UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. 2)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material Pursuant to Rule 14a-12

MRI INTERVENTIONS,

INC.

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ Fee paid previously with preliminary materials:

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by Registration Statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

SECOND SUPPLEMENT TO THE PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 6, 2019

On April 16, 2019, MRI Interventions, Inc. (“we”, “us”, “our” or the “Company”) filed a definitive proxy statement relating to its 2019 Annual Meeting of Stockholders (the “Annual Meeting”) with the Securities and Exchange Commission (the “SEC”), as supplemented by Amendment No. 1 to such definitive proxy statement filed with the SEC on May 17, 2019 (collectively, the “Proxy Statement”). The Annual Meeting will be held at the Courtyard by Marriott Irvine Spectrum, 7955 Irvine Center Drive, Irvine, California 92618, on Thursday, June 6, 2019 at 9:00 a.m., Pacific Time.

The Company is furnishing this second supplement (this “Supplement”) in order to provide our stockholders with the opportunity (i) to cast an advisory (non-binding) vote on the compensation of our named executive officers and (ii) to cast an advisory (non-binding vote) to set the frequency of future advisory votes on executive compensation, which are included as Proposal Nos. 4 and 5, respectively, in this Supplement. These proposals were inadvertently omitted from the Proxy Statement and proxy card when originally filed with the SEC, and this filing corrects that error.

This Supplement is being furnished to our stockholders of record as of the close of business on April 8, 2019, the record date for the Annual Meeting, in connection with the solicitation of proxies to be voted at the Annual Meeting, and at any adjournment thereof, pursuant to the accompanying Second Amended Notice of Annual Meeting of Stockholders attached hereto as Appendix A.

This Supplement does not provide all of the information that is important to your decisions with respect to voting on all of the proposals that are being presented to stockholders for their vote at the Annual Meeting. Additional information is contained in the Proxy Statement, which was previously mailed to you. To the extent that the information in this Supplement differs from, updates or conflicts with the information contained in the Proxy Statement, the information in this Supplement amends and supersedes the information in the Proxy Statement. Except as so amended or superseded, all information set forth in the Proxy Statement remains unchanged. Accordingly, we urge you to read this Supplement carefully and in its entirety together with the Proxy Statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL

MEETING TO BE HELD ON JUNE 6, 2019.

This Supplement, the Proxy Statement, the second amended proxy card and our 2018 Annual Report on Form 10-K are available on the internet at www.cstproxy.com/mriinterventions/2019. In addition, a copy of the 2018 Annual Report on Form 10-K will be provided without charge upon the written request of any stockholder to MRI Interventions, Inc., Attn: Corporate Secretary, 5 Musick, Irvine, California 92618, and may be found on the Company’s website at www.mriinterventions.com.

Proposal No. 4

Advisory (Non-Binding) Vote to Approve EXECUTIVE COMPENSATIOn

In accordance with Section 14A of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) and as a matter of good corporate governance, the Company’s Board of Directors (the “Board”) is asking our stockholders to vote on an advisory resolution to approve the compensation of our named executive officers as reported in the Proxy Statement. Accordingly, the following advisory resolution is being submitted to our stockholders for approval at the Annual Meeting:

RESOLVED, that the stockholders of MRI Interventions, Inc. (the “Company”) approve, on an advisory (non-binding) basis, the compensation of the Company’s named executive officers disclosed in the Proxy Statement for the Company’s 2019 Annual Meeting of Stockholders.

The compensation of our named executive officers is designed to tie a significant percentage of an executive’s compensation to the attainment of financial and other performance measures that the Board believes promote the creation of long-term stockholder value and position the Company for long-term success. As described more fully in the “Executive Compensation” section of the Proxy Statement, the mix of fixed and performance based compensation, the terms of long-term incentive awards and the terms of executives’ employment agreements are designed to enable the Company to attract, motivate and retain key executives crucial to our long-term success while, at the same time, creating a close relationship between performance and compensation. The Compensation Committee and the Board believe that the design of the current compensation practices, and hence the compensation awarded to our named executive officers under the current compensation practices, fulfills this objective.

To be approved on an advisory (non-binding) basis, this matter must receive the affirmative vote of the majority of the shares of the Company’s common stock present in person or by proxy and entitled to vote on the matter. Although the vote is non-binding, the Board and the Compensation Committee will review the voting results and take them into consideration in connection with their ongoing evaluation of the Company’s compensation practices and when making future decisions regarding executive compensation.

THE BOARD RECOMMENDS YOU VOTE “FOR” THE ADVISORY (NON-BINDING) RESOLUTION TO APPROVE EXECUTIVE COMPENSATION.

Proposal No. 5

Advisory (Non-Binding) Vote to SET the frequency of future advisory votes

ON EXECUTIVE COMPENSATION

Pursuant to Section 14A of the Exchange Act, the Board is asking our stockholders to vote on whether future advisory votes on executive compensation of the nature reflected in Proposal No. 4 above should occur every year, every two years or every three years.

The Board believes that the most appropriate policy for the Company at this time is to hold an advisory vote on executive compensation every year and therefore recommends that stockholders vote for future advisory votes on executive compensation to occur every year. If approved, the next advisory vote on executive compensation will occur in 2020. The Board believes that giving our stockholders the right to cast an advisory vote every year on approval of the compensation of our named executive officers is a good corporate governance practice and is in the best interests of our stockholders, by allowing our stockholders to provide us with their input on our executive compensation practices as disclosed in our proxy statement every year.

This advisory vote to set the frequency of future advisory votes on executive compensation is non-binding on the Board. Stockholders are able to select one of four choices for this proposal on the proxy card: one year, two years, three years or abstain. Stockholders are not voting to approve or disapprove the Board’s recommendation. Although non-binding, the Compensation Committee will carefully review and consider the voting results. Notwithstanding the Board’s recommendation and the outcome of the stockholder vote, the Board may in future years choose to conduct advisory votes on a more or less frequent basis and may change its practice and policies based on additional factors.

THE BOARD RECOMMENDS A VOTE TO HOLD FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION EVERY YEAR.

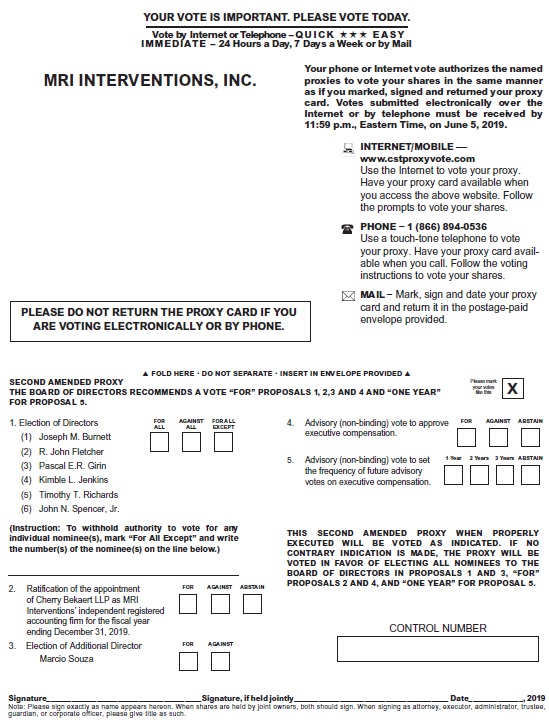

VOTING

The second amended proxy card enclosed with this Supplement differs from the proxy card previously furnished to you with the Proxy Statement, in that the enclosed second amended proxy card includes the addition of Proposal Nos. 4 and 5 to cast advisory (non-binding) votes (i) to approve the compensation of our named executive officers, and (ii) to set the frequency for future advisory votes on executive compensation, respectively. You should resubmit your vote on all proposals by submitting the second amended proxy card enclosed with this Supplement. If you sign and return the second amended proxy card, it will revoke and replace any previous proxy you have submitted. If you have already voted and do not submit the second amended proxy card or new voting instructions, your previously submitted proxy or voting instructions will be voted at the Annual Meeting with respect to all other applicable proposals but will not include any vote on Proposal Nos. 4 or 5.

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count “FOR” and “WITHHOLD” votes and broker non-votes with respect to Proposal Nos. 1 and 3, “FOR” and “AGAINST” votes, abstentions and broker non-votes with respect to Proposal Nos. 2 and 4, and “1 YEAR”, “2 YEAR”, “3 YEAR” votes, abstentions and broker non-votes with respect to Proposal No. 5. A broker non-vote occurs when a nominee, such as a broker or bank, holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary authority to vote with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner. In the event that a broker, bank, custodian, nominee or other record holder of our common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum for the transaction of business at the Annual Meeting. Abstentions will be counted towards the tabulation of shares present in person or represented by proxy and entitled to vote and will have the same effect as “AGAINST” votes on Proposal Nos. 2, 4 and 5. Although broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum, broker non-votes will not be counted for purposes of determining the number of shares present in person or represented by proxy and entitled to vote with respect to a particular proposal. Therefore, a broker non-vote will not affect the outcome of the vote on any of the proposals.

OTHER BUSINESS

As of the date of this Supplement, our Board does not know of any matters other than those described in the Proxy Statement and this Supplement that will be presented for action at the 2019 Annual Meeting of Stockholders. If other matters are properly brought before the meeting, any proxy given pursuant to this solicitation will be voted in accordance with the recommendations of management.

Appendix A

MRI INTERVENTIONS, INC.

5 Musick

Irvine, California 92618

SECOND AMENDED NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 6, 2019

The regular Annual Meeting of Stockholders of MRI Interventions, Inc. will be held on Thursday, June 6, 2019 at 9:00 a.m., Pacific Time, at the Courtyard by Marriott Irvine Spectrum, 7955 Irvine Center Drive, Irvine, California 92618 for the following purposes:

| 1. | Election of our Directors. To elect six directors of the Company to serve until the 2020 Annual Meeting of Stockholders. | |

| 2. | Ratification of the Auditors. To ratify the selection of Cherry Bekhaert LLP as the Company’s independent registered public accounting firm for the current fiscal year. | |

| 3. | Election of the Additional Director. To elect Marcio Souza as an additional director of the Company to serve until the 2020 Annual Meeting of Stockholders. | |

| 4. | Advisory (Non-Binding) Vote to Approve Executive Compensation. To cast an advisory (non-binding) vote to approve the compensation of the Company’s named executive officers. | |

| 5. | Advisory (Non-Binding) Vote to Set the Frequency of Future Advisory Votes on Executive Compensation. To cast an advisory (non-binding) vote to set the frequency of future advisory votes on executive compensation. | |

| 6. | Other Business. To transact such other business as may properly come before the Annual Meeting or any adjournment of the meeting. |

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” PROPOSAL NOS. 1, 2, 3 AND 4

AND VOTE TO HOLD FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION EVERY YEAR

IN PROPOAL NO. 5.

The proxy statement first made available to stockholders on or about April 19, 2019, as supplemented by Amendment No. 1 to such proxy statement first made available to stockholders on or about May 17, 2019 (collectively, the “Proxy Statement”), provides information about the matters you will be asked to consider and vote on at the Annual Meeting, except that certain information with respect to the fourth and fifth proposals listed above is set forth in the accompanying second supplement to the Proxy Statement (the “Supplement”).

The Company’s Board of Directors fixed the close of business on April 8, 2019 as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. On that day, 11,067,207 shares of common stock were outstanding. Each share entitles the holder to one vote.

Your vote is very important. Please carefully review the Proxy Statement and the Supplement and submit your proxy over the Internet, by telephone or by mail whether or not you plan to attend the Annual Meeting. If you hold your shares in street name through a broker, bank or other nominee, please follow the instructions you receive from them to vote your shares.

By Order of the Board of Directors.

Harold A. Hurwitz,

Chief Financial Officer and Secretary

Irvine, California

May 21, 2019