the Board for its approval from time-to-time. In this regard, the Compensation Committee may request that management report to the Compensation Committee periodically on the status of the Board’s compensation in relation to other similarly situated companies.

In determining compensation for our executive officers, the Compensation Committee typically considers, but is not required to accept, the recommendations of our Chief Executive Officer regarding the performance and proposed base salary and bonus and equity awards for the other executive officers, as well as himself. The Compensation Committee may also request the assistance of our Chief Financial Officer in evaluating the financial, accounting and tax implications of various compensation awards paid to the executive officers. However, our Chief Financial Officer does not determine the amounts or types of compensation paid to the executive officers. Our Chief Executive Officer and certain of our other executive officers may attend Compensation Committee meetings, as requested by the Compensation Committee. None of our executive officers, including our Chief Executive Officer, attend any portion of the Compensation Committee meetings during which his or her compensation is established and approved.

During 2015, neither us, nor our Board, nor the Compensation Committee retained any compensation consultant to advise the Compensation Committee on executive and/or director compensation. Rather, the Compensation Committee and our Chief Executive Officer applied subjective discretion to make compensation decisions. They did not use a specific formula or matrix to set compensation in relation to compensation paid by other medical device companies. Our Compensation Committee designed our executive compensation program based on the Compensation Committee’s general knowledge of compensation practices and the application of such knowledge to attract and retain our executive officers. During 2015, the Compensation Committee did not perform reviews of our compensation programs with those of similarly-situated companies, nor did it engage in benchmarking of compensation paid to our executive officers. Our historical approach has been to consider compensation practices and relevant factors rather than establishing compensation at specific benchmark percentiles. This has enabled us to respond to dynamics in the labor market and provided us with flexibility in maintaining and enhancing our executive officers’ engagement, focus, motivation and enthusiasm for our future. However, we expect to build some of these objective practices into our compensation approach over time.

What are the responsibilities of the Corporate Governance and Nominating Committee?

Our Corporate Governance and Nominating Committee currently consists of Mr. Koob, Dr. Pizzo and Ms. Sainz. Mr. Koob serves as the Chairman of our Corporate Governance and Nominating Committee. The functions of the Corporate Governance and Nominating Committee include:

| · | evaluating director performance on the Board and applicable Committees of the Board; |

| · | interviewing, evaluating, nominating and recommending individuals for membership on our Board; |

| · | evaluating nominations by stockholders of candidates for election to our Board; |

| 16 |

| · | reviewing and recommending to our Board any amendments to our corporate governance documents; and |

| · | making recommendations to the Board regarding management succession planning. |

Our Board has determined that Mr. Koob, Dr. Pizzo and Ms. Sainz each satisfy the independence standards for corporate governance and nominating committees established by the Nasdaq Marketplace Rules. The Corporate Governance and Nominating Committee met one time during 2015. A copy of the charter for our Corporate Governance and Nominating Committee is posted on our website at www.mriinterventions.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

When evaluating director candidates, the Corporate Governance and Nominating Committee may consider several factors, including relevant experience, independence, commitment, compatibility with the Chief Executive Officer and the Board culture, prominence and understanding of the Company’s business, as well as any other factors the Corporate Governance and Nominating Committee deems relevant at the time. The Corporate Governance and Nominating Committee makes a recommendation to the full Board as to any person it believes should be nominated by our Board, and our Board determines the nominees after considering the recommendation and report of the Corporate Governance and Nominating Committee. During 2015, the Corporate Governance and Nominating Committee did not engage any third party to assist it in identifying or evaluating nominees for election to our Board.

Any director or executive officer of the Company may recommend a candidate to the Corporate Governance and Nominating Committee for its consideration. The Corporate Governance and Nominating Committee will also consider nominees to our Board recommended by stockholders if stockholders comply with the advance notice requirements in our bylaws. Our bylaws provide that a stockholder who wishes to nominate a person for election as a director at a meeting of stockholders must deliver timely written notice to our Corporate Secretary. This notice must contain, as to each nominee, all of the information relating to such person as would be required to be disclosed in a proxy statement meeting the requirements of Regulation 14A under the Exchange Act and certain other information, including: the name and address of the stockholder delivering the notice as it appears on our books; the class and number of shares owned beneficially and of record by such stockholder; information about derivative instruments beneficially owned by such stockholder and any opportunity to profit or share in any profit derived from any increase or decrease in the value of the shares of our stock; any proxy, contract, arrangement, understanding or relationship pursuant to which such stockholder has a right to vote any shares of our stock; any short interest in any of our securities held by such stockholder; any rights to dividends on shares of our stock owned beneficially or of record by such stockholder that are separated or separable from the underlying shares of stock; any proportionate interest in shares of our stock or derivative instruments held by a general or limited partnership in which such stockholder is, or owns a beneficial interest in, the general partner; any performance-related fees that such stockholder is entitled to based on the value of our securities; any arrangement or understanding between such stockholder and the proposed nominee; and whether such stockholder intends to deliver a solicitation notice, as more fully described in our bylaws. The foregoing summary does not include all requirements a stockholder must satisfy in order to nominate a candidate to our Board. Stockholders who wish to recommend a nominee to our Board should carefully read our bylaws, which are available at the “Investors” tab of our website at www.mriinterventions.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

Stockholder nominations must be submitted in accordance with the deadlines set forth under the caption “STOCKHOLDER PROPOSALS FOR THE 2017 ANNUAL MEETING” located on page 34 of this Proxy Statement. Stockholder nominations should be sent to MRI Interventions, Inc., Attn: Corporate Secretary, 5 Musick, Irvine, California 92618.

| 17 |

DIRECTOR COMPENSATION

The following table and accompanying footnotes set forth information with respect to the compensation of our non-employee directors in 2015.

| Name | Fees Earned or Paid in Cash ($) |

Option Awards ($)(1) |

All Other Compensation ($) |

Total ($) | ||||||||||||

| Kimble L. Jenkins(2) | $ | 13,250 | (2) | $ | 9,798 | (3) | $ | 462,078 | (4) | $ | 485,126 | |||||

| Pascal E.R. Girin | $ | 20,500 | (5) | $ | 9,798 | (3) | $ | – | $ | 30,298 | ||||||

| Charles E. Koob | $ | 28,000 | (6) | $ | 9,798 | (3) | $ | – | $ | 37,798 | ||||||

| Philip A. Pizzo | $ | 23,500 | (7) | $ | 9,798 | (3) | $ | – | $ | 33,298 | ||||||

| Timothy T. Richards | $ | 24,000 | (8) | $ | 9,798 | (3) | $ | – | $ | 33,798 | ||||||

| Andrew K. Rooke | $ | 18,000 | (9) | $ | 9,798 | (3) | $ | – | $ | 27,798 | ||||||

| Michael J. Ryan(10) | $ | 5,750 | (10) | $ | 12,005 | (10) | $ | – | $ | 17,755 | ||||||

| Maria Sainz | $ | 21,000 | $ | 9,798 | (3) | $ | – | $ | 30,798 | |||||||

| John N. Spencer, Jr. | $ | 29,000 | (11) | $ | 9,798 | (3) | $ | – | $ | 38,798 | ||||||

| (1) | These amounts do not represent cash compensation paid to the named individuals. These non-cash amounts represent either: (a) the aggregate grant date fair value of option awards; or (b) the date on which original option terms were modified, as applicable and as described below, computed in accordance with ASC Topic 718. For a discussion of the assumptions made in the valuation of the awards, see the discussion under “Management’s Discussion and Analysis of Financial Condition and Results of Operations–Critical Accounting Policies and Significant Judgments and Estimates–Share-based Compensation” and Note 8 to the audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2015. |

| (2) | On January 1, 2015, Mr. Jenkins’ employment as our Chief Executive Officer ceased, and thereafter, he continued as our Executive Chairman through March 31, 2015 for which he received $81,250 in cash. Since April 1, 2015, Mr. Jenkins has served as our Chairman in a non-executive role, and accordingly, on that date, Mr. Jenkins commenced earning compensation under our Non-Employee Director Compensation Plan and elected to receive 15,694 shares of our common stock in lieu of cash fees totaling $8,333. |

| (3) | Represents the grant date fair value of a stock option grant following our 2015 Annual Meeting of Stockholders, which entitles the director to purchase 20,000 shares of our common stock at an exercise price of $1.04 per share. |

| (4) | This amount represents $425,000 of compensation under Mr. Jenkins’ employment agreement, which has terminated, and $36,578 of compensation under Mr. Jenkins’ consulting agreement, which has expired. |

| (5) | Under our Non-Employee Director Compensation Plan, Mr. Girin elected to receive 33,020 shares of our common stock in lieu cash fees totaling $20,500. |

| (6) | Under our Non-Employee Director Compensation Plan, Mr. Koob elected to receive 43,865 shares of our common stock in lieu cash fees totaling $28,000. |

| (7) | Under our Non-Employee Director Compensation Plan, Dr. Pizzo elected to receive 37,171 shares of our common stock in lieu cash fees totaling $23,500. |

| (8) | Under our Non-Employee Director Compensation Plan, Mr. Richards elected to receive 37,635 shares of our common stock in lieu cash fees totaling $24,000. |

| (9) | Under our Non-Employee Director Compensation Plan, Mr. Rooke elected to receive 28,291 shares of our common stock in lieu cash fees totaling $18,000. |

| (10) | Effective April 1, 2015, Mr. Ryan voluntarily resigned as a director of the Company to give Mr. Grillo the opportunity to serve on the Board. Mr. Ryan’s resignation was not the result of any disagreement with us, our management or our operations, policies or practices. In recognition of Mr. Ryan’s contributions as director, our Board approved the acceleration of vesting of two stock options previously awarded to Mr. Ryan and extended the exercise period through April 1, 2017 for all vested options held by Mr. Ryan. In conformity with ASC Topic 718, we revalued Mr. Ryan’s stock option based on the modified terms described above and recorded share-based compensation expense of $12,005. In addition, under our Non-Employee Director Compensation Plan, Mr. Ryan elected to receive 3,833 shares of our common stock in lieu cash fees totaling $3,833. |

| (11) | Under our Non-Employee Director Compensation Plan, Mr. Spencer elected to receive 30,281 shares of our common stock in lieu cash fees totaling $19,333. |